Cheniere Energy Advances LNG Production with New Expansion Approval

Cheniere Energy, Inc. (LNG), a Houston-based leader in oil and gas storage and transportation, has secured approval from U.S. regulators to expand its Corpus Christi liquefied natural gas (“LNG”) facility in Texas. This expansion is poised to enhance the United States’ standing as a global leader in LNG exports and aligns with Cheniere’s strategic growth aspirations. The Federal Energy Regulatory Commission (“FERC”) has authorized the construction of the Midscale Trains 8 and 9 project, which is crucial for Cheniere’s operations along the Gulf Coast.

Cheniere Energy’s Leadership in U.S. LNG Production

As the largest LNG producer in the United States, Cheniere Energy plays a pivotal role in transforming the nation into the premier exporter of LNG globally. The company’s ongoing investments in expanding its production capacity, especially at the Corpus Christi facility, underscore its dominance in the sector.

The recent approval for the Midscale Trains 8 and 9 project was announced by Cheniere’s chief commercial officer, Anatol Feygin, during a Houston industry conference. This project is a significant advancement, enabling Cheniere to boost its LNG output and further solidify its commitment to addressing the rising global demand for natural gas.

The Details of the Midscale Trains 8 and 9 Expansion

The Midscale Trains 8 and 9 expansions will increase Cheniere’s production capacity at its Corpus Christi plant by 3 million metric tons per annum (“mtpa”), raising the overall capacity to 18 mtpa. This enhancement strengthens the facility’s importance in the global energy landscape.

These two new production trains are central to Cheniere’s long-term strategy to diversify and expand its LNG supply chain. This expansion will enhance Cheniere’s ability to serve international markets effectively, providing reliable, clean natural gas to meet increasing energy demands worldwide.

Stage 3 Expansion: Enhancing Cheniere’s Capacity

Beyond the Midscale project, Cheniere is also advancing its Stage 3 expansion at the Corpus Christi site, which will contribute an additional 10 mtpa to its production capacity. This further development significantly increases the plant’s output and bolsters Cheniere’s status as a global LNG leader.

The Stage 3 expansion reflects Cheniere’s proactive approach and its insight into evolving dynamics in the global LNG market. As demand for clean and sustainable energy rises, the company is well-positioned to meet these challenges with innovative solutions and expanded infrastructure.

Importance of FERC Approval in Cheniere’s Development Process

FERC’s approval of the Midscale Trains 8 and 9 project marks a crucial milestone in Cheniere’s growth journey. The commission ensures that LNG projects in the U.S. adhere to safety, environmental, and operational standards. The approval, which followed Cheniere’s application in March 2023, enables the firm to pursue its expansion plans while complying with regulatory obligations.

Cheniere’s successful application reflects its commitment to high standards in energy production and project development. This achievement demonstrates the company’s meticulous planning and skill in navigating regulatory frameworks effectively, paving the way for timely project completions.

Cheniere’s Strategic Impact on U.S. LNG Exports

Cheniere’s expansion initiatives underline its vital role in the U.S. energy ecosystem. By increasing its LNG production capabilities, Cheniere not only fortifies its market position but also contributes to the United States’ broader economic goals.

As the foremost LNG exporter in the country, Cheniere is a significant contributor to the U.S.’s rising influence on the global energy stage. Its expansions at Corpus Christi, among other projects, position the company as a key energy supplier to international markets. This is increasingly critical as the global appetite for natural gas grows, driven by the shift toward cleaner energy alternatives.

Looking Ahead: Growth and Innovation for Cheniere

In the future, Cheniere’s continued investment in expanding the Corpus Christi LNG plant signifies its commitment to growth and innovation. The upcoming Midscale Trains 8 and 9 expansion, along with the larger Stage 3 project, marks just the beginning of its broader strategy to adapt to the world’s evolving energy needs. Cheniere’s proven record in delivering large-scale LNG projects efficiently positions it for ongoing success in the global energy market.

In summary, Cheniere Energy’s enhancement of the Corpus Christi LNG facility represents a significant advancement in the U.S. energy sector. With FERC approval secured, the company is positioned to expand its capacity and address the increasing global demand for LNG. As the United States maintains its leadership in global LNG exports, Cheniere’s role is expected to grow in shaping the future of energy production and distribution.

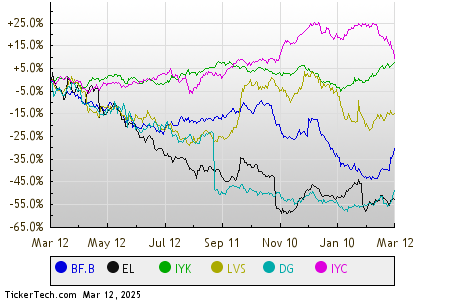

LNG’s Zacks Ranking and Investment Opportunities

LNG currently holds a Zacks Rank #3 (Hold).

Investors keen on the energy sector might consider other stocks with higher rankings, such as Archrock (AROC), which holds a Zacks Rank #1 (Strong Buy), and both Antero Resources (AR) and Coterra Energy (CTRA), each with a Zacks Rank #2 (Buy). For the complete list of today’s Zacks #1 Rank stocks, you can click here.

Archrock has a market value of $3.98 billion, with shares increasing by 30.7% over the past year. The company specializes in natural gas contract compression services and aftermarket services for compression equipment.

Antero Resources, valued at $10.79 billion, has seen a 36.9% rise in share value during the past year. This Denver-based independent exploration company focuses on acquiring and developing natural gas, natural gas liquids, and oil resources within the Appalachian Basin.

Coterra Energy, valued at $20.44 billion, has experienced a modest share price increase of 1.4% in the last year. CTRA operates independently in the exploration, development, and production of natural gas, crude oil, and natural gas liquids.

Five Stocks Expected to Double

These five stocks were selected by a Zacks expert as the top picks to potentially yield +100% or more in 2024. Previous recommendations have generated impressive