Investing Through Market Drops: Lessons from Amazon’s Success

Experiencing a significant drop in the Stock market can lead to anxiety as you watch your portfolio’s value decline. During these turbulent times, making the right choices becomes crucial.

Concerns may arise regarding your retirement, your children’s education, or your long-term financial dreams. In the wake of a market downturn, there are specific strategies to adopt and others to avoid.

One of the most notable stories to examine during such periods is that of Amazon.

Amazon’s Remarkable Growth Story

When asked about the biggest Stock market success stories of the last century, Amazon likely springs to mind. Starting as a modest online bookseller, the company evolved into one of the world’s leading powerhouses, achieving a market valuation of $1 trillion in 2020.

Amazon’s extensive product range and the visionary leadership of its founder, Jeff Bezos, contributed to this transformation, making him one of the wealthiest individuals globally. Consequently, shareholders have witnessed phenomenal growth, with the company’s market value soaring over 120,000% since its initial public offering (IPO) in 1997. This impressive rate means that a mere $10,000 investment would now be worth around $12 million.

What Typically Goes Unnoticed

While many know of Amazon’s success, fewer recall key financial details, such as the Dow Jones Industrial Average’s movements on March 4, 2015, or October 18, 2013. Information about mortgage rates on December 12, 2003, or the Federal Reserve’s short-term interest rates on July 27, 2011, is similarly obscure.

Ultimately, what mattered most were not the market fluctuations or interest rates, but the strength of Amazon’s business model. The challenges of recessions, bear markets, and stock market corrections became minor obstacles on Amazon’s path to unprecedented achievement.

For Amazon’s shareholders, what truly mattered was the relentless innovation, the value delivered to customers, and the effective strategies implemented by management. This principle holds true for other successful companies like Apple, Disney, Starbucks, and Google. No matter the surrounding economic turmoil, these companies achieved growth through innovation and strategic business practices.

Understanding Market Dynamics

For long-term investors, experiencing bear markets and market corrections is a given. These events, even modest declines of around 15%, may trigger stress and doubt about stock ownership.

Long-term investors will frequently encounter “bearish” news that breeds pessimism. Numerous financial analysts and journalists perpetuate a cycle of negative forecasts, warning of impending economic crises.

Unfortunately, many absorb this information to heart, reflecting our evolutionary tendency to focus on potential threats—a survival instinct from our ancient ancestors.

In today’s climate, while we may no longer encounter natural predators, we remain susceptible to the barrage of alarmist headlines. Simplistically put, “Fear sells,” and the media knows this. It thrives on drawing attention to disasters and gloomy predictions.

Shaping Your Investment Approach

Encouraging a rational mindset grounded in fact will benefit you as an investor. Historical data supports this assertion: the Stock market’s average annual return over the last century stands at approximately 10%. The upward trajectory of prosperity, driven by free markets and enterprise, is one of the most enduring trends in human history.

Furthermore, stocks appreciated by an astonishing 1,500,000% during the 20th century. This figure implies that a $100 investment would yield $1.5 million today.

Resilience Amidst Adversity

The 20th century was rife with challenges—two world wars, the Great Depression, and numerous economic crises, yet U.S. stocks showed remarkable resilience, achieving significant value appreciation. Companies such as Coca-Cola, Ford, and Apple not only met the challenges head-on but thrived, creating incredible wealth.

Despite persistent issues in the U.S., such as debt and inequality, proactive innovation flourishes. This should motivate investors to maintain their positions rather than retreat in fear.

While it’s easy to become engrossed in the problems of the day, remember that for every issue that arises, countless innovative solutions are being developed. Brilliant minds continuously work on products and services that enhance our quality of life.

As you navigate your investment journey, remain focused on the fundamentals of sustained growth and innovation; this mindset will guide you through the market’s structure.

