Investors Eye $10 Trillion in Corporate Buybacks Amid AI Boom

For nearly two years, the Stock market has experienced a pronounced uptrend, with investors easily identifying several catalysts fueling this surge. Critical factors have included a robust U.S. economy, a decline in inflation from its peak over 9%, and corporate earnings that have frequently surpassed expectations. These elements have propelled the Dow Jones Industrial Average, S&P 500 (SNPINDEX: ^GSPC), and Nasdaq Composite to multiple record-closing highs.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

Among these catalysts, the emergence of artificial intelligence (AI) has stood out the most. AI technologies enable software and systems to reason independently, enhancing efficiency and learning new skills over time.

Stock chart.” src=”https://g.foolcdn.com/image/?url=https%3A%2F%2Fg.foolcdn.com%2Feditorial%2Fimages%2F810520%2Fbuy-low-sell-high-Stock-market-chart-investing-retirement-getty.jpg&w=700″>

Image source: Getty Images.

According to a report from PwC titled Sizing the Prize, the AI revolution is projected to enhance global productivity, adding $6.6 trillion by 2030, with an additional $9.1 trillion in benefits driven by consumption. In total, AI is anticipated to contribute $15.7 trillion to global GDP, a figure likely to draw investor interest.

In response, companies are heavily investing in AI infrastructure and software, aiming to secure an early-mover advantage. Notably, several firms, referred to as the “Magnificent Seven,” are spending billions on graphics processing units (GPUs) essential for their high-performance data centers.

Corporate Buybacks Set to Exceed $1 Trillion Annually

However, there’s another trend expected to outpace AI in terms of overall corporate spending. Over the next decade, S&P 500 companies are projected to allocate over $10 trillion—averaging more than $1 trillion per year—toward corporate buybacks.

Corporate buybacks are gaining traction as one of the hottest trends. Between 2011 and 2017, S&P 500 firms repurchased $413 billion to $592 billion of their own Stock annually. This translated to approximately $100 billion to $150 billion per quarter until significant shifts occurred after Donald Trump assumed the presidency.

Trump’s Tax Cuts and Jobs Act (TCJA), enacted in December 2017, reduced the federal corporate tax rate from 35% to 21%, marking the lowest peak since 1939. This change has allowed many established public companies to access greater capital for investments, including buybacks.

Excluding the uncertainties brought about by the COVID-19 pandemic, S&P 500 companies have consistently repurchased between $815 billion and $950 billion each year following the TCJA’s implementation. Trump has even suggested an additional reduction in the tax rate by 29% for companies manufacturing domestically.

Goldman Sachs projects that S&P 500 Stock buybacks could achieve a record $1.075 trillion in 2025. With ongoing corporate tax benefits and Trump potentially remaining in office for an extended term, buyback activity is expected to continue increasing.

Firms typically resort to share repurchases for three main reasons. First, buybacks can incrementally boost existing shareholders’ ownership, which encourages long-term investment—a strategy Warren Buffett has followed, spending nearly $78 billion on repurchasing shares of Berkshire Hathaway since mid-2018.

Second, buybacks send a clear signal to investors that management views the company’s Stock as undervalued. Lastly, and most critically, companies with stable or increasing net income that regularly engage in buybacks can enhance their earnings per share (EPS), making their Stock more appealing to value investors. The growth in earnings attributed to share repurchases has been significant in supporting the current bullish market phase.

Stock charts displayed on computer monitors.” src=”https://g.foolcdn.com/image/?url=https%3A%2F%2Fg.foolcdn.com%2Feditorial%2Fimages%2F810520%2Fmoney-manager-Stock-chart-volume-buy-sell-invest-getty.jpg&w=700″>

Image source: Getty Images.

Potential Market Instability Despite Massive Investments

While signs indicate that S&P 500 companies will invest significantly in buybacks over the coming decade, these repurchases may not shield the stock market from an inevitable downturn.

