Analysts Anticipate Strong Upside for Fidelity MSCI Industrials ETF

At ETF Channel, we’ve examined the underlying holdings of the ETFs within our coverage universe. By comparing the trading prices of these holdings against the average 12-month analyst target prices, we derived the weighted average implied analyst target price for each ETF. For the Fidelity MSCI Industrials Index ETF (Symbol: FIDU), the implied analyst target price stands at $81.93 per unit.

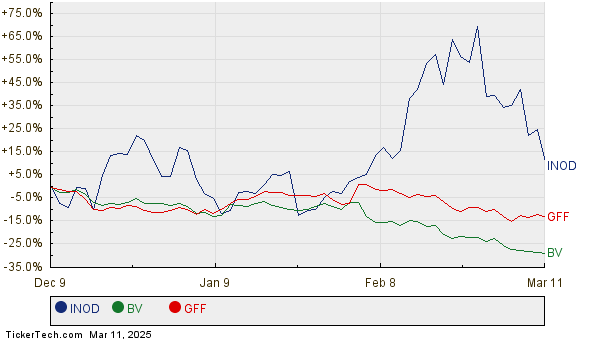

Currently, FIDU is trading around $69.05 per unit. Analysts project an 18.66% upside based on the average target prices of its underlying holdings. Among FIDU’s constituents, three stocks display significant upside potential relative to their analyst target prices: Innodata Inc (Symbol: INOD), BrightView Holdings Inc (Symbol: BV), and Griffon Corp. (Symbol: GFF). Recently, INOD traded at $41.10 per share, while the average analyst target is 60.58% higher at $66.00. BrightView Holdings has a recent price of $12.27, indicating a 44.25% upside to the average target of $17.70. Additionally, analysts anticipate a target price of $98.75 for GFF, suggesting a 42.19% increase from its recent trading price of $69.45. Below is a twelve-month price history chart that illustrates the stock performance of INOD, BV, and GFF:

Current Analyst Target Prices Overview

Below is a summary table that details the current analyst target prices discussed above:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| Fidelity MSCI Industrials Index ETF | FIDU | $69.05 | $81.93 | 18.66% |

| Innodata Inc | INOD | $41.10 | $66.00 | 60.58% |

| BrightView Holdings Inc | BV | $12.27 | $17.70 | 44.25% |

| Griffon Corp. | GFF | $69.45 | $98.75 | 42.19% |

This raises questions about whether analysts’ targets are justified or overly optimistic regarding stock performance in the next twelve months. Are these target prices based on realistic forecasts, or do they reflect outdated perspectives on recent company and industry trends? While a high price target relative to a stock’s current trading price often indicates optimism, it could also signal potential for future downgrades if the projections don’t materialize.

![]() Discover 10 ETFs With Most Upside To Analyst Targets »

Discover 10 ETFs With Most Upside To Analyst Targets »

Further Reading:

• Utilities Stocks Hedge Funds Are Selling

• CUBA Market Cap History

• MPSX Price Target

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.