The Resilience of American Innovation and Market Growth

The innovators who created life-changing inventions—like the light bulb, television, pacemaker, airplane, and iPhone—share a common trait. They possess both the intellect and work ethic necessary to establish remarkable enterprises, such as Starbucks, Facebook, Amazon, Whole Foods, Apple, Nike, and Google.

These companies have generated millions of jobs, delivered goods and services to satisfied customers, and created substantial wealth for shareholders. Their achievements stem from a continuous focus on creation and innovation.

Despite some negative opinions, esteemed investor Warren Buffett is correct: America remains the best place to conduct business. This country boasts:

- Deep and liquid capital markets

- Robust rule of law

- High-quality accounting standards that foster transparency

- A nurturing environment for innovation

- Respect for property rights

- An efficient transportation network

- A broad consumer base with considerable purchasing power

The strides made by American entrepreneurs have significantly improved the lives of today’s average Americans. Remarkably, even those in the “low income” demographic enjoy superior medical care, food quality, transportation, and information access compared to individuals from a century ago, regardless of wealth.

Free markets, innovation, and productive enterprise have driven humanity’s remarkable progress through challenges like wars, recessions, and bear markets. This trend has persisted for centuries and is likely to continue going forward.

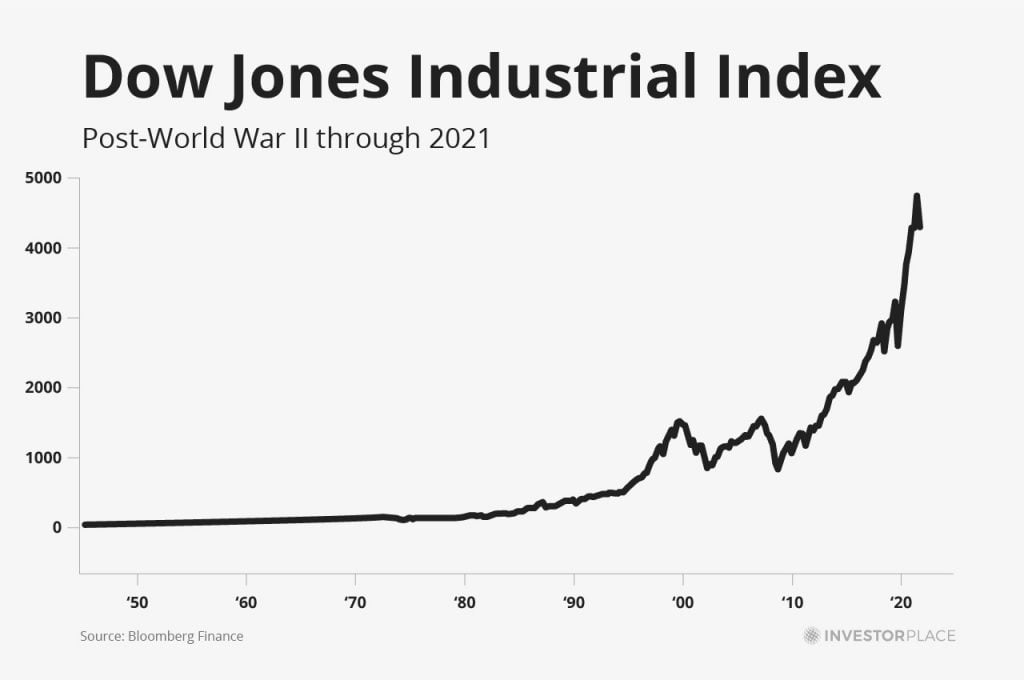

Below, you can see a chart depicting the Dow Jones Industrial Index from the post-World War II era through 2021:

Incredible, isn’t it?

The market declines of 1987, 2000, and 2008 were difficult, but they appear as mere speed bumps on the long-term growth chart. The message is clear: American prosperity has a consistent upward trajectory, alongside a rising stock market.

