Historical Investor Sentiment: A Bullish Opportunity Amid Fear

Perhaps it’s time to heed Warren Buffett’s advice and be greedy while others are fearful.

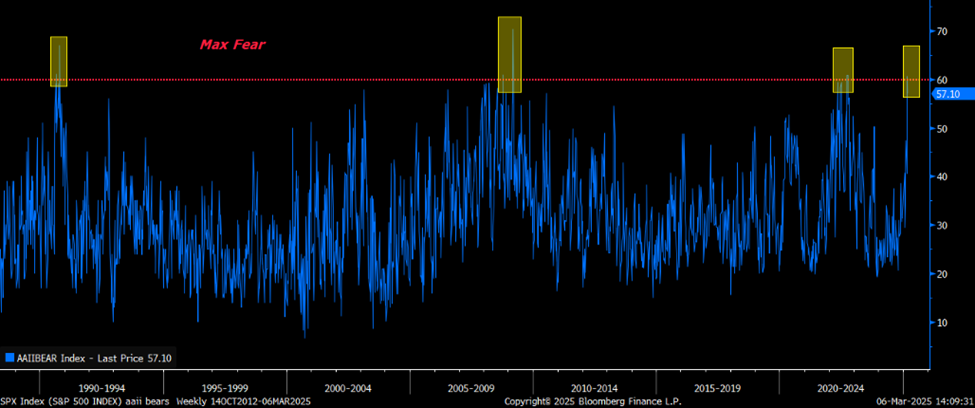

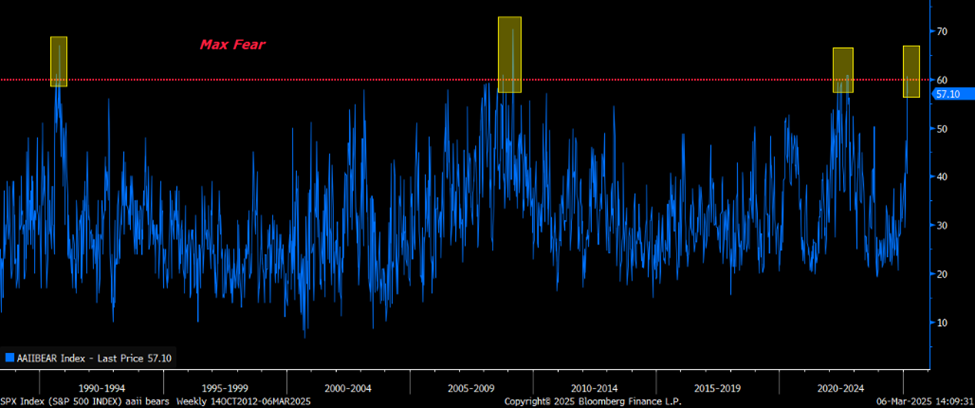

Editor’s Note: Currently, many investors express bearish sentiments towards the market. The American Association of Individual Investors (AAII) survey shows that the percentage of bearish investors has exceeded 60% on only six occasions since the late 1980s: twice in late 1990, twice during the 2008 financial crisis, and again twice during the inflation crisis of 2022.

Historically, each previous instance of investor sentiment dipping this low coincided with the stock market’s bottoming phase after a crash, followed by significant rallies over the subsequent year. The average return in these cases? Close to 30%!

This historical data doesn’t guarantee a similar outcome for stocks this time.

However, my InvestorPlace colleague, Luke Lango, joins us to discuss why this moment might warrant a more optimistic approach. Let’s hear from Luke.

You have likely encountered Warren Buffett’s well-known advice: “Be greedy when others are fearful.”

Currently, fear pervades the market. As per the weekly AAII survey, approximately 60% of individual investors feel bearish about market conditions.

This statistic holds historical significance. Since the late 1980s, the AAII has tracked bearish sentiment, which has only surpassed 60% on six prior occasions: twice in late 1990, twice during the 2008 financial crisis, and twice amid the inflation crisis in 2022.

In essence, investor sentiment is unusually negative right now.

What’s behind this pervasive pessimism?

