Bigbear.ai’s Shares Plummet Amid Losses and Uncertain Outlook

Bigbear.ai (BBAI) shares have fallen 25.2% since the company revealed its fourth-quarter earnings for 2024 on March 6. This notable decline stems from a wider-than-expected net loss of $108 million, a significant shift from the year-ago quarter’s loss of $21.3 million, alongside a less optimistic outlook for 2025.

Financial Projections and Recent Performance

Looking ahead to 2025, Bigbear.ai forecasts revenues between $160 million and $180 million. However, the company anticipates a negative adjusted EBITDA in the single-digit millions, raising concerns regarding its path to profitability.

For the fourth quarter of 2024, BBAI reported revenues of $43.8 million. This figure not only fell short of the Zacks Consensus Estimate by 19.09% but also represented an 8% increase year over year.

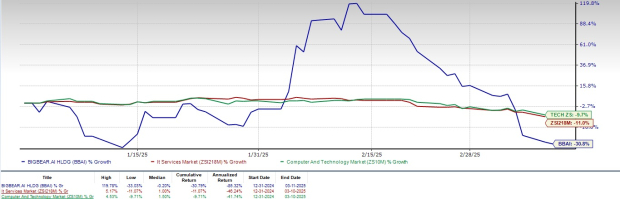

Overall, BBAI shares have plunged 30.8% in the year-to-date, compared to a 9.7% decline in the Zacks Computer & Technology sector. By contrast, the Zacks Computers – IT Services industry has seen an 11% increase during the same timeframe.

Year-to-Date Performance

Image Source: Zacks Investment Research

Can BBAI’s expanding product portfolio and solid partnerships enable the stock to recover in 2025? Let’s explore.

Strategic Government Contracts Highlight Growth Potential

BBAI’s growth is partly driven by government investment in artificial intelligence (AI) solutions. The rising interest from government sectors enhances BBAI’s innovation pipeline, broadening its capacity to capture a larger market share.

Recently, BBAI secured a 3.5-year, $13.2 million sole-source contract from the U.S. Department of Defense (DoD). This contract will support the Chairman of the Joint Chiefs of Staff’s Directorate for Force Management (J-35).

Under this agreement, Bigbear.ai will enhance and maintain the ORION Decision Support Platform (DSP), an AI-driven system that provides real-time operational insights and strategic planning for the DoD’s Joint Planning and Execution Community.

Furthermore, BBAI obtained a contract from the DoD’s Chief Digital and Artificial Intelligence Office, focusing on advancing its Virtual Anticipation Network prototype. This initiative is designed to help the DoD assess media trends from potential foreign adversaries, facilitating faster national security decisions through advanced AI analytics. This aligns with BBAI’s mission to deliver impactful AI solutions for vital government applications.

BigBear.ai Holdings, Inc. Price and Consensus

BigBear.ai Holdings, Inc. price-consensus-chart | BigBear.ai Holdings, Inc. Quote

Partnership Expansion Strengthens Market Position

Bigbear.ai’s commitment to expanding its product offerings has enabled it to secure significant clients. Its solutions are integrated into offerings from industry leaders like Proof Labs, Autodesk (ADSK), Amazon (AMZN), and Palantir (PLTR).

In December 2024, the company announced a collaboration with Proof Labs to develop the Cyber Resilient On-Orbit solution for the Department of the Air Force. This initiative will utilize Proof Labs’ SpaceCREST technology for AI/ML-based cyber intrusion detection and anomaly monitoring of U.S. Space Force satellite networks.

Additionally, AMZN’s cloud platform, Amazon Web Services (AWS), has integrated BBAI’s ProModel solution to create AWS ProServe, which supports AI-driven warehousing. Notably, the involvement of leaders like Autodesk, Amazon, and Palantir indicates the reliability of BBAI’s product suite.

Mixed Earnings Estimates for BBAI

The Zacks Consensus estimate for 2025 loss per share is calculated at 22 cents, having widened by a couple of cents over the past 60 days.

Image Source: Zacks Investment Research

Find the latest EPS estimates and surprises on Zacks earnings Calendar.

Conclusion: Consider Caution with BBAI Stock

Although BBAI continues to grow its portfolio and form strategic alliances, the company encounters significant competition within the AI market. Additionally, challenges posed by the macroeconomic landscape and losses associated with the Virgin Orbit bankruptcy could impact operational performance.

BBAI’s heavy reliance on government contracts creates vulnerability to spending discrepancies and potential shifts in national security focuses. Such dependence may lead to revenue fluctuations and investor insecurity, especially following recent defense budget cuts that underscore this risk, possibly affecting BBAI’s operations substantially.

Recent announcements regarding a $50 billion defense budget cut directly threaten Bigbear.ai’s core business, given its reliance on government contracts in the defense arena.

BBAI is also known for its boom-and-bust cycle. The stock price frequently experiences steep increases followed by sharp declines, which raises risks for investors.

Currently, BBAI holds a Zacks Rank of #4 (Sell), suggesting investors should consider waiting before investing in this stock.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Zacks’ Research Chief Names Stock Most Likely to Double

Our expert team has released five stocks with the highest potential for over 100% gains in the upcoming months. Among these, the Director of Research Sheraz Mian accentuates one stock poised for substantial growth.

This standout pick is recognized as a leading financial firm, showcasing a rapidly expanding customer base exceeding 50 million and innovative solutions. While not every selection is guaranteed success, this one could significantly outperform prior Zacks recommendations like Nano-X Imaging, which soared by 129.6% in just over nine months.

Free: See Our Top Stock And 4 Runners-Up

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report.

Amazon.com, Inc. (AMZN): Free Stock Analysis report

Autodesk, Inc. (ADSK): Free Stock Analysis report

Palantir Technologies Inc. (PLTR): Free Stock Analysis report

BigBear.ai Holdings, Inc. (BBAI): Free Stock Analysis report

This article originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.