Strong Options Trading Activity in S&P 500 Components Today

Today, there is significant options trading activity among S&P 500 index components. Notably, JPMorgan Chase & Co (Symbol: JPM) has seen a total volume of 68,236 contracts traded, which equates to approximately 6.8 million underlying shares, since each options contract represents 100 shares. This volume represents 71.6% of JPM’s average daily trading volume over the past month, which is 9.5 million shares. A particularly strong interest is evident in the $260 strike call option expiring May 16, 2025, with 3,187 contracts traded today, amounting to about 318,700 underlying shares. The chart below details JPM’s trailing twelve-month trading history, highlighting the $260 strike in orange:

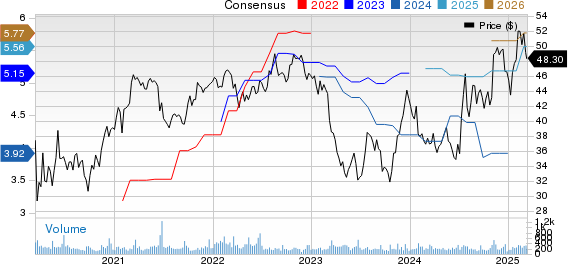

Tapestry Inc (Symbol: TPR) also experienced notable options trading, with 38,622 contracts exchanged, representing roughly 3.9 million underlying shares. This accounts for about 70.3% of TPR’s average daily trading volume over the past month, which stands at 5.5 million shares. The $57.50 strike put option, set to expire on April 17, 2025, has garnered particular attention, as 10,750 contracts have traded today, corresponding to approximately 1.1 million underlying shares of TPR. Below, you can see TPR’s trailing twelve-month trading history, with the $57.50 strike highlighted in orange:

Furthermore, Uber Technologies Inc (Symbol: UBER) reported an impressive options trading volume of 126,092 contracts, which reflects about 12.6 million underlying shares, or approximately 52.9% of UBER’s average daily trading volume of 23.8 million shares over the past month. The $77.50 strike put option, expiring on March 21, 2025, has had a particularly high volume, with 16,287 contracts traded today, representing roughly 1.6 million underlying shares of UBER. The following chart shows UBER’s trailing twelve-month trading history, with the $77.50 strike illustrated in orange:

For more information on various available expirations for JPM, TPR, and UBER options, please visit StockOptionsChannel.com.

![]() Today’s Most Active Call & Put Options of the S&P 500 »

Today’s Most Active Call & Put Options of the S&P 500 »

Also See:

- STX Market Cap History

- QVCA Options Chain

- Institutional Holders of BNRG

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.