We are facing the most significant global trade battle in nearly a century. Last month, layoff announcements soared to their highest level since July 2020, escalating by 245% to reach 172,017. Moreover, consumer sentiment has plummeted by 9.8% since January, as evidenced by the University of Michigan’s survey. Federal budget cuts are shaking up the job market, and GDP growth projections have fallen sharply from a previous +2.3% to a troubling -2.8% this quarter.

Given the current climate, it’s no surprise that investor confidence is low.

However, history tells us that extreme bearishness offers potential buying opportunities.

Bearish Sentiment: A Potential Contrarian Signal

In late 1990, when bearish sentiment surpassed 60% in the AAII’s survey, the stock market was nearing the end of a substantial crash. During this period, the S&P 500 tumbled roughly 18% between mid-July and mid-October. Following this downturn, the index experienced a recovery of over 20% within the next year.

Similarly, in late 2008 and early 2009, when bearish sentiment surged above 60%, stocks were again nearing the end of another significant crash. The market plunged approximately 30% between mid-October and mid-March but rebounded with a more than 60% increase in the following year.

In late 2022, when bearishness again exceeded 60%, the stock market was, predictably, bottoming out. Between mid-August and the end of September that year, stocks fell over 16%, only to rally about 20% in the following 12 months.

In short, every time investor sentiment reached today’s levels of negativity, stocks were nearing the bottom after a crash. Subsequently, they rallied significantly. The average 12-month forward return? Nearly 30%!

Conclusion

This historical data does not imply that stocks will undoubtedly rise in the next 12 months.

Yet, it serves as a compelling indicator, suggesting that it might be wise to consider an optimistic stance in line with Buffett’s renowned wisdom.

Market Analysis: Buy AI Stocks as S&P 500 Rest on Key Support

Amid market uncertainty, seasoned investors may find opportunity by adopting a bold approach amidst widespread fear.

S&P 500 Nears Crucial Support Level

The S&P 500 currently hovers around its critical support point: the 200-day moving average. Should the index make a rebound from this level, analysts consider it a strong buy signal.

Focus on Promising AI Stocks

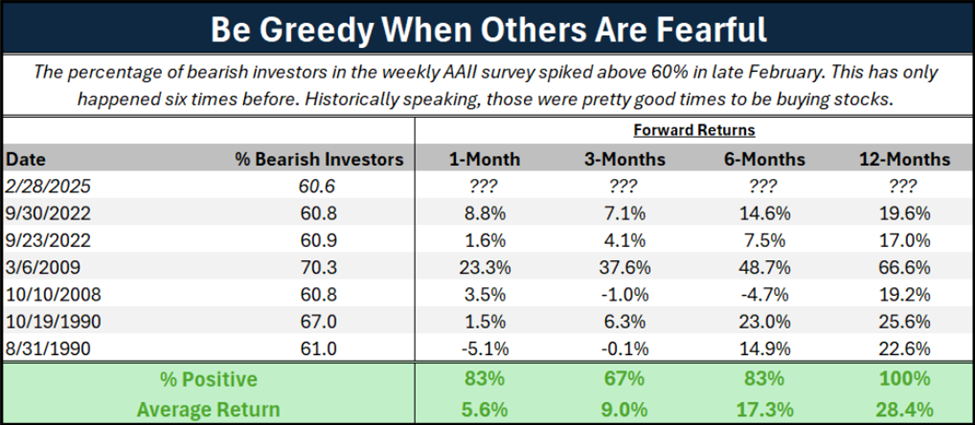

For investors looking to capitalize on potential gains, we advocate for a focus on AI stocks. This sector has displayed robust and consistent growth over the past two years.

The Global X Artificial Intelligence and Technology ETF (AIQ) serves as an effective indicator of the overall industry performance. Since March 2023, AIQ has surged more than 40%, highlighting the sector’s increasing momentum.

Future Outlook for the AI Sector

We anticipate continued strong growth within the AI sector moving forward, reflecting broader trends in technology and data application.

Identifying Breakout Stocks

However, there’s a specific subset of stocks that appears particularly promising at this juncture.

Discover key breakout stocks that are positioned for significant growth.

Regards,

Luke Lango

Editor, Hypergrowth Investing