ONE Gas Stock Surpasses Analyst Target: What’s Next?

In recent trading, shares of ONE Gas, Inc. (Symbol: OGS) have exceeded the average analyst 12-month target price of $73.83, currently priced at $74.63 per share. When a stock reaches its analyst target, the analyst faces two choices: downgrade on valuation or adjust their target price higher. Their response may also hinge on the fundamental business developments that could be influencing the stock price. If the outlook for the company improves, perhaps it’s time for an upward revision of the target price.

There are nine different analyst targets within the Zacks coverage universe contributing to the average price for ONE Gas, Inc. While the average serves as a mathematical median, individual targets vary significantly. For instance, one analyst predicts a price target of $66.00, while another projects a high target of $82.00, indicating a standard deviation of $5.159.

The significance of looking at the average OGS price target lies in the collective wisdom of many analysts, rather than relying on a single opinion. With OGS surpassing the average target price of $73.83 per share, investors are prompted to reassess the company. They must determine whether $73.83 is merely a stopping point on the way to a higher target, or if the stock has become overvalued, prompting a re-evaluation of their positions. Below is a table reflecting the current insights from analysts covering ONE Gas, Inc.:

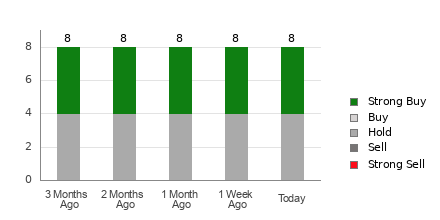

| Recent OGS Analyst Ratings Breakdown | ||||

|---|---|---|---|---|

| » | Current | 1 Month Ago | 2 Months Ago | 3 Months Ago |

| Strong buy ratings: | 2 | 2 | 2 | 1 |

| Buy ratings: | 0 | 0 | 0 | 0 |

| Hold ratings: | 7 | 7 | 7 | 6 |

| Sell ratings: | 0 | 0 | 0 | 0 |

| Strong sell ratings: | 1 | 1 | 1 | 1 |

| Average rating: | 2.8 | 2.8 | 2.8 | 3.0 |

The average rating ranges from 1 to 5, with 1 being Strong Buy and 5 being Strong Sell. This article uses data from Zacks Investment Research via Quandl.com. For the latest Zacks research report on OGS, visit their site—FREE.

![]() The Top 25 Broker Analyst Picks of the S&P 500 »

The Top 25 Broker Analyst Picks of the S&P 500 »

More Insights:

• LUNA Insider Buying

• Top Ten Hedge Funds Holding ICNB

• RIGP Options Chain

The views and opinions expressed herein are solely those of the author and do not necessarily reflect those of Nasdaq, Inc.