Qualcomm Faces Revenue Challenges Amidst Trade Tensions

Recently, Qualcomm Incorporated (QCOM) has experienced a notable decline in its share price. This downturn follows President Trump’s decision to impose a 10% tariff on imports from China, effectively doubling the tariff established in February. As one of the major U.S. companies operating in China, Qualcomm is particularly vulnerable to market instabilities. With China generating 66% of Qualcomm’s total revenues in fiscal 2024, any disruptions in the Chinese market significantly impact the company’s financial health.

Qualcomm maintains a strong presence in over 12 cities across China, focusing on enhancing semiconductor and mobile telecommunications technologies. The firm supplies chips and components to prominent local smartphone manufacturers such as Xiaomi and Huawei. However, recent geopolitical tensions have made operations in China increasingly challenging for Qualcomm.

The ongoing U.S.-China trade dispute lies at the heart of these struggles. Restrictions imposed by the U.S. Commerce Department have limited the sale of high-tech equipment, chips, and components to China, which are essential for developing advanced smartphones and AI-enabled technologies. The tariffs imposed by Trump have prompted retaliatory measures from China, further squeezing Qualcomm’s revenue potential.

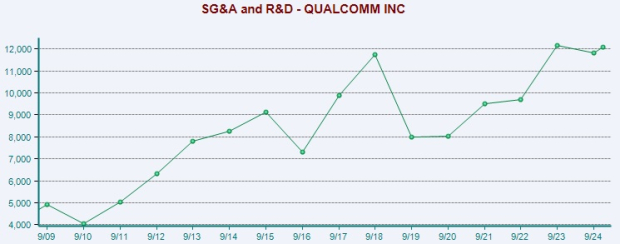

High R&D Costs Squeeze QCOM Margins

Over the years, Qualcomm’s profit margins have eroded due to rising operating costs and significant R&D investments. The company anticipates a continued slowdown in the handset market, which, coupled with a decline in demand for integrated chipsets from its Snapdragon platform, poses additional risks. Increased competition from low-cost chip manufacturers and established players within the mobile chipset sector further complicates Qualcomm’s profitability outlook. While the global smartphone market is expected to expand over the next few years, most of this growth is projected to emerge from cost-sensitive markets, potentially restricting Qualcomm’s margins.

Image Source: Zacks Investment Research

Snapdragon Growth Supports QCOM

In response to these challenges, Qualcomm has been developing its licensing program within the mobile sector. The company is strategically positioned to achieve its long-term revenue goals, driven by robust 5G adoption and an increasingly diversified revenue base. Qualcomm’s Snapdragon portfolio presents substantial growth opportunities, thanks to its advanced mobile technologies.

The Snapdragon mobile platforms, equipped with multi-core CPUs, cutting-edge graphics, and extensive connectivity options, deliver superior performance while maximizing power efficiency. They enable enhanced augmented and virtual reality experiences, superior camera functionalities, and advanced 4G LTE and 5G connectivity with enhanced security features.

Qualcomm is also expanding its AI capabilities in the laptop and desktop markets with the unveiling of the Snapdragon X chip tailored for mid-range AI desktops and laptops. This move reflects a strategic pivot from its traditional smartphone-centric focus, aimed at broadening its revenue streams and augmenting its AI presence.

The Snapdragon X SoC (system-on-chip) is the latest of its series, succeeding the Snapdragon X Plus and Snapdragon X Elite. Utilizing a 4-nanometer manufacturing process, this new chip includes an 8-core Oryon central processor, a graphics unit, and a neural processing unit (NPU). The NPU is designed to accelerate AI tasks, achieving 45 TOPS (trillions of operations per second), ideal for promoting Microsoft Corporation’s MSFT vision for AI-focused PCs.

Emphasis on Automotive Sector Growth

Qualcomm’s initiatives in automotive telematics and connectivity platforms, as well as its digital cockpit and C-V2X solutions, align with growing trends in the automotive industry, such as connected vehicles and vehicle electrification. The company aims to become the leading smartphone radio frequency front-end provider by revenue in the near future. Last quarter, automotive revenues surged by 61% to a record $961 million, bolstered by increased demand for the Snapdragon Digital Chassis in new vehicle launches.

Stock Performance Overview

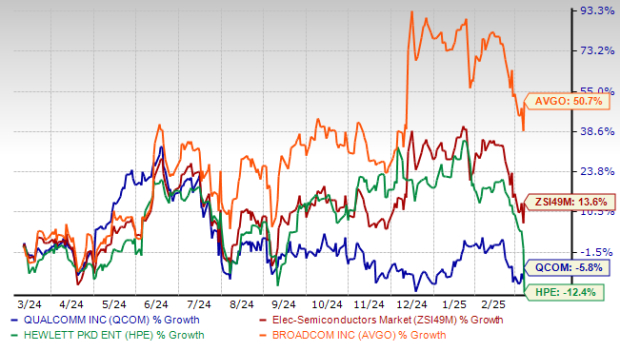

Over the past year, QCOM shares have dropped by 5.6%, in contrast to the industry’s overall growth of 13.7%. While QCOM has outperformed peers like Hewlett Packard Enterprise Company (HPE), it has lagged behind Broadcom Inc. (AVGO).

One-Year QCOM Stock Price Performance

Image Source: Zacks Investment Research

Earnings Estimate Trajectory for QCOM

Earnings forecasts for Qualcomm for fiscal 2025 have risen by 12.4% to $11.76 over the past year, while estimates for fiscal 2026 have increased by 4.7% to $12.44, indicating positive market sentiment around QCOM’s prospects.

Image Source: Zacks Investment Research

Conclusion

Qualcomm appears to be navigating a complex landscape, bolstered by robust support from its automotive sector and the strengthening of its Snapdragon product offerings. The company’s commitment to quality and effective operational strategies aims to generate added value for its customers. Improving earnings estimates reflect a more favorable view of its stock.

However, the company faces significant risks from intense competition and softness in key markets, which could hinder growth. The burden of high R&D expenses has also impacted Qualcomm’s profitability. There are reports that the company is considering layoffs in response to the escalating tariffs in China, putting further weight on its long-term plans in the region. As a result, Qualcomm holds a Zacks Rank of #3 (Hold), suggesting investors should approach with caution.

5 Stocks Expected to Soar

Analysts have identified five stocks poised to gain +100% or more in 2024. Past recommendations have demonstrated impressive returns of +143.0%, +175.9%, +498.3%, and +673.0%.

Many of the stocks in this report remain under the radar on Wall Street, presenting a valuable opportunity to invest early.

Today, discover These 5 Potential Opportunities >>

Curious about the latest recommendations from Zacks Investment Research? Download the 7 Best Stocks for the Next 30 Days today. Click for your free report.

QUALCOMM Incorporated (QCOM): Free Stock Analysis report.

Microsoft Corporation (MSFT): Free Stock Analysis report.

Broadcom Inc. (AVGO): Free Stock Analysis report.

Hewlett Packard Enterprise Company (HPE): Free Stock Analysis report.

This article originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.