Three Stocks to Consider for Strong Growth Potential

Today, March 11, here are three stocks with buy rankings that demonstrate solid growth characteristics for investors:

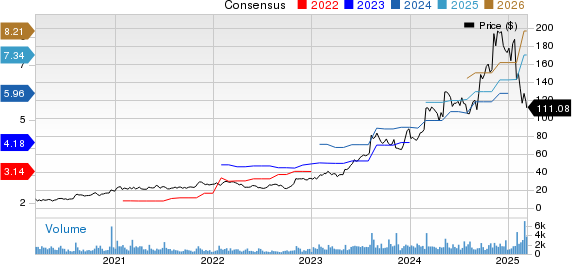

Sterling Infrastructure, Inc. (STRL)

Sterling Infrastructure, Inc. focuses on infrastructure and transportation solutions. It holds a Zacks Rank #1, with the Zacks Consensus Estimate for its current year earnings increasing by 14% in the last 60 days.

Price and Consensus for Sterling Infrastructure, Inc.

Sterling Infrastructure, Inc. price-consensus-chart | Sterling Infrastructure, Inc. Quote

The company’s PEG ratio stands at 1.07, slightly lower than the industry average of 1.14. Furthermore, it holds a strong Growth Score of A.

PEG Ratio (TTM) for Sterling Infrastructure, Inc.

Sterling Infrastructure, Inc. peg-ratio-ttm | Sterling Infrastructure, Inc. Quote

BGC Group, Inc. (BGC)

BGC Group, Inc. specializes in financial brokerage and technology services. It also holds a Zacks Rank #1, with a 9.4% rise in the Zacks Consensus Estimate for its current year earnings over the past two months.

Price and Consensus for BGC Group, Inc.

BGC Group, Inc. price-consensus-chart | BGC Group, Inc. Quote

BGC Group’s PEG ratio is notably low at 0.34, compared to the industry average of 1.80, indicating strong growth potential with a Growth Score of B.

PEG Ratio (TTM) for BGC Group, Inc.

BGC Group, Inc. peg-ratio-ttm | BGC Group, Inc. Quote

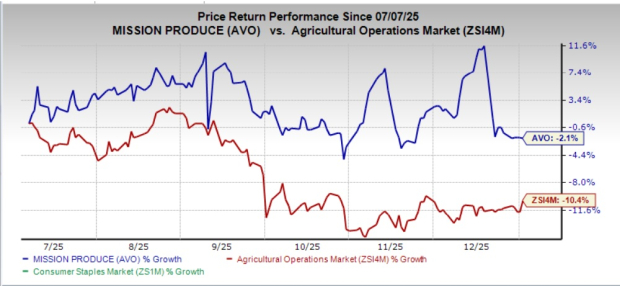

Dana Incorporated (DAN)

Dana Incorporated provides vehicle and industrial energy solutions and maintains a Zacks Rank #1. Its current year earnings estimate has increased by 23.1% over the last 60 days.

Price and Consensus for Dana Incorporated

Dana Incorporated price-consensus-chart | Dana Incorporated Quote

Dana’s PEG ratio is 0.45, significantly lower than the industry average of 1.87, and it holds a Growth Score of A.

PEG Ratio (TTM) for Dana Incorporated

Dana Incorporated peg-ratio-ttm | Dana Incorporated Quote

See the complete list of top-ranked stocks here.

Learn more about the Growth Score and its calculation here.

Zacks Highlights Potential “Double” Stock

Zacks’ research team has identified five stocks with the highest probability of gaining +100% or more in the upcoming months. Among these, the Director of Research, Sheraz Mian, has highlighted one stock as likely to achieve the greatest gains.

This top recommendation is from a cutting-edge financial firm that already serves over 50 million customers. With its suite of innovative solutions, this stock may be set for significant appreciation. While not every elite pick guarantees success, past examples like Nano-X Imaging, which surged +129.6% in under nine months, demonstrate potential.

For free access to the top stock and four runners-up, click here.

Stay updated with the latest recommendations from Zacks Investment Research. Download the report on the 7 Best Stocks for the Next 30 Days here.

BGC Group, Inc. (BGC): Free Stock Analysis report.

Dana Incorporated (DAN): Free Stock Analysis report.

Sterling Infrastructure, Inc. (STRL): Free Stock Analysis report.

This article was originally published by Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions presented in this article are solely those of the author and do not necessarily reflect the views of Nasdaq, Inc.