With this perspective, I advise investors to “make the trend your friend.” Ignore the naysayers. Don’t panic during market corrections, and resist allowing sensational headlines to undermine your confidence in high-quality innovative stocks poised to make an impact.

When faced with Stock market corrections, concentrate on the essentials: progress, transformative industry trends, creating value for others, and innovation.

The history shows that shareholders of innovative companies serving their customers have built substantial wealth, making this approach reliably profitable in America for over a century. I expect it will remain so for at least another century. This optimism regarding human progress and innovation informs our principles at InvestorPlace.

This belief is why, when subscribers inquire about methods to navigate bear markets, we share this essay.

Our approach entails reviewing historical facts, thinking long-term, and seeking to acquire high-quality stocks at discounted prices, rather than selling in a panic.

I firmly believe that when an investor can detach from the immediate market fluctuations and interest rate concerns to concentrate on tangible factors—those that history proves truly matter—they elevate their understanding of finance and investing. This realization marks a crucial milestone on their journey to mastering money.

Eight Charts to Consider During Market Turmoil

Since 1928, the benchmark S&P 500 has experienced 26 bear markets. Remarkably, after each correction, stocks climbed back to new all-time highs. The historical record in this regard is flawless.

Recent examples provide strong evidence that a thoughtful “bear market strategy” should focus on the facts, maintain a long-term outlook, and resist panic-selling during downturns.

We believe these eight charts can counteract a detrimental mindset we refer to as “Short-Term-itis.”

For instance, during the notorious crash known as “Black Monday” in 1987, the stock market plummeted by 33.5% in just one day, inciting global financial fears. However, less than two years later, the market soared to new heights.

Historical Market Declines and Resilient Recoveries: A Review

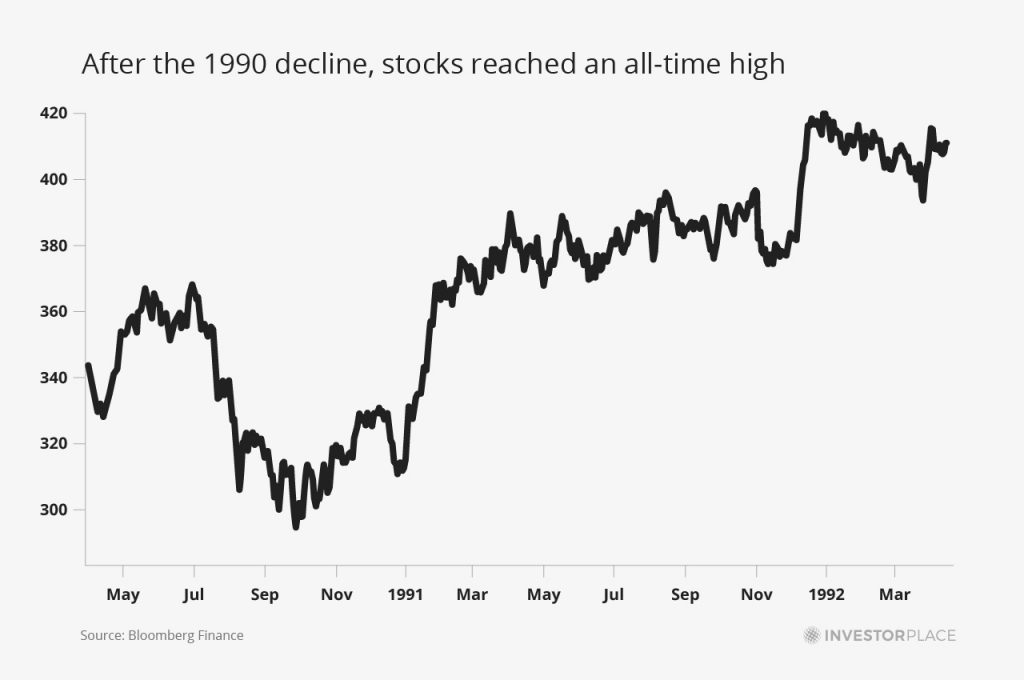

Market fluctuations are a recurring theme in financial history, with significant declines often followed by impressive recoveries. One prominent example is the market decline of 1990, driven by fears of a U.S. recession and the Gulf War. During this tumultuous period, stocks fell by 19.9%. Nevertheless, recovery was swift, with equities reaching new all-time highs in less than a year.

