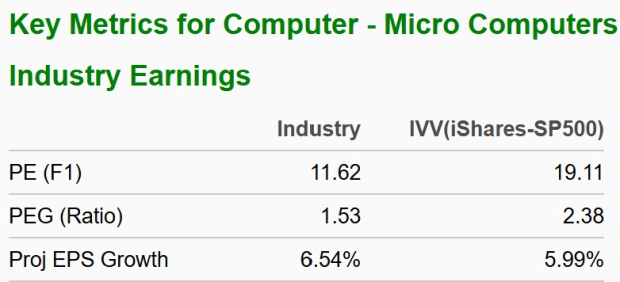

iShares Dow Jones U.S. ETF Falls into Oversold Condition

In trading on Monday, shares of the iShares Dow Jones U.S. ETF (Symbol: IYY) dropped into oversold territory, reaching as low as $135 per share. The Relative Strength Index (RSI), a key technical analysis tool, measures momentum on a scale from zero to 100. An asset is deemed oversold when its RSI reading falls below 30.

For the iShares Dow Jones U.S., the RSI has been recorded at 28.3. In comparison, the S&P 500 currently holds an RSI of 28.9. A bullish investor might interpret IYY’s 28.3 figure as an indication that recent heavy selling could be tapering off, presenting potential buying opportunities.

Examining the one-year performance of IYY (see chart below), the ETF’s 52-week low stands at $120.56 per share, while its high reaches $149.87. The last traded price was recorded at $136.21. As of Monday, iShares Dow Jones U.S. is trading down approximately 2.6% for the day.

Free report: Top 8%+ Dividends (paid monthly)

![]() Discover what 9 other oversold stocks you need to know about »

Discover what 9 other oversold stocks you need to know about »

Also see:

- HBCP Stock Predictions

- Funds Holding CNXM

- XRTX shares outstanding history

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.