NuScale Power’s Journey: Bears to Bulls in 12 Months

NuScale Power (NYSE: SMR) has sparked debate since its IPO in May 2022. Initially, bulls highlighted the revolutionary potential of its small modular reactors (SMRs) to transform the nuclear power sector. Meanwhile, bears critiqued the sustainability of its business model and the high valuation. For a while, the bearish sentiment prevailed, and the stock fell significantly in the subsequent year and a half.

However, shares of NuScale have surged over 330% in the past year as some of these bearish concerns have diminished. Is this the right time for investors to chase this rally?

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Learn More »

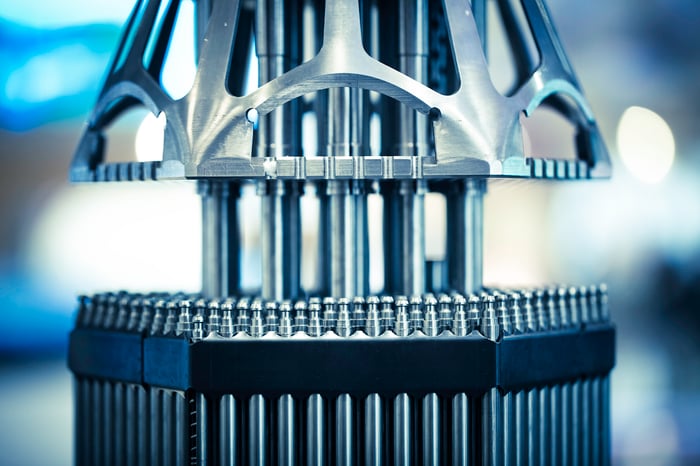

Image source: Getty Images.

Overview of NuScale Power’s Operations

NuScale’s SMRs are designed to fit into vessels that measure only nine feet wide and 65 feet high. Their pre-fabricated modules can be delivered and assembled on-site, providing flexibility for nuclear power companies. This adaptability allows installations in areas unsuitable for larger nuclear reactors.

NuScale offers the only SMRs currently certified with a Standard Design Approval (SDA) from the U.S. Nuclear Regulatory Commission, but this designation covers reactors generating up to 50 megawatts (MW) of electricity. To compete cost-effectively with coal, each reactor cluster needs to produce at least 77 MW. NuScale anticipates completing the long-awaited NRC review for its 77 MW module by mid-2025. CEO John Hopkins expressed optimism during the fourth-quarter conference call, anticipating that approval would broaden its customer base and improve economic efficiency, thereby enhancing the company’s competitive position.

Factors Behind NuScale’s Recent Growth

Despite challenges, including the cancellation of plans for six nuclear reactors in Idaho by 2023 and significant layoffs in early 2024, several catalysts have contributed to NuScale’s stock recovery. Notable events included a supply agreement with South Korea’s Doosan Enerbility for SMR components and an offer from the U.S. Department of Energy (DOE) that could provide up to $900 million in cost-shared funding for SMR development. Additionally, Amazon (NASDAQ: AMZN) has disclosed plans to support further SMR development.

NuScale is also progressing on its 462 MW plant project for RoPower in Romania as a subcontractor to its major investor, Fluor (NYSE: FLR). Contracts for both phases of the front-end engineering and design project were signed in December 2022 and July 2023, respectively.

This expansion into Romania has significantly increased NuScale’s revenue by 62% to $37 million in 2024, offsetting losses tied to the Idaho project. While revenue has climbed, the net loss has grown from $180 million to $348 million, with no new contracts secured in the U.S. market.

Looking ahead to 2025, analysts forecast an increase in revenue to $74 million, while the net loss is expected to narrow to $84 million. By 2026, revenue may jump to $219 million, further reducing the net loss to $76 million.

This optimistic outlook is predicated on several factors: successful approval of the 77 MW design from the NRC, securing DOE funds, expanding operations in Romania, and obtaining new contracts in the U.S. as tech giants like Amazon, Microsoft, and Meta Platforms invest in reliable energy sources like SMRs for their cloud infrastructure needs.

Despite the positive projections, it’s clear that NuScale will not achieve profitability in the immediate future. However, with $447 million in cash, cash equivalents, and short-term investments reported at the end of 2024, the company has the financial capacity to absorb potential losses as it grows its operations.

Investment Considerations for NuScale Power

With an enterprise value of $2.1 billion, NuScale’s valuation of 10 times next year’s sales appears reasonable. Yet, the company has expanded its number of outstanding shares by 83% over the last two years due to secondary stock offerings and stock-based compensation. Notably, insiders sold 16 times more shares than they purchased in the past year. This ongoing dilution combined with tepid insider sentiment suggests limited upside for the stock until NuScale stabilizes its domestic operations.

Investors might consider NuScale’s stock for potential speculative gains in the emerging SMR sector, but caution is warranted. The company faces significant uncertainties, and it’s possible the stock could experience substantial declines before recovering again.

Is Now the Right Time to Invest in NuScale Power?

Before purchasing shares of NuScale Power, it is essential to keep the following in mind:

The Motley Fool Stock Advisor analyst team has identified what they consider the 10 best stocks for current investment, and NuScale Power is not among them. The top ten could deliver significant returns in the foreseeable future.

For instance, had you invested $1,000 in Nvidia after it was recommended on April 15, 2005, your investment would be worth approximately $690,624 today!

Stock Advisor offers investors a straightforward approach to success with tools for portfolio building, regular updates, and new stock picks each month. The service has outperformed the S&P 500 by more than four times since its inception in 2002. Don’t miss the latest top 10 list available upon joining Stock Advisor.

*Stock Advisor returns as of March 3, 2025

Randi Zuckerberg, a former director of market development at Facebook, sits on The Motley Fool’s board of directors. John Mackey, the former CEO of Whole Foods Market, is also part of the board. Leo Sun holds positions in Amazon and Meta Platforms. The Motley Fool has interests in and sponsors Amazon, Meta Platforms, and Microsoft. It also recommends NuScale Power and specific options related to Microsoft. For full disclosures, please refer to their policy.

The views and opinions expressed herein are solely those of the author and do not necessarily reflect those of Nasdaq, Inc.