Assessing NVIDIA and Broadcom: Which AI Stock to Buy?

With the rise of artificial intelligence (AI), NVIDIA Corporation (NVDA) and Broadcom Inc. (AVGO) have seen their shares increase. Both companies are developing AI technologies, but they approach it differently. Broadcom’s custom AI accelerators, created in partnership with Alphabet Inc. (GOOGL), directly compete with NVIDIA’s renowned graphic processing units (GPUs). This article evaluates which of these two stocks might be a better investment opportunity.

NVIDIA: A Strong Option for Investors

Concerns over the DeepSeek large language model’s cost-effectiveness have been exaggerated and are unlikely to affect NVIDIA in the long term. As more users adopt low-cost models, there will likely be an increase in computing power demand, benefiting NVIDIA. The semiconductor leader has the resources to produce affordable products and to advance the AI ecosystem.

Developers currently show a strong preference for NVIDIA’s CUDA software platform over Advanced Micro Devices, Inc. (AMD) ROCm platform. Transitioning to ROCm presents significant challenges, making such a shift improbable.

NVIDIA’s leading position in the GPU market continues to provide it with a competitive advantage, driving future growth. Recently, the company’s quarterly sales from the Blackwell AI processor exceeded market expectations due to high demand. This robust demand is expected to continue owing to Blackwell’s faster AI interface and improved efficiency.

Broadcom: Growth in Custom AI Solutions

Broadcom is witnessing strong demand for its custom AI accelerators and application-specific integrated circuits, which should propel revenue growth. The company anticipates tapping into a significant market for custom AI accelerators, projected to be between $60 billion and $90 billion by 2027.

In fiscal 2024, Broadcom’s revenue from custom AI accelerators and connectivity switches reached $12.2 billion, marking a 220% increase from the previous fiscal year. The company expects continued growth in AI revenues in the first quarter of fiscal 2025.

The acquisition of VMware has strengthened Broadcom’s infrastructure software solutions, adding over 4,500 top customers to its VMware Cloud Foundation for on-premises private cloud deployments.

Furthermore, Broadcom generated significant cash flows in fiscal 2024, which supported its ability to issue dividends and conduct share buybacks, reflecting management’s confidence in future earnings.

NVIDIA vs. Broadcom: Investment Potential

NVIDIA continues to benefit from lessening fears around DeepSeek, GPU dominance, and strong demand for Blackwell chips. Conversely, Broadcom stands to gain from the heightened demand for its custom AI accelerators.

However, Broadcom’s custom AI accelerators cannot surpass NVIDIA’s GPUs, as they are typically optimized for workloads suited specifically for Broadcom’s designs. Despite this, Broadcom operates in a broader range of sectors, but its AI hardware segment was the main driver of sales growth in fiscal 2024, while other segments faced challenges. In contrast, NVIDIA’s revenue for fiscal 2025 is projected at $130.5 billion, reflecting a significant 114% year-over-year increase.

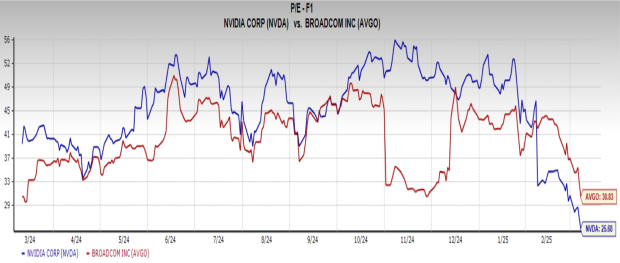

Given these factors, NVIDIA’s higher revenue growth suggests it is currently a more attractive investment than Broadcom. Moreover, purchasing NVIDIA shares appears to be a more economical choice; NVDA trades at a forward price/earnings ratio of 25.6, compared to Broadcom’s 30.83.

Image Source: Zacks Investment Research

Currently, NVIDIA Stock holds a Zacks Rank #2 (Buy), while Broadcom Stock has a Zacks Rank #3 (Hold). For a comprehensive list of top Zacks #1 (Strong Buy) stocks, you can find it here.

Five Stocks Poised to Increase

These stocks were selected by a Zacks expert as favorites expected to gain +100% or more in 2024. Although not every selection can succeed, past recommendations have surged by +143.0%, +175.9%, +498.3%, and +673.0%.

Many of the shares in this report are currently overlooked by Wall Street, providing an excellent opportunity to enter at a favorable time. Discover these potential home runs today.

For the latest insights from Zacks Investment Research, you can download the report on the 7 Best Stocks for the Next 30 Days. Click for your free report.

Advanced Micro Devices, Inc. (AMD): Free Stock Analysis report

NVIDIA Corporation (NVDA): Free Stock Analysis report

Broadcom Inc. (AVGO): Free Stock Analysis report

Alphabet Inc. (GOOGL): Free Stock Analysis report

This article originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.