Quantum Mechanics Poised for a Breakthrough Like the Transistor

In 1844, American inventor Samuel Morse sent the first long-distance telegraph from Washington, D.C., to Baltimore with the message:

“What hath God wrought?”

This pioneering moment didn’t just signal a new era of instant communication; it also marked one of the first practical applications of electricity, a once-mystical force that could now report on personal matters, such as a family member’s health.

Over the next century, advancements in science enhanced our understanding and control over this power. We transitioned from using electricity for simple messaging to the complex task of transmitting video wirelessly.

However, it was the invention of the MOSFET transistor in 1964 that truly transformed the landscape. This “transistor moment” enabled the use of electricity for computing—a feat that had been the realm of massive mechanical devices until then. The world would soon witness the emergence of the first personal computer in 1971, the laptop in 1981, and the World Wide Web in 1989.

Investors who recognized the potential during this technological revolution saw dramatic gains. We believe that quantum mechanics is on the brink of a similar breakthrough.

Quantum mechanics, like electricity in its infancy, is complex and abstract. It shares several characteristics:

- Typically invisible,

- Exhibits counterintuitive behavior,

- Has taken decades to decipher.

We are now approaching a pivotal shift where quantum mechanics is moving beyond brute-force applications to the nuanced demands of modern computing chips. This transition is occurring more rapidly than we had anticipated.

In a special presentation later this week, InvestorPlace Senior Analyst Louis Navellier will take a moment to focus on a transformative idea that he believes could change the world, akin to the impact of the transistor.

On March 20, during the inaugural “Quantum Day” event, Nvidia Corp. (NVDA) might unveil a groundbreaking technology set to usher in the next stage of the AI supercycle.

A small-cap company is positioned to play a key role in Nvidia’s upcoming announcements due to its technology, which is protected by 102 patents.

On Thursday, March 13, at 1 p.m. Eastern, Navellier will host a time-sensitive briefing designed to prepare you for these developments. Click here to register for the free event.

This may all sound overwhelming. Therefore, in this special Sunday InvestorPlace Digest, I (Tom Yeung) will:

- Explain the fundamentals of quantum computing,

- Discuss the significance of Louis’s presentation,

- Outline how to strategically invest in anticipation of this seismic shift.

Let’s begin by addressing the what of quantum mechanics:

What is it, and how does it work?

It’s Quantum Mechanics, Not Sorcery

In 1955, the invention of the cesium atomic clock marked a milestone as the first machine to utilize quantum mechanics. Researchers employed precise microwaves to excite cesium atoms into a “superposition” state, where they simultaneously held multiple energy states (ground and excited). This energy difference was converted into oscillation periods, establishing the standard for time measurement we still use today.

At its core, quantum mechanics describes the behaviors of atomic and subatomic particles. As we scale down to extremely small sizes, the conventional physics rules often do not apply. Consider the following:

- Quantum tunneling. Particles can disappear when encountering an obstacle, only to reappear elsewhere.

- Quantum entanglement. Photons can influence each other instantaneously, regardless of the distance separating them.

- Quantum states. Atoms can simultaneously occupy multiple states, similar to how cesium atoms function in atomic clocks. These states can even change simply by being observed.

- Electroluminescence. When electrons are energized, they can emit energy in the form of light, transforming electricity into illumination.

This may seem peculiar or even fictional, but proprietary research supports that quantum mechanics is a genuine phenomenon recognized since 1900. Many everyday technologies, such as MRI machines, solar panels, and LED bulbs, leverage these principles.

Now, an unparalleled opportunity in quantum computing awaits us.

This potential shift will redefine our understanding of technology.

Understanding the implications of harnessing such “magical” elements of quantum mechanics for computing is essential.

Bringing the “Quantum” Into Computing

The justification for integrating quantum mechanics into computing is straightforward:

Subatomic particles can perform tasks that traditional electricity cannot.

Today’s computers operate on binary systems, using “0”s and “1”s to process data. While functional, this system leads to certain calculations being significantly time-intensive.

For example, breaking encryption requires evaluating numerous combinations sequentially to identify the solution.

In contrast, quantum mechanics allows for simultaneous states of “0” and “1,” as well as countless possibilities in between. A quantum computer could potentially store much more data in a single location and execute complex calculations much faster than traditional computing.

Using quantum technology, encryptions could potentially be cracked in seconds since these advanced machines could evaluate thousands or even millions of combinations at once.

Modern microprocessors face physical limitations as the etchings on semiconductors reach minuscule sizes. As the grooves narrow, they become less effective at conducting electricity. Imagine if we could implement the concepts of quantum tunneling or quantum entanglement—we could theoretically transport data instantly to their destinations, revolutionizing computing and baffling the ants.

Where’s My Quantum Computer?

Nonetheless, the journey to integrate quantum physics into computing has been fraught with difficulties.

The Evolution of Quantum Computing: Breakthroughs and Investment Insights

The original cesium atomic clock relied on beaming microwaves at a “fountain” of cesium-133 atoms. Modern versions still depend on supercooled metal streams injected in a vacuum, a process challenging to replicate on a microchip.

Quantum computing has faced its own set of hurdles. Atoms and subatomic particles frequently vanish into their surroundings, causing delays in computational advancement. It wasn’t until 1998 that the first “quantum computer” appeared, which could only track two carbon-13 atoms for mere nanoseconds.

