Nvidia Aims for Recovery Amid Market Volatility

Nvidia (NASDAQ: NVDA) has recently experienced significant weakness, primarily due to a broad market sell-off that heavily impacted companies tied to the artificial intelligence (AI) sector. The stock has fallen over 20% from its all-time high, entering bear market territory. Despite this downturn, analysts maintain that Nvidia’s average price target remains substantially higher than its current trading price, suggesting a promising outlook.

TipRanks reports the average price target for Nvidia’s stock, as estimated by 42 analysts, stands at $178.18, which signals a 54% potential upside. Notably, Rosenblatt analyst Hans Mosesmann has set the highest target at $220, indicating a remarkable 90% upside from present levels.

What are the best investment options for $1,000? Our analysts have identified what they consider the 10 best stocks for investment currently. Learn More »

Given a potential price mark, the upcoming projections for Nvidia’s financial performance merit attention.

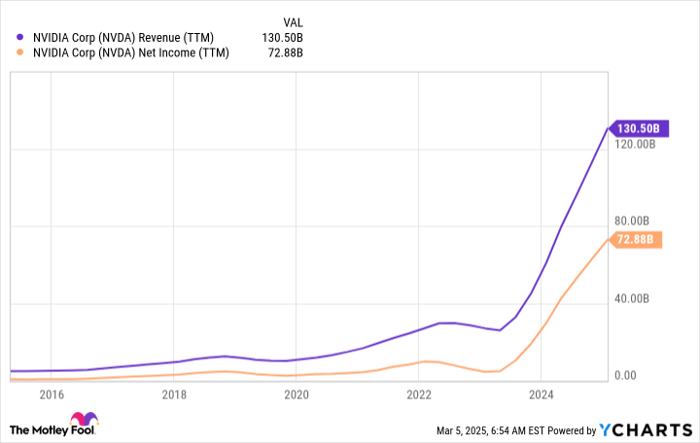

Nvidia’s Remarkable Revenue Growth

Nvidia plays a pivotal role in the AI revolution, with its graphics processing units (GPUs) outperforming traditional CPUs by processing numerous calculations simultaneously. This technological edge, paired with strong infrastructure support, has solidified Nvidia’s dominance in a vital industry.

Strong demand for these GPUs has driven significant revenue growth, particularly since the AI arms race escalated in 2023. This financial momentum is expected to continue, particularly as major clients signal plans to increase their AI-related spending in 2025.

NVDA Revenue (TTM) data by YCharts

For the first quarter, management anticipates revenue of $43 billion, reflecting a 65% growth rate. While future guidance for FY 2026 wasn’t provided, Wall Street forecasts total revenue to reach $204 billion, indicating a robust 56% growth trajectory. Such unprecedented growth levels are rarely seen for a company of Nvidia’s scale.

This strong business outlook underpins Mosesmann’s aggressive $220 price target for Nvidia’s stock. But is this target within reach?

Nvidia’s Stock Valuation and Future Projections

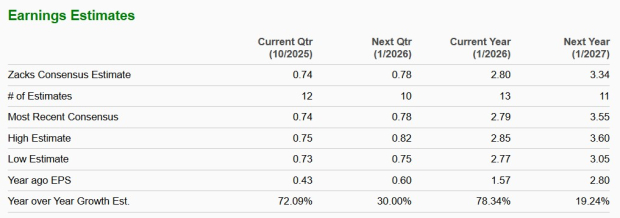

To assess the feasibility of a $220 stock price, we need to analyze Nvidia’s valuation history. Since 2024, Nvidia has traded at approximately 61 times trailing earnings, a common multiple for a high-growth company.

NVDA PE Ratio data by YCharts

Currently, the stock trades at around 39.5 times trailing earnings, indicating a potential discount. To achieve a $220 price, with a return to a 60 times trailing earnings valuation, Nvidia would need earnings per share (EPS) of $3.67. Over the past year, its EPS stood at $2.97, signaling that just a 24% growth would suffice to meet that target. Given the expected 56% revenue growth and Wall Street’s projected EPS of $4.50 for this year, the $220 valuation may be plausible.

However, achieving a 60 times earnings valuation is unlikely in the short term. A more sustainable target would be a 40 times earnings valuation. For Nvidia to reach $220 at that multiple, it would require an EPS of $5.50. This exceeds the anticipated $4.50 but is in line with analyst projections of $5.72 for FY 2027.

Could Nvidia’s stock reach $220 in the next year? While challenging, it remains a possibility. With a longer time perspective of two years, a target of $220 becomes much more achievable, leading to a potential 90% return over that period. Given the stock’s current dip from its highs, now may be an excellent opportunity to invest in one of the market’s leading players.

Should You Invest $1,000 in Nvidia?

Before making an investment decision regarding Nvidia’s stock, consider the following:

The Motley Fool Stock Advisor team has identified 10 other top stocks worthy of investment at this time, excluding Nvidia. These selected stocks may offer exceptional returns in the coming years.

Reflecting back to April 15, 2005… a $1,000 investment at that time would be worth $677,631 today!*

Stock Advisor provides clear investment guidance, including portfolio building advice, regular market updates from analysts, and two new stock recommendations monthly. The Stock Advisor service has substantially outperformed the S&P 500 since 2002*. Don’t miss out on their latest top 10 list when you join Stock Advisor.

*Stock Advisor returns as of March 3, 2025

Keithen Drury has positions in Nvidia. The Motley Fool has positions in and recommends Nvidia. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.