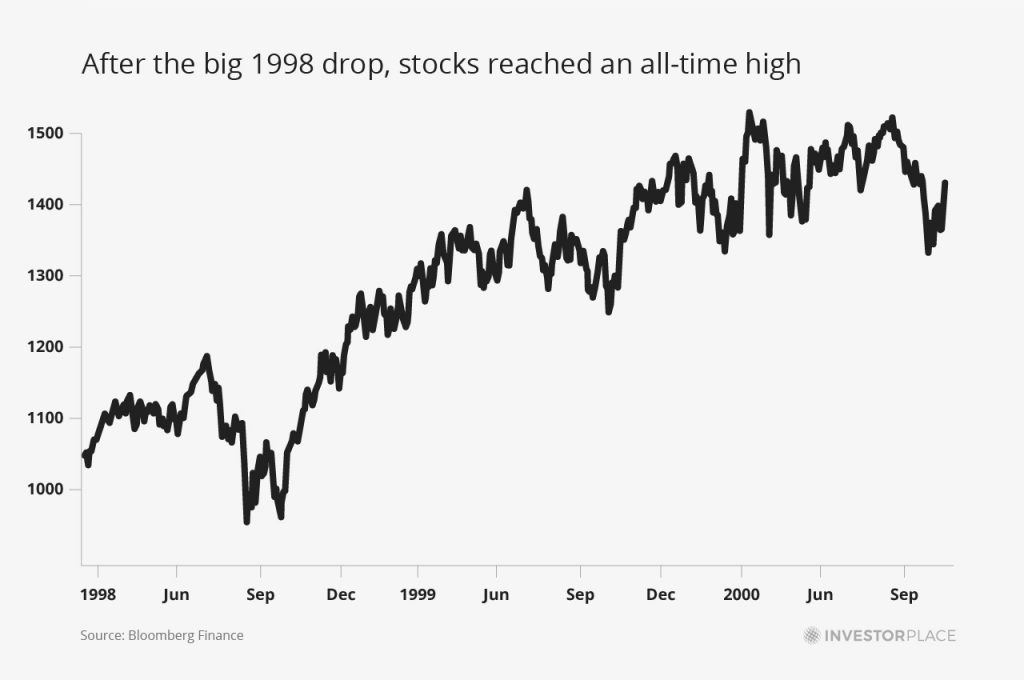

The late 1990s presented another notable decline in 1998. During this brief downturn, the market experienced a drop of 19.3%. Yet again, stocks demonstrated resilience, quickly recovering and achieving new highs by early 1999.