Major Breakthroughs in Quantum Circuit Design

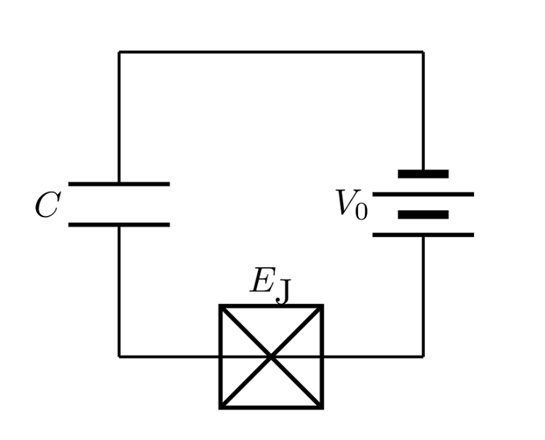

A notable advancement came in 1999, when a research team from Japan introduced the “charge qubit.” This concept integrated an electric circuit with quantum mechanical properties, recognizable as a variation of an LC circuit involving capacitors and inductors to create oscillation.

source

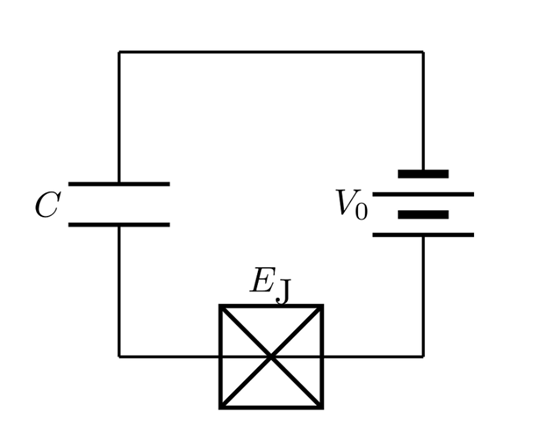

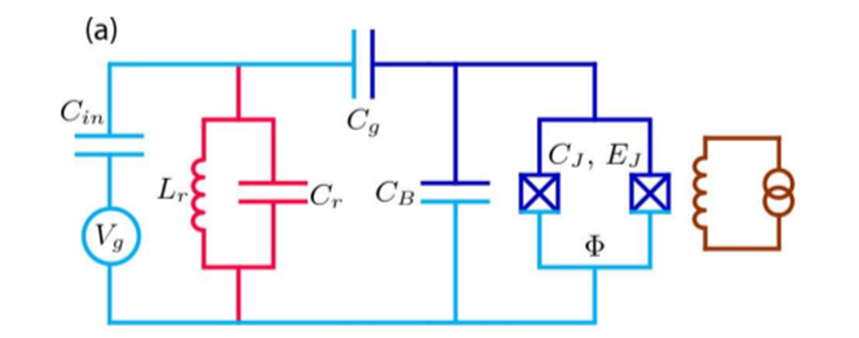

In 2007, Yale researchers made further strides by developing the “Transmon qubit.” This innovation used multiple charge qubits to shield them from external charge noise, allowing for improved retention of quantum states. A representation of this updated circuit design is shown below.

source

Since these developments, the pace of innovation in quantum computing has accelerated. In December 2024, Alphabet Inc. (GOOGL) launched “Willow,” a quantum processor boasting 105 transmon qubits. Recently, similar announcements regarding “quantum chips” have emerged from Amazon.com Inc. (AMZN) and Microsoft Corp. (MSFT).

The potential for these prototypes to evolve into commercially viable products is promising.

Current Landscape and Future Considerations

The primary challenge in quantum computing remains the error rates stemming from the fragile nature of qubits. Environmental disturbances introduce errors in every few hundred calculations. A single qubit might exhibit a 1-in-500 chance of error, increasing in two-qubit systems, and so forth. Consequently, a 1,000-qubit chip is likely to produce errors without robust error correction. Experts suggest that functional quantum chips will need several million qubits for practical utility.

Alphabet’s Willow showcases a significant enhancement by enabling qubits to monitor each other for errors. Theoretically, its 105-qubit design can correct three errors simultaneously, a capability that will improve as more qubits are integrated.

Meanwhile, Microsoft and Amazon are investigating alternative qubit types that might surpass the capabilities of transmons. Microsoft is delving into “topological qubits” that can store quantum information on surfaces, facilitating easier scalability by expanding surface area. Amazon, on the other hand, utilizes “cat qubits” that maintain qubits in a suspended state using microwaves.

This exploration mirrors efforts at Bell Labs during the 1950s and 1960s, leading to the evolution of the 1947 transistor into the usable “MOSFET” chips. At that time, the successful approach was unclear, but the eventual breakthrough was monumental for the semiconductor industry.

Investment Opportunities in Quantum Computing

Currently, Wall Street expert Louis Navellier identifies two companies poised to shape the future of quantum computing. The first is Nvidia Corp. (NVDA), which recognizes the potential risk quantum technology poses to its business, notably in breaking encryption and solving complex problems that traditional MOSFET chips cannot efficiently handle.

The second company is a smaller firm that Navellier will unveil in his upcoming presentation on Thursday, March 13, at 1 p.m. ET. This startup is at the forefront of one of the qubit technologies noted previously, and Navellier believes it might become a leading force in the quantum computing landscape, akin to Bell Labs.

Investors interested in this sector need to act swiftly. As Wall Street grapples with economic uncertainties, this innovative company forges ahead toward creating the next “transistor moment.”

Reserve your place for Navellier’s free event here.

Until next week,

Thomas Yeung

Markets Analyst, InvestorPlace