Investors Eye AI Stocks as Valuations Dip in 2024

Many of the largest companies today have grown exponentially due to their involvement with artificial intelligence (AI). This includes developers of AI applications and suppliers of essential AI components. However, in 2024, many of these companies have seen a reduction in their valuations. For investors seeking growth opportunities, now may be the best time in months to consider AI stocks.

Spotlight on a Promising AI Stock: SoundHound AI

While most investors may not recognize SoundHound AI (NASDAQ: SOUN), this smaller AI firm is experiencing rapid growth. On paper, it offers significantly more room for expansion compared to its larger counterparts.

So, what does SoundHound do? The company focuses on sound applications powered by AI. Their technology facilitates interactions based on voice commands—ranging from communicating with your vehicle regarding road conditions to placing orders at fast-food restaurants. Essentially, any daily activity related to voice communication falls within SoundHound’s expertise.

Current customers, including major brands like Applebee’s and White Castle, are already testing SoundHound’s voice platform for handling phone and drive-thru orders. Additionally, automotive brands such as Dodge and Kia enable drivers to converse with their cars regarding maintenance and navigation through this platform. Planet Fitness utilizes SoundHound for customer service inquiries, while various banks and insurers have adopted it to streamline claims processing and notifications.

SoundHound estimates its total addressable market at around $140 billion, a compelling figure considering its current market cap is under $4 billion. Although competition from well-funded tech giants exists, SoundHound’s early commercialization has provided the company with crucial industry validation and robust real-world data for model training.

Growth Potential Amid Competitive Pressures

While larger tech firms may eventually outpace SoundHound’s innovation capabilities, significant opportunities still exist in niche markets overlooked by these competitors. Additionally, SoundHound’s smaller size could make it an attractive acquisition target should it achieve any important technological advancements.

Even with the competitive landscape becoming a concern, the recent decline in AI stock prices presents a timely buying opportunity for investors.

Could SoundHound’s Stock See a Price Doubling in 2025?

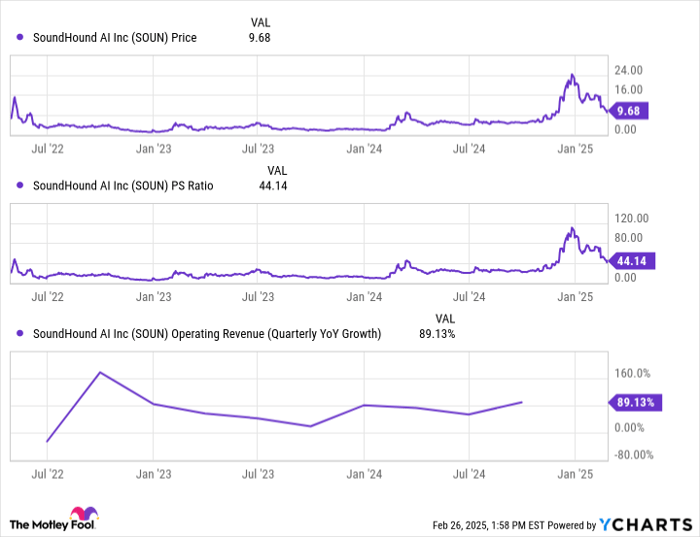

SoundHound’s stock could potentially double in value as early as 2025. Before the recent dip, its shares were trading at nearly three times their current price. The decline did not stem from a drop in sales growth; rather, it was a reflection of a reduced price-to-sales ratio. Essentially, the market is currently valuing SoundHound’s growth at a lower multiple.

SOUN data by YCharts.

Analysts predict that by 2025, SoundHound’s sales growth will reach 97%, exceeding this year’s estimates by over 10%. This growth trajectory remains strong. If you are optimistic that AI investments will rebound following this market correction, now is an opportunity to invest in a small but rapidly expanding AI business, available at a significant discount compared to last year’s stock prices.

Don’t Miss Out on This Potentially Lucrative Opportunity

If you’ve ever felt that you missed out on investing in top-performing stocks, this might be your chance. Our analysts occasionally issue a “Double Down” recommendation for companies poised for significant growth. If you’re concerned that you missed your opportunity to invest, consider making your move before it’s too late.

- Nvidia: If you invested $1,000 when we doubled down in 2009, you’d have $277,401!*

- Apple: If you invested $1,000 when we doubled down in 2008, you’d have $43,128!*

- Netflix: If you invested $1,000 when we doubled down in 2004, you’d have $467,393!*

Our team is currently issuing “Double Down” alerts for three exceptional companies, and opportunities like this may not come around again soon.

Continue »

*Stock Advisor returns as of March 10, 2025

Ryan Vanzo has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.