Salesforce Faces 15% Decline: Is It Time to Hold or Sell?

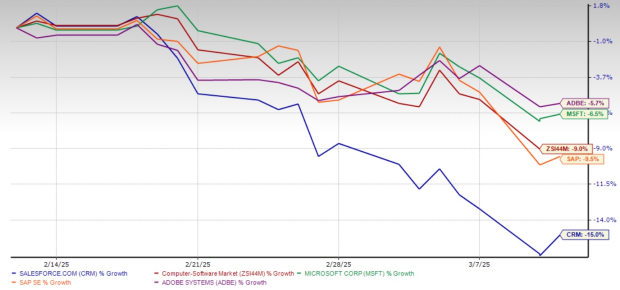

Salesforce, Inc. (CRM) has recently experienced a notable decline, falling more than 15% over the past month. This performance notably lags behind the Zacks Computer – Software industry, which saw a drop of 9% during the same timeframe. In comparison to key competitors such as Microsoft Corporation (MSFT), SAP SE (SAP), and Adobe Inc. (ADBE), Salesforce’s downturn is particularly stark.

Understanding the Recent Price Performance

Image Source: Zacks Investment Research

Given this sharp decline, investors may ponder whether to cut their losses or maintain their positions. Despite short-term challenges, Salesforce’s long-term growth potential remains strong, suggesting it may be worthwhile to hold onto the stock.

Reasons Behind Salesforce’s Struggles

The recent downturn for Salesforce can be attributed to a combination of leading market trends and internal factors. A broad sell-off in technology stocks—driven by concerns over escalating trade tensions and slowing economic growth—has cast a shadow over the sector as a whole. Consequently, companies that thrived during the AI boom, including Salesforce, are now facing valuation corrections.

In its latest earnings report, Salesforce’s fourth-quarter results for fiscal 2025 disappointed many investors. Although revenues increased by 7.5% year-over-year to reach $9.99 billion, they fell short of the Zacks Consensus Estimate. The company’s forecasts concerning first-quarter and full fiscal 2026 revenue growth indicated even more cause for concern, predicting a slowdown to a range of 6-8%. This marks a significant shift from the double-digit growth that investors had become accustomed to in prior years.

Salesforce Inc. Price, Consensus and EPS Surprise

Salesforce Inc. price-consensus-eps-surprise-chart | Salesforce Inc. Quote

Furthermore, enterprise customers are tightening their IT budgets due to economic uncertainty, further dampening Salesforce’s growth momentum. Analysts project a cautious spending environment will linger, with expected revenue growth for fiscal years 2026 and 2027 forecasted at 7.7% and 9.3%, respectively. While these figures are slower than historical rates, Salesforce’s strong market position in enterprise software endures.

Salesforce’s Firm Market Position

In spite of current growth concerns, Salesforce maintains its status as the leading player in the customer relationship management market. The company surpasses competitors like Microsoft, Oracle, and SAP, holding the largest market share as per Gartner’s assessments. This dominance is unlikely to diminish in the near future.

Salesforce has strategically developed a comprehensive ecosystem that seamlessly integrates across various enterprise applications. Its recent acquisitions, including Slack and the Own Company, reflect a long-term ambition to expand beyond traditional CRM solutions into areas like enterprise collaboration, data security, and AI-driven automation.

AI represents a crucial element in Salesforce’s growth narrative. Since introducing Einstein GPT in 2023, the company has integrated AI across its platform, enabling clients to automate workflows, enhance decision-making, and improve customer interactions. As AI adoption expands within industries, Salesforce is well-positioned to benefit from this shift.

Moreover, rising global IT spending is anticipated to provide a long-term boost. Gartner predicts that worldwide IT expenditure will reach $5.61 trillion in 2025, reflecting a 9.8% year-over-year growth. The enterprise software segment, integral to Salesforce, is projected to increase even more rapidly, with a forecasted growth of 14.2%. While economic conditions may temporarily hinder spending, the priority of digital transformation among businesses will likely ensure steady demand for Salesforce’s solutions.

Valuation Insights Support Holding Strategy

One positive aspect of the recent sell-off is that Salesforce’s valuation has become more attractive. The stock is currently trading at a forward P/E of 24.21, which is below the industry average of 27.71. Although it may not be classified as cheap, this valuation indicates that much of the immediate pessimism is already reflected in the price.

Forward 12-Month P/E Ratio

Image Source: Zacks Investment Research

Given Salesforce’s strong positioning within enterprise software, ongoing AI initiatives, and robust long-term growth potential, the recent share price drop does not warrant an exit. While the company contends with short-term challenges, its underlying fundamentals remain solid, indicating it is a stock to hold.

Conclusion: Maintain Position in Salesforce Stock

Salesforce’s recent downturn is largely due to broader market conditions and concerns regarding growth slowdowns. Nevertheless, the company continues to assert its dominance in the customer relationship management sector, remains vital to enterprise IT budgets, and is strategically leveraging AI for future growth.

Additionally, its valuation now presents a more appealing opportunity compared to historical benchmarks. Although short-term growth may be constrained, the long-term outlook for Salesforce is substantial. For investors with a forward-looking perspective, holding the stock seems to be the prudent choice. Currently, CRM holds a Zacks Rank #3 (Hold). Investors can view the full list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Zacks’ Research Chief Highlights a Potential Star Stock

Our expert team recently identified 5 stocks with the highest potential for a gain of +100% or more in the near future. Among these, Director of Research Sheraz Mian points out one particular stock expected to climb the highest.

This standout pick belongs to one of the most innovative financial firms, boasting a rapidly growing customer base of over 50 million and a wide array of cutting-edge solutions. This stock is positioned for significant growth. While not every elite stock will succeed, this one could outperform others such as Nano-X Imaging, which soared by +129.6% in just over 9 months.

Free: view Our Top Stock And 4 Runners Up

Interested in the latest recommendations from Zacks Investment Research? Download today’s insight on the 7 Best Stocks for the Next 30 Days. Click for your complimentary report

Microsoft Corporation (MSFT): Free Stock Analysis report

Salesforce Inc. (CRM): Free Stock Analysis report

SAP SE (SAP): Free Stock Analysis report

Adobe Inc. (ADBE): Free Stock Analysis report

This article was originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.