CenterPoint Energy Shares Surpass Analyst Target Prices: What’s Next?

In recent trading, shares of CenterPoint Energy, Inc (Symbol: CNP) surpassed the average 12-month target price set by analysts, currently priced at $34.26 per share—above the target of $33.57. When a stock reaches an analyst’s target, they typically have two options: either downgrade the stock on valuation grounds or adjust their target price upwards. The analyst’s decision may also hinge on the fundamental business developments that have influenced the stock price. If the company’s outlook improves, it may warrant a higher target price.

There are 15 analyst targets covered by Zacks contributing to the average for CenterPoint Energy, Inc. However, the average is merely a mathematical midpoint. Some analysts set lower targets, with one predicting a price of $30.00. Conversely, another analyst has set a target as high as $37.00, with a standard deviation of $2.242.

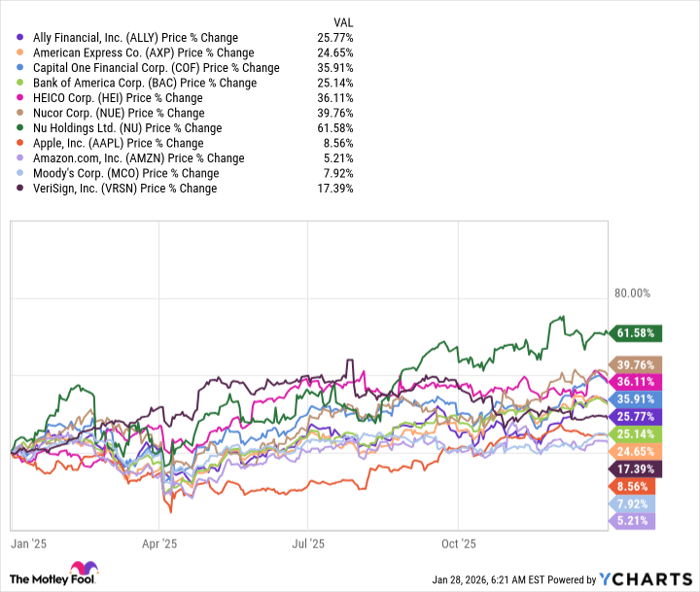

Analyzing the average CNP price target allows investors to leverage the collective insights from many analysts rather than depending solely on a single expert’s opinion. As CNP shares have moved above the average target price of $33.57, investors should take this moment to evaluate the company. The key question for investors is whether $33.57 is a stepping stone toward a higher target or if the valuation has become too high, prompting a reassessment of holdings. Below is a breakdown of current analyst ratings for CenterPoint Energy, Inc:

| Recent CNP Analyst Ratings Breakdown | ||||

|---|---|---|---|---|

| » | Current | 1 Month Ago | 2 Months Ago | 3 Months Ago |

| Strong buy ratings: | 5 | 5 | 6 | 4 |

| Buy ratings: | 1 | 1 | 1 | 1 |

| Hold ratings: | 10 | 10 | 9 | 10 |

| Sell ratings: | 0 | 0 | 0 | 0 |

| Strong sell ratings: | 1 | 1 | 1 | 1 |

| Average rating: | 2.47 | 2.47 | 2.35 | 2.56 |

The average rating, displayed in the last row of the table, is scored from 1 to 5, where 1 signifies a Strong Buy and 5 denotes a Strong Sell. Data was provided by Zacks Investment Research via Quandl.com. For updated insights, you can view the latest report on CNP — FREE.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

• BSCN shares outstanding history

• Top Ten Hedge Funds Holding MGF

• WTBA market cap history

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.