Costco’s Q2 Earnings Spark Investor Debate on Stock Performance

Costco Wholesale Corporation (COST) released its second-quarter fiscal 2025 results last Thursday, igniting discussions among investors regarding the stock’s trajectory. Renowned for its stability and extensive customer base, Costco remains a key player in the retail sector—even amid economic challenges. With the latest earnings report now available, investors face a choice: to increase their holdings or maintain their current positions.

Analyzing Costco’s Performance: A Blend of Results

Following the earnings report, Costco shares declined by 9%. This decline reflects broader market negativity, influenced by tariff concerns and Costco’s mixed results this quarter. Notably, while the company’s revenues surpassed the Zacks Consensus Estimate, its earnings did not meet expectations. (Read: Costco Q2 earnings Lag Estimates, E-Commerce Comp Sales Rise 21%)

Costco demonstrated solid comparable sales across different regions, showcasing its effective pricing strategy and strong member loyalty. Excluding gasoline prices and foreign exchange effects, comparable sales increased by 9.1%. In the United States, comparable sales were up 8.6%, while Canada and Other International markets reported gains of 10.5% and 10.3%, respectively.

At the end of the quarter, Costco had 78.4 million paid household members, a 6.8% increase compared to the previous year. Executive memberships, which are more lucrative for the company, grew by 9.1% to 36.9 million, making up 47.1% of all paid members and driving 73.8% of total sales. This loyalty reflects Costco’s commitment to value and quality.

Consensus Estimates After Q2 Earnings Report

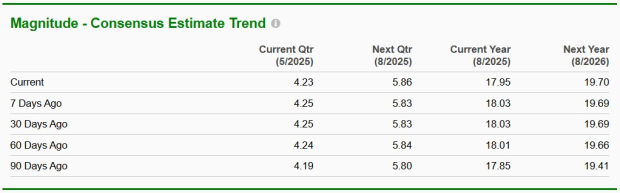

In the week following the earnings release, analysts adjusted their estimates downward for the current fiscal year, decreasing expectations by 8 cents to $17.95. Conversely, the Zacks Consensus Estimate for the next fiscal year rose slightly by a penny to $19.70. These figures suggest anticipated year-over-year growth rates of 11.4% and 9.7%, respectively.

Image Source: Zacks Investment Research

Costco’s Membership Model: A Driving Force

Costco’s membership-based model is vital to its growth. High membership renewal rates, efficient supply chain management, and bulk purchasing capabilities allow for competitive pricing. With a renewal rate of 93% in the United States and Canada—and 90.5% worldwide—Costco has established a strong foundation that supports its growth, even during economic downturns.

Through annual membership fees, Costco generates consistent revenue streams while fostering a sense of exclusivity and value. In the second quarter of fiscal 2025, membership fee income increased by 7.4% year over year, totaling $1,193 million. A recent membership fee hike contributed about 3% to this income, with the most significant benefits anticipated over the next four quarters.

Adapting to market trends, Costco regularly updates its product lines to include both essentials and unique high-demand items. This adaptability allows the company to effectively expand both domestically and internationally.

The company plans to open 28 new warehouses in fiscal 2025, three of which will be relocations. Of these, 15 will be located in the U.S., three in Canada, and seven in international markets. With expansion in high-growth areas like Mexico, Taiwan, and Korea, Costco is poised for significant growth beyond its established market.

Costco’s investment in digital and e-commerce efforts is also paying off. The company reported a 20.9% growth in e-commerce comparable sales for the second quarter. Costco Logistics experienced a record holiday season, facilitating over 500,000 deliveries, positioning the company to capture a larger share of the online market.

Competitive Landscape: Navigating Challenges

Costco’s impressive sales figures occur within a context of increasing retail competition. Rivals such as Walmart (WMT) and BJ’s Wholesale Club (BJ) are enhancing their e-commerce strategies and customer experience to compete effectively. In addition, Amazon (AMZN) continues to lead in online shopping, prompting traditional retailers, including Costco, to innovate quickly.

Margins will be a critical aspect to observe, particularly with potential concerns regarding the selling, general, and administrative expense ratio. Furthermore, foreign exchange fluctuations and tariff uncertainties pose additional challenges. Meanwhile, consumer spending patterns are shifting towards essentials, resulting in weaker demand for discretionary items.

Valuation: Is Costco’s Stock Price Justifiable?

Costco’s stock has shown robust performance, increasing 26.8% over the past year, significantly outpacing the industry’s growth of 7.9%. This strong performance reflects investor confidence in Costco’s business model.

Image Source: Zacks Investment Research

Nonetheless, the stock is currently trading at a notable premium compared to its competitors. Costco’s forward 12-month price-to-earnings ratio is at 49.39, which is significantly higher than the industry’s average of 30.32 and the S&P 500’s 20.63.

Investors should carefully assess whether Costco’s growth and revenue prospects justify its elevated stock price amidst evolving market conditions.

Costco’s Resilient Performance Suggests Long-Term Holding Potential

Investors facing a changing macroeconomic landscape may find Costco’s trajectory justifies its premium valuation. The company’s historical performance and strategic efforts could make it a strong candidate for long-term investment in its stock.

Assessing Costco’s Stock: Is it a Good Hold After Q2?

Costco’s recent second-quarter results highlight the strength of its business model, showing robust membership growth alongside an expanding international presence. The company’s aggressive store expansion and e-commerce strategy position it well for sustained growth over the long term. Nevertheless, potential challenges like its premium valuation relative to competitors, foreign exchange risks, and tariff concerns could affect performance. Current shareholders should consider holding onto the stock, but new investors may want to wait for a market pullback before entering. As of now, Costco holds a Zacks Rank #3 (Hold). You can see today’s complete list of Zacks #1 Rank (Strong Buy) stocks here.

Zacks Research Director Identifies Stock Poised for Major Growth

Zacks’ team has recently identified five stocks with a strong potential for at least a 100% increase in the near term. Director of Research Sheraz Mian has highlighted one particular stock as the standout with the highest expected growth.

This top selection is among the most innovative companies in the financial sector. With a rapidly growing customer base—over 50 million—and a diverse range of advanced solutions, this stock is positioned for significant gains. While not every selection will guarantee success, this stock demonstrates potential that could outperform previous Zacks’ predictions like Nano-X Imaging, which rose +129.6% in just over nine months.

Free: See Our Top Stock Along with 4 Candidates

Interested in the latest recommendations from Zacks Investment Research? Download the list of 7 Best Stocks for the Next 30 Days today. Click to access this report for free.

Stock Analysis available for:

- Amazon.com, Inc. (AMZN): Free Stock Analysis Report

- Walmart Inc. (WMT): Free Stock Analysis Report

- BJ’s Wholesale Club Holdings, Inc. (BJ): Free Stock Analysis Report

- Costco Wholesale Corporation (COST): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.