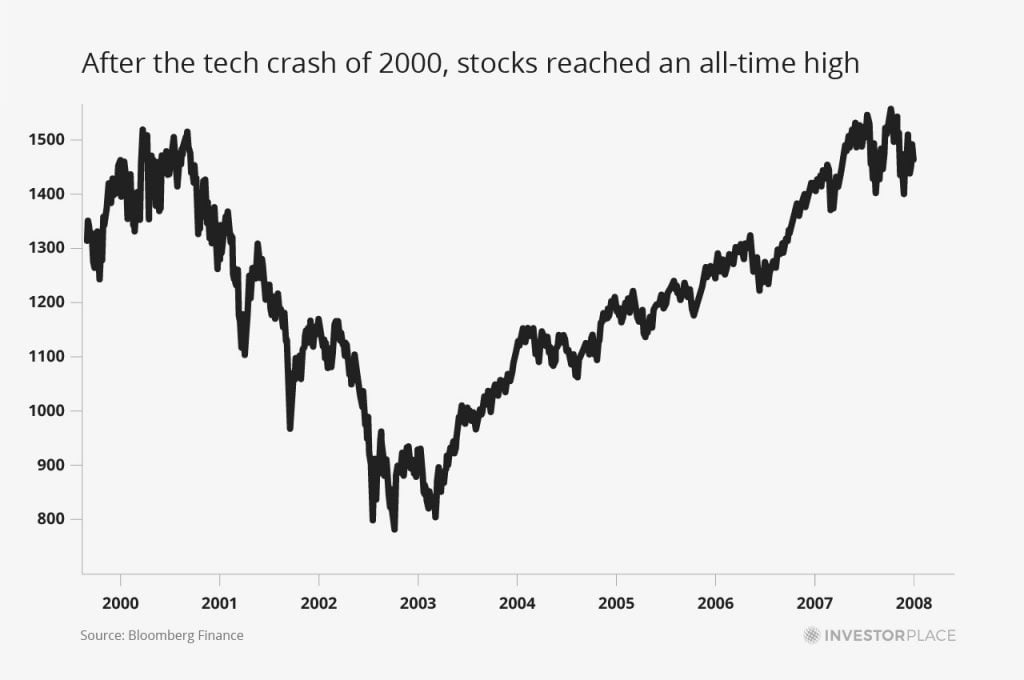

Another significant downturn occurred during the 2000-2002 bear market, a consequence of the dot-com bubble bursting after reaching its peak in March 2000. This downturn stands as one of the worst in U.S. market history, characterized by substantial losses and a lengthy recovery period.

Overall, history shows that while market declines are inevitable, resilience and recovery are equally part of the financial landscape. Investors frequently find opportunities in the aftermath of these downturns, underscoring the dynamic nature of the stock market.

Stock Market Recoveries: Key Historical Moments of Resilience

The stock market has experienced significant downturns followed by remarkable recoveries over the past two decades. Following the tech crash in 2000, stocks bounced back, achieving new all-time highs by 2007.

