Scotiabank Sees Major Upside for Perspective Therapeutics Stock

Fintel has reported that on March 7, 2025, Scotiabank initiated coverage of Perspective Therapeutics (NYSEAM:CATX) with a Sector Outperform recommendation.

Analyst Price Forecast Signals Significant Growth

As of March 4, 2025, the average one-year price target for Perspective Therapeutics stands at $16.42 per share. Estimates vary, ranging from a low of $6.06 to a high of $22.05. This average price target implies a remarkable increase of 529.20% from its last reported closing price of $2.61 per share.

Find our leaderboard of companies with the highest price target upside.

The projected annual revenue for Perspective Therapeutics is $11 million, reflecting an impressive 632.18% increase. On the earnings side, the projected annual non-GAAP EPS stands at -0.14.

Current Fund Sentiment Towards Perspective Therapeutics

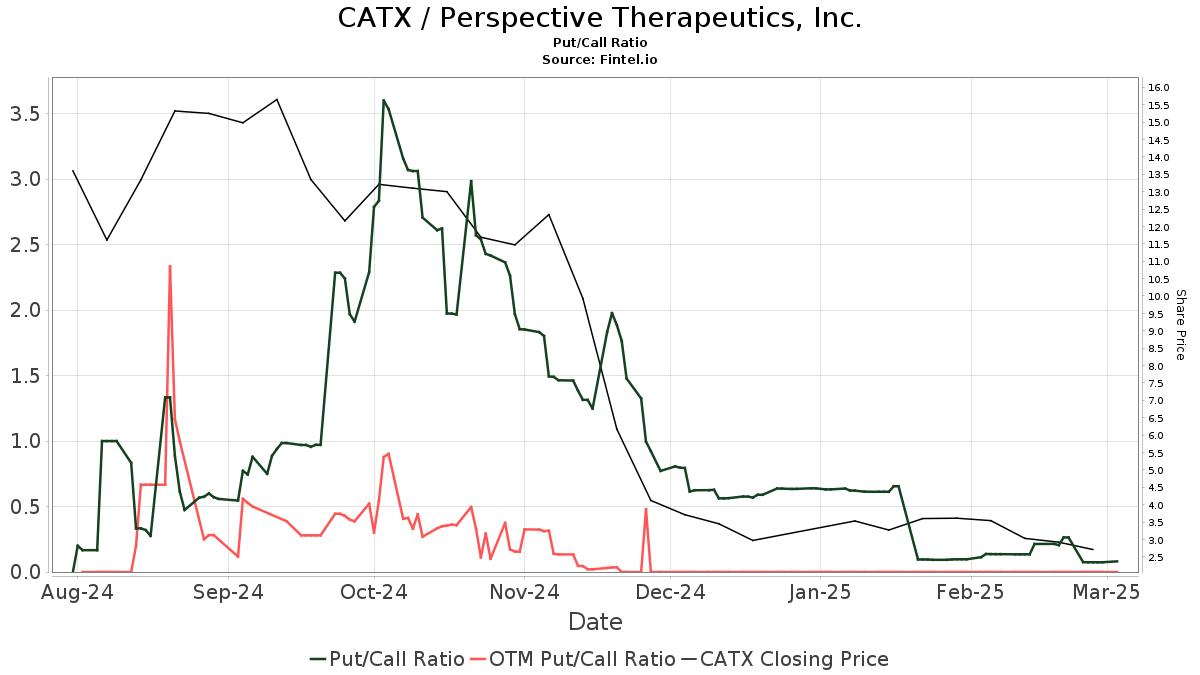

A total of 272 funds or institutions are reporting positions in Perspective Therapeutics, marking an increase of 33 new owners, or 13.81%, over the past quarter. The average portfolio weight for all funds invested in CATX is 0.07%, showing a significant increase of 66.80%. However, total shares owned by these institutions slipped by 0.13% in the last three months, down to 53,544,000 shares.  The put/call ratio for CATX currently sits at 0.10, signaling a bullish sentiment among investors.

The put/call ratio for CATX currently sits at 0.10, signaling a bullish sentiment among investors.

Institutional Holdings Show Mixed Activity

Deerfield Management Company, L.P. owns 2,939,000 shares, which is 4.35% of the company’s total shares. This reflects a 4.12% increase from its previous holding of 2,818,000 shares. However, the firm has reduced its overall portfolio allocation in CATX by 68.41% over the last quarter.

Avidity Partners Management holds 2,695,000 shares, accounting for 3.99% of the company. This also indicates a decline, as the firm previously reported a total of 3,444,000 shares, translating to a 27.81% decrease. Their portfolio allocation for CATX decreased by 64.00% in the last three months.

Octagon Capital Advisors has increased its stake, holding 2,305,000 shares—or 3.41% ownership—up from 1,422,000 shares, which represents a 38.29% increase. However, the firm’s portfolio allocation in CATX has contracted by 59.03% over the same period.

The VTSMX – Vanguard Total Stock Market Index Fund Investor Shares holds 1,695,000 shares, representing 2.51% ownership. This is a slight increase of 0.15% from its previous total of 1,692,000 shares. The firm has seen a substantial reduction of 76.42% in its portfolio allocation to CATX lately.

Additionally, Nicholson Wealth Management Group owns 1,609,000 shares, which is 2.38% ownership. This shows a minor increase of 0.43% from the previous 1,602,000 shares. However, the firm’s portfolio allocation in CATX has decreased significantly by 80.47% over the last quarter.

Understanding Perspective Therapeutics

This description is provided by the company.

Isoray, Inc., through its subsidiary Isoray Medical, Inc., produces Cesium Blu brachytherapy seeds, expanding treatment options for brachytherapy across various types of cancer.

Fintel offers one of the most comprehensive investing research platforms for individual investors, traders, financial advisors, and small hedge funds.

Our extensive data includes fundamentals, analyst reports, ownership data, fund sentiment, options sentiment, insider trading, options flow, and much more. Moreover, our exclusive stock picks are driven by advanced, backtested quantitative models designed to enhance profitability.

Click to Learn More

This article originally appeared on Fintel.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.