KGI Securities Launches Neutral Coverage on Under Armour with Growth Prospects

Fintel reports that on March 7, 2025, KGI Securities initiated coverage of Under Armour (LSE:0R2I) with a Neutral recommendation.

Analyst Price Forecast Indicates Potential for Substantial Upside

As of March 4, 2025, the average one-year price target for Under Armour stands at 9.90 GBX/share. Forecasts indicate a range between a low of 4.02 GBX to a high of 15.68 GBX. This target reflects a potential increase of 42.57% from its latest reported closing price of 6.94 GBX/share.

See our leaderboard of companies with the largest price target upside.

Projected Revenue and Earnings Growth

The anticipated annual revenue for Under Armour is 6,483MM, indicating a 21.95% increase. Moreover, the projected annual non-GAAP EPS is estimated at 0.74.

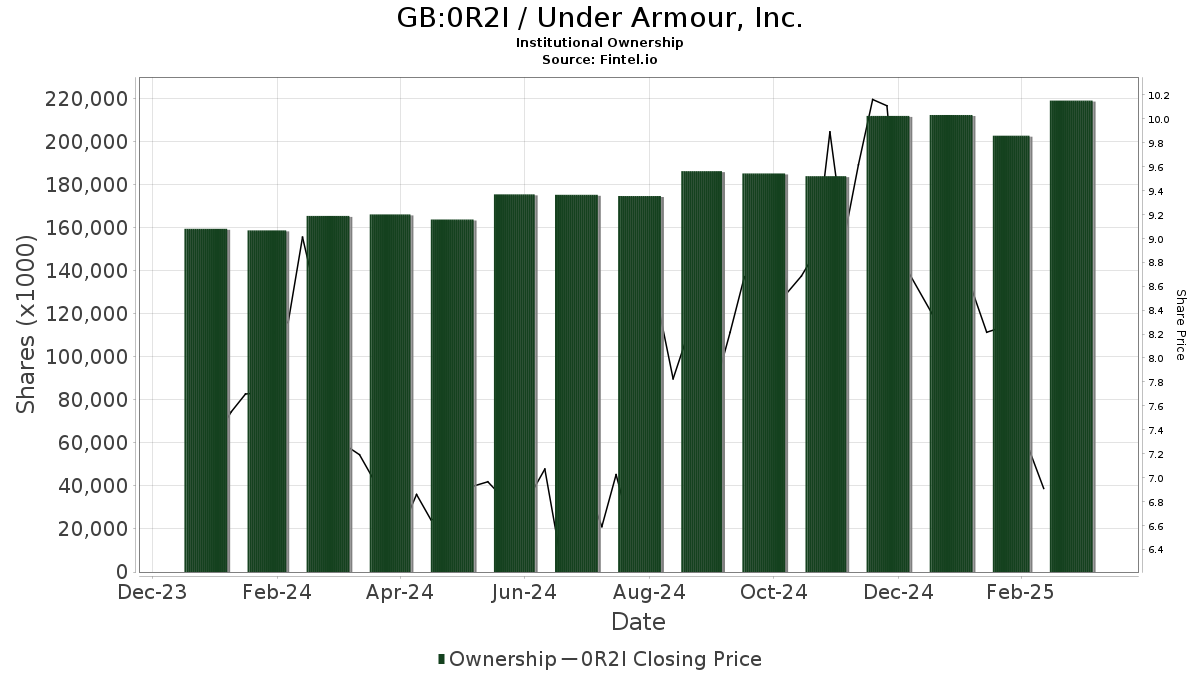

Insights into Fund Sentiment

Currently, 683 funds or institutions are reporting positions in Under Armour, reflecting an increase of 12 owners, or 1.79%, in the last quarter. The average portfolio weight of all funds with a stake in 0R2I is 0.06%, which is up by 100.53%. Over the last three months, total shares owned by institutions rose by 3.41% to 219,047K shares.

Actions of Key Shareholders

FBGRX – Fidelity Blue Chip Growth Fund holds 12,290K shares, amounting to a 6.51% ownership in the company. The firm reported an increase from its previous holding of 945K shares, marking a rise of 92.31%. Additionally, its portfolio allocation in 0R2I surged by 352.55% over the last quarter.

Alyeska Investment Group now holds 9,790K shares, representing 5.18% ownership, an increase from its prior holding of 6,287K shares, reflecting a growth of 35.78%. This firm’s portfolio allocation in 0R2I increased by 6.50% in the last quarter.

FIL maintains 7,350K shares, which translates to 3.89% ownership, with no changes in the last quarter. Fairfax Financial Holdings holds 6,312K shares, representing 3.34% ownership, also unchanged from the previous quarter.

The IJH – iShares Core S&P Mid-Cap ETF holds 6,139K shares, accounting for 3.25% ownership. This reflects a modest increase from the prior holding of 5,895K shares, representing a 3.97% rise, although the firm has decreased its portfolio allocation in 0R2I by 7.07% over the previous quarter.

Fintel is recognized as one of the most thorough investing research platforms for individual investors, traders, financial advisors, and small hedge funds, providing insights across various markets.

Our extensive data encompasses fundamentals, analyst reports, ownership data, fund sentiment, options sentiment, and insider trading, among other resources. Additionally, our exclusive Stock recommendations are driven by advanced, backtested quantitative models to enhance profitability.

Click to Learn More. This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.