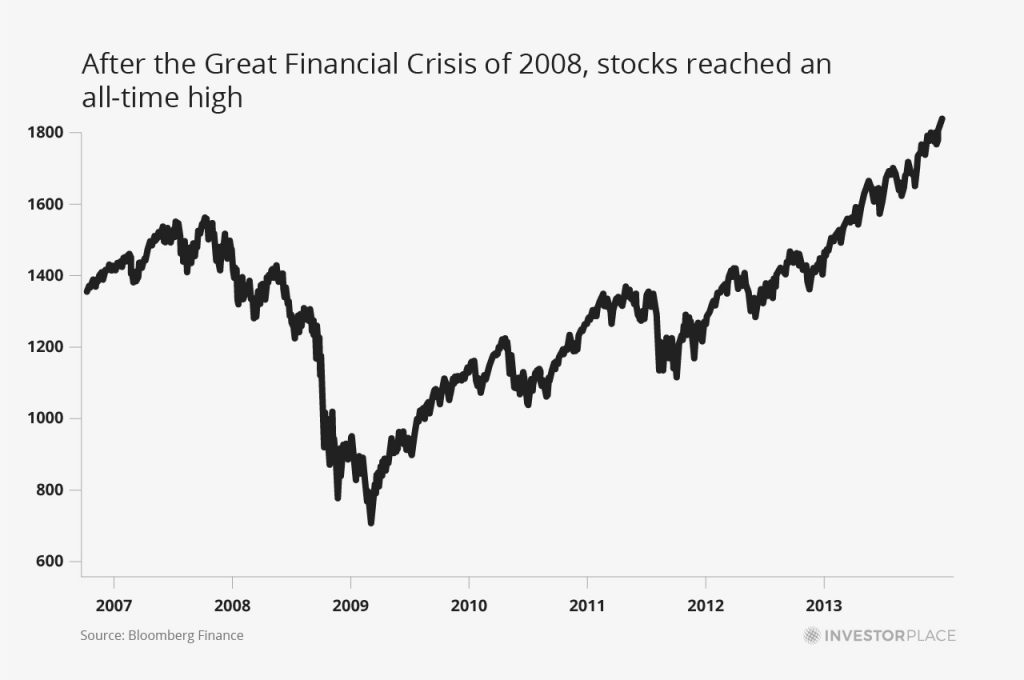

Following this, the bear market associated with the Great Financial Crisis of 2008 saw stocks plunge an astonishing 56%. However, the market rebounded, entering a historic bull phase that lasted a decade. This recovery allowed many investors to regain their losses, culminating in a new all-time high by 2013.

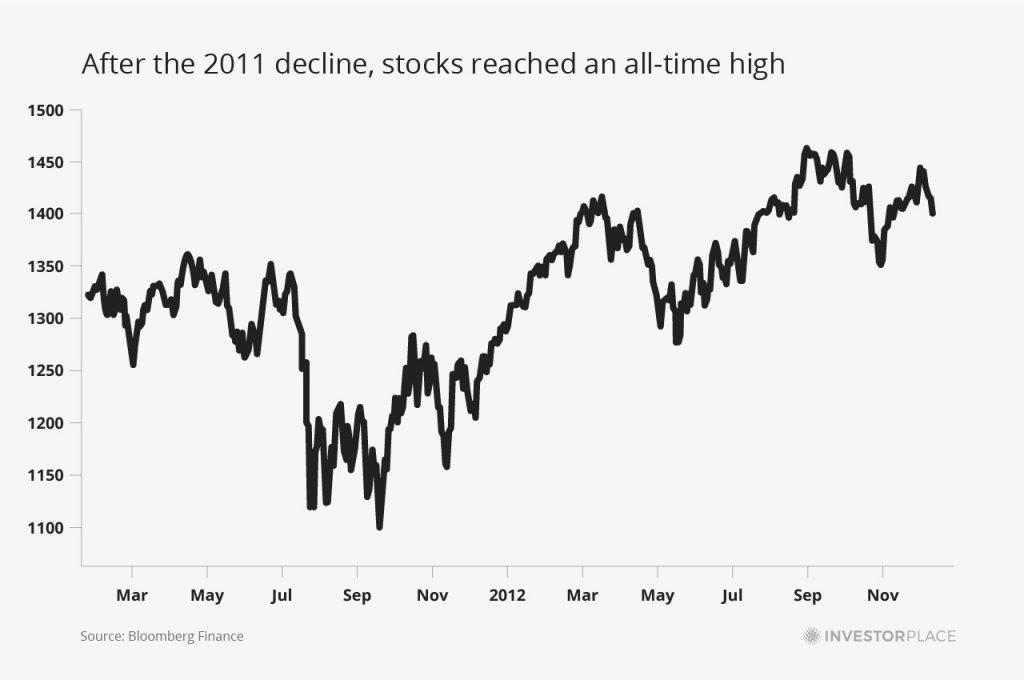

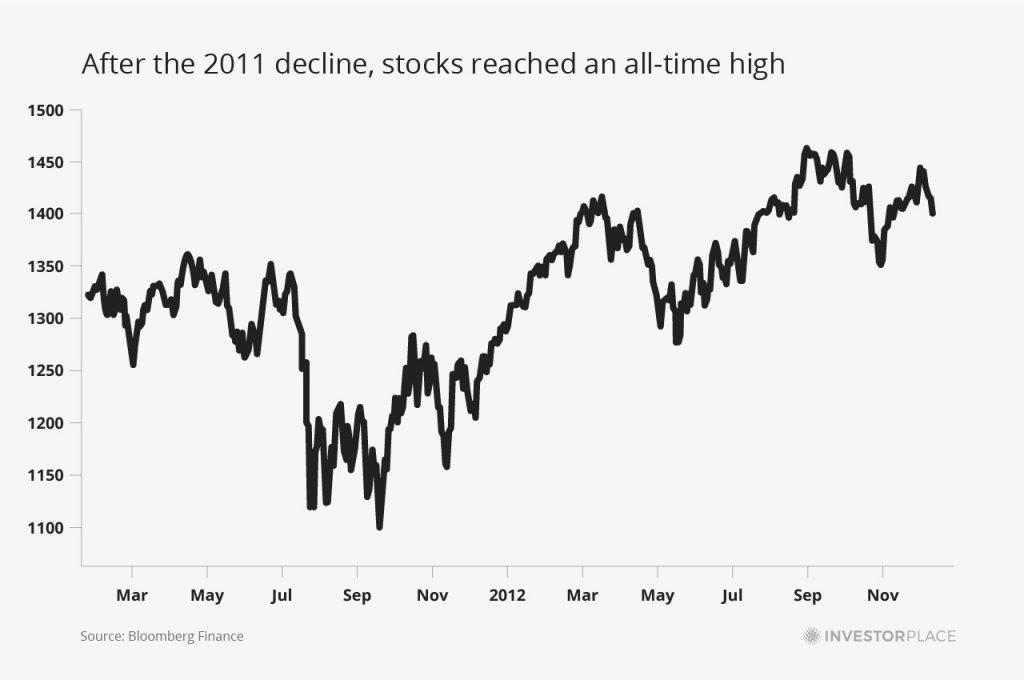

During the prolonged recovery following the 2008 collapse, the S&P 500 faced a 19% decline in late 2011. However, it quickly regained momentum, reaching a new all-time high by early 2012.

Historical Stock Rebounds: Market Corrections Followed by Recovery

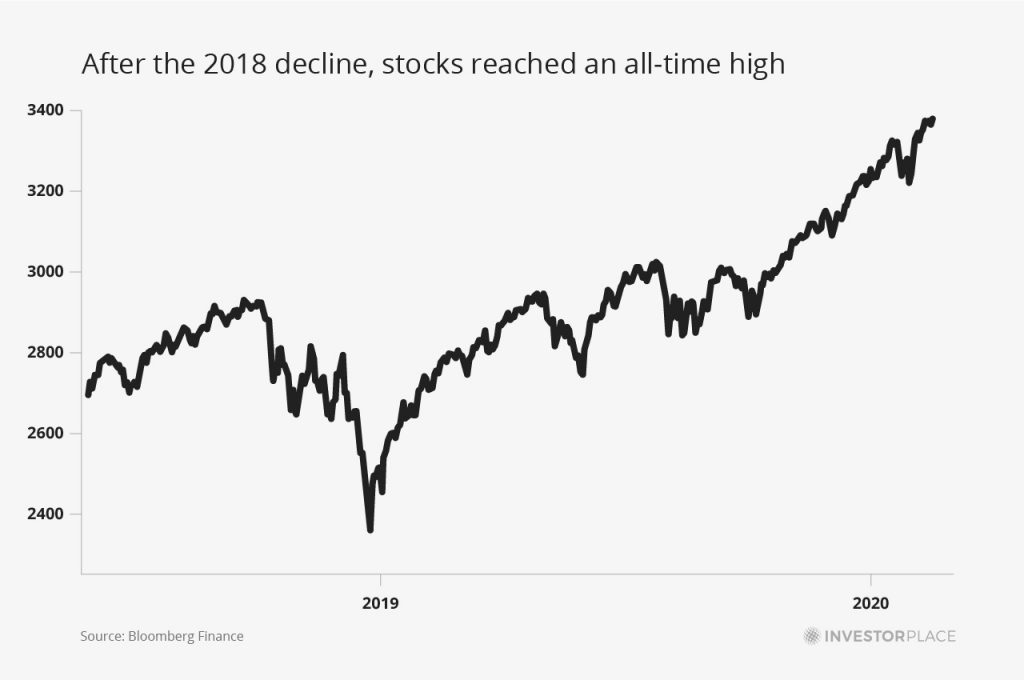

In 2018, the stock market experienced a steep decline of 19%. However, by the summer of the next year, equities rebounded, achieving a new all-time high.

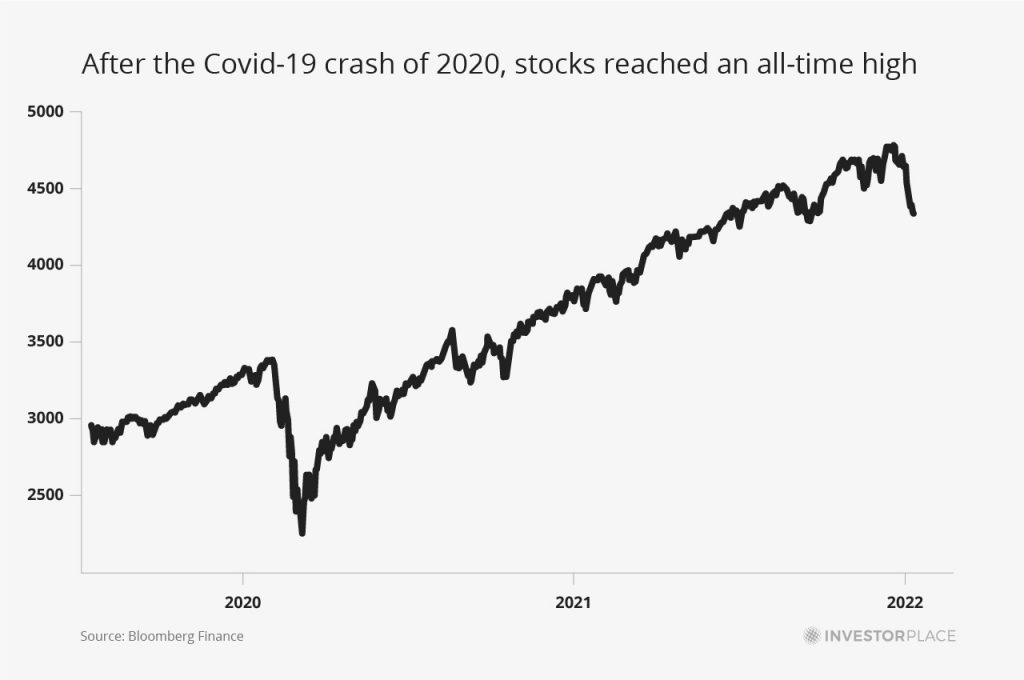

Another significant decline occurred in 2020, related to the covid-19 pandemic. The market plummeted 53% in less than two months as the gravity of the situation became apparent. Nonetheless, federal stimulus measures facilitated a swift recovery, and stocks reached a new all-time high by year’s end.

Key Takeaways

This overview has examined significant financial downturns over the past six decades.

You have explored notable bear markets and stock crashes, including Black Monday in 1987, the dot-com crisis of 2000, and the Great Financial Crisis of 2008.

Importantly, data shows that every period of decline has ultimately led to all-time highs.

These recoveries reflect a consistent long-term trend: Every major stock market correction or crash in American history has been succeeded by new peaks.

This leads us to emphasize the importance of focusing on what truly matters during market fluctuations: progress, transformational industry trends, value creation, and innovation.

Despite various setbacks over the past century, investors in innovative companies have typically reaped substantial rewards.

It is critical to maintain confidence in the American market.

Consider implementing a sound investment strategy long-term, predicated on the insights discussed here, as a means to navigate bear markets effectively.

Regards,

Brian Hunt