Amazon Stock Dips: Is This the Right Time to Invest?

Down 11% this year, Amazon AMZN Stock has fallen to under $200 a share again, presenting a more attractive entry point for investors.

Although the broader market has continued its sharp selloff on Monday, it’s worth considering whether now is a favorable time to invest in the tech giant at a more reasonable Stock price and valuation.

Image Source: Zacks Investment Research

Current Market Sentiment Towards Amazon

Traded at 20% beneath its 52-week high of $242 a share, Amazon’s Stock has not escaped recent market fluctuations. Still, investor confidence had been high for AMZN prior to the spike in economic uncertainties.

In this context, Amazon reported record revenues of $637.96 billion last year. Analysts project its top line will grow over 9% in fiscal years 2025 and 2026. Approaching annual sales of $700 billion, Amazon’s strength as the leading e-commerce and cloud provider (AWS) is further enhanced by the company’s initiatives in artificial intelligence.

In December, Amazon plans to release the second generation of its Trainium AI chips. The Trainium 2 aims to boost the performance and efficiency of machine learning tasks. This advancement positions Amazon to effectively compete with Nvidia NVDA, AMD AMD, and other leading chip manufacturers by offering cost-effective and scalable solutions for AI workloads.

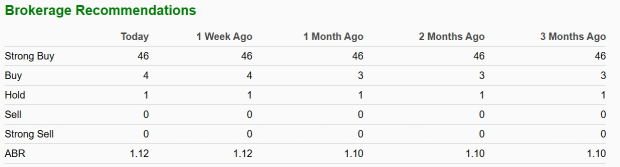

Brokerage Recommendations and Price Targets

A total of 51 brokerage firms provide coverage for Amazon Stock, with data available through Zacks. Currently, AMZN holds an average brokerage recommendation (ABR) of 1.12 on a scale from 1 (Strong Buy) to 5 (Strong Sell).

Image Source: Zacks Investment Research

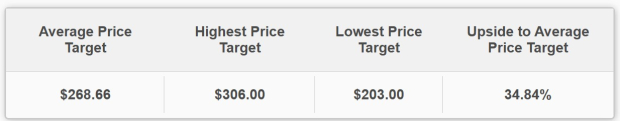

Out of 50 analysts, the Average Zacks Price Target for AMZN stands at $268.66, indicating an upside potential of over 30% from current prices.

Image Source: Zacks Investment Research

Amazon’s Valuation and Investment Potential

Given Amazon’s positive growth trajectory, many investors are considering the stock’s recent dip a suitable buying opportunity. Currently, AMZN trades at its most favorable P/E valuation in some time.

With a forward P/E ratio of 31.5X, AMZN is aligning closer to the S&P 500’s P/E multiple, significantly lower than its five-year high of 161.3X, and offers a notable discount compared to its median P/E of 65.1X during this period.

Image Source: Zacks Investment Research

Conclusion: Is Now the Time for Amazon?

While there may be better buying opportunities ahead for Amazon Stock, AMZN currently holds a Zacks Rank #3 (Hold). Deciding whether to buy or hold may be confusing amid the ongoing decline of the tech-focused Nasdaq. However, long-term investors might find themselves rewarded due to Amazon’s promising outlook and expansion in artificial intelligence.

5 Stocks Set to Double

Each stock was carefully selected by a Zacks expert as the top pick to potentially gain +100% or more in 2024. Not all selections succeed, but previous recommendations have risen +143.0%, +175.9%, +498.3%, and +673.0%.

Many of the stocks in this report are currently flying under Wall Street’s radar, presenting an excellent opportunity for early investment.

Today, explore These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? You can download 7 Best Stocks for the Next 30 Days today. Click for this free report.

Amazon.com, Inc. (AMZN): Free Stock Analysis report.

Advanced Micro Devices, Inc. (AMD): Free Stock Analysis report.

NVIDIA Corporation (NVDA): Free Stock Analysis report.

This article originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.