Target’s Stock Struggles Present Opportunities Amidst Market Volatility

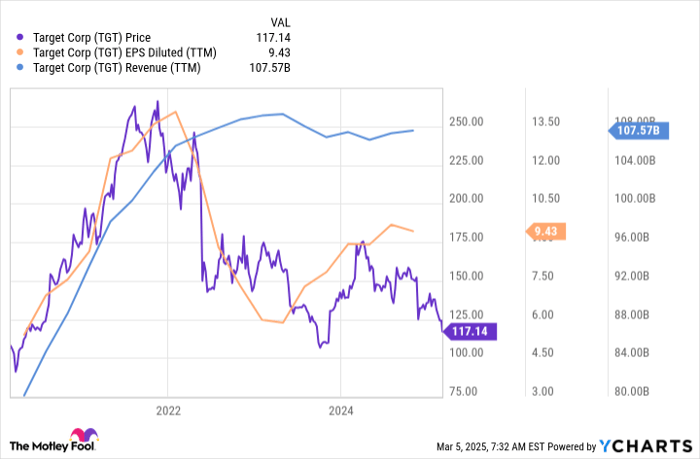

Target (NYSE: TGT) has seen disappointing performance over the last few years, dropping more than 50% from its three-year high. The stock’s struggles show little sign of improvement anytime soon.

Despite these challenges, investors are left questioning the merits of investing in a underperforming stock. However, many savvy investors recognize that the best opportunities often arise when stocks are down. Nvidia and Amazon both faced significant declines of around 50% in 2022, yet those who capitalized on these downturns are now enjoying substantial gains—Nvidia’s stock has surged 405% over the past three years, while Amazon has increased 40% since last summer.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Learn More »

Now, let’s examine the case for buying Target Stock today.

Current Challenges for Target

Target’s ongoing struggles are reflected in its stock performance. Customers are cutting back on spending, resulting in lower purchases at Target. This decline comes even as other discount retailers, such as Walmart and Costco, have reported strong growth.

Target’s product mix is more focused on discretionary items compared to its competitors, which centers more on grocery sales. During economic downturns, while consumers may still spend on essentials like food, they often restrain discretionary purchases, impacting Target’s sales in areas such as home goods. To address low sales volumes, Target has resorted to aggressive discounting, further straining its margins.

Additionally, CEO Brian Cornell has raised concerns about tariffs, suggesting that the situation remains “fluid.” The company is adjusting its supply chain operations to navigate these challenges.

Reasons to Consider Buying Now

While Target’s progress has been inconsistent, recent quarterly results vary between underwhelming and promising. The market reacted negatively to the fiscal fourth-quarter and full-year results for 2024, which ended on February 1. Adjusting for an additional week in 2023, sales saw a modest 1% year-over-year gain, and earnings per share (EPS) increased 3%. However, when not adjusted, both sales and EPS were slightly lower, disappointing investors.

On a brighter note, Target’s digital sales have been robust, increasing by 8.7% for the year, driven mainly by a 25% rise in same-day service usage. Comparable sales rose by 1.5% in the last quarter but only by 0.1% overall for the year. Traffic increased by over 2% year over year in the fourth quarter, indicating continued customer engagement, which could turn into higher spending as economic conditions improve.

Addressing tariff concerns, Cornell highlighted Target’s extensive experience in managing economic fluctuations, showcasing a resilience honed over decades.

Balancing Winning and Losing Stocks

Investors often face the dilemma of clinging to underperforming stocks while overlooking high-performing ones. The key to successful investing lies in recognizing the potential of promising stocks and allowing them to compound returns over time. Holding onto Target stock may be prudent given its customer loyalty and robust omnichannel network, which are essential for future growth.

For those who don’t currently hold Target Stock, this may be an opportune moment to buy. The stock has dropped 22% over the past year and has a favorable price-to-earnings (P/E) ratio of 12. This decline may be an overreaction compared to the company’s revenue and earnings potential.

TGT data by YCharts

Despite the market’s current pessimism, Target may eventually show renewed strength that aligns with its stock performance. Additionally, investors should consider the dividend opportunity. As a Dividend King, Target has raised its dividends for 51 consecutive years, reflecting reliability. Currently, Target’s Stock offers an attractive yield of 3.8%. Although not positioned for high growth immediately, Target remains a solid dividend investment that could reward long-term holders.

A Unique Opportunity Awaits Potential Investors

It’s common to feel you’ve missed your chance at purchasing successful stocks. However, you may still have time.

Occasionally, our expert analysts issue a “Double Down” Stock recommendation for companies poised for growth. If you worry that opportunities are passing you by, now may be the prime moment to invest. Historical data supports this approach:

- Nvidia: Invest $1,000 when we doubled down in 2009, and it would be worth $286,710!*

- Apple: A $1,000 investment when we recommended doubling down in 2008 would have grown to $44,617!*

- Netflix: If you invested $1,000 when we doubled down in 2004, it would be worth $488,792!*

Currently, we’re issuing “Double Down” alerts for three promising companies, offering a rare opportunity.

Continue »

*Stock Advisor returns as of March 3, 2025

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Jennifer Saibil has positions in Walmart. The Motley Fool has positions in and recommends Amazon, Costco Wholesale, Nvidia, Target, and Walmart. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.