Valuation remains a crucial consideration for investors, particularly the traditional price-to-earnings (P/E) ratio, calculated by dividing a company’s share price by its trailing earnings per share. However, this metric can be less reliable for growth stocks and in times of economic upheaval.

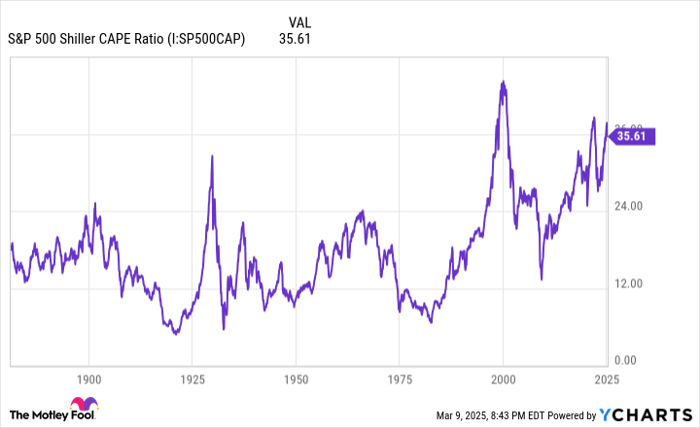

A more accurate valuation perspective is offered by the Shiller P/E Ratio, also known as the cyclically adjusted P/E Ratio (CAPE). This measure, which accounts for inflation-adjusted EPS over the previous decade, helps avoid distortions from temporary shocks. As of March 7, the S&P 500’s Shiller P/E Ratio was reported at 36.34, significantly above its long-term average of 17.21, indicating potential market overvaluation.

Market Signals: Shiller P/E Ratio Highlights Potential Downturn

S&P 500 Shiller CAPE Ratio data by YCharts.

Historical Context of the Shiller P/E Ratio

As of now, the Shiller P/E ratio stands at a level not seen since early market histories, marking the third-highest reading during a continuous bull market. Since 1871, the ratio has exceeded 30 only six times, with each prior instance leading to a minimum drop of 20% in the S&P 500. While the Shiller P/E is not a precise timing tool, its previous patterns signal significant losses ahead for equities.

Share Buybacks: A Temporary Fix

On Wall Street, share repurchases can temporarily boost valuation premiums but have limitations. For example, Apple (NASDAQ: AAPL) has been responsible for approximately $695.3 billion of the S&P 500’s cumulative $7.11 trillion in buybacks over the past decade, as reported by S&P Global. Despite this substantial investment in share repurchases, Apple’s earnings per share have remained stagnant in recent years.

Furthermore, Apple’s net income has declined from $99.8 billion in fiscal 2022 to $93.7 billion projected for fiscal 2024. This situation illustrates the mixed results of aggressive share buybacks, highlighting that even the largest investments in repurchases may not prevent an eventual downturn.

The Investment Landscape Ahead

No amount of investment—over $10 trillion projected in the next decade—can guarantee stability in the market. Investors need to be cautious and evaluate their strategies carefully.

Is Investing in the S&P 500 Index Reliable Now?

Before allocating funds to the S&P 500 Index, reconsider your options:

The Motley Fool Stock Advisor team suggests there are currently 10 stocks that may outperform the S&P 500 Index. Those stocks are projected to yield significant returns. For instance, an investment of $1,000 in Nvidia—which made their list back on April 15, 2005—would now be worth an impressive $655,630.*

Stock Advisor provides a framework for investment, featuring portfolio guidance and two new stock recommendations each month. This service has yielded returns that have significantly outpaced the S&P 500 since 2002.* Join to see the most recent top recommendations.

*Stock Advisor returns as of March 10, 2025

Sean Williams holds no shares in the companies mentioned. The Motley Fool endorses positions in Apple, Berkshire Hathaway, Goldman Sachs Group, and S&P Global and adheres to a disclosure policy.

The views expressed here reflect the author’s opinions and do not necessarily align with those of Nasdaq, Inc.