Analysts Predict Upside for Vanguard S&P Small-Cap 600 ETF

At ETF Channel, we’ve analyzed the underlying holdings of the ETFs in our coverage universe. We compared the trading price of each individual holding against the average analyst 12-month forward target price, then computed the weighted average implied analyst target price for the ETF itself. For the Vanguard S&P Small-Cap 600 ETF (Symbol: VIOO), the implied analyst target price based on its underlying holdings stands at $123.51 per unit.

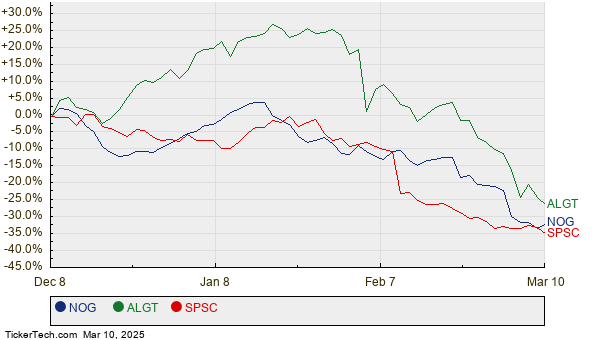

With VIOO trading recently at about $99.30 per unit, analysts foresee a potential upside of 24.38% based on the average target prices for its underlying holdings. Noteworthy are three of VIOO’s holdings that show significant upside potential. Northern Oil & Gas Inc (Symbol: NOG) currently trades at $27.49 per share, while the average analyst target is set at $47.71 per share—a 73.55% increase. Additionally, Allegiant Travel Company (Symbol: ALGT) has a recent share price of $60.76 and an analyst target of $101.09, indicating a 66.38% upside. Furthermore, analysts expect SPS Commerce, Inc. (Symbol: SPSC) to reach a target price of $208.90 per share, which is 62.92% above its recent price of $128.22. Below is a price history chart comparing the stock performance of NOG, ALGT, and SPSC:

Below is a summary table of the current analyst target prices discussed above:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| Vanguard S&P Small-Cap 600 ETF | VIOO | $99.30 | $123.51 | 24.38% |

| Northern Oil & Gas Inc | NOG | $27.49 | $47.71 | 73.55% |

| Allegiant Travel Company | ALGT | $60.76 | $101.09 | 66.38% |

| SPS Commerce, Inc. | SPSC | $128.22 | $208.90 | 62.92% |

Are analysts justified in these price predictions, or are they overly optimistic about where these stocks will stand in 12 months? Investors may wonder if there are valid rationales for these targets or if they reflect outdated assessments following recent developments in the companies and their industry. While high price targets compared to a stock’s trading price may suggest optimism, they can also forecast potential downgrades if they are based on past performance. These are crucial questions that require further investigation.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

also see:

CBIN Videos

Institutional Holders of EVRI

Funds Holding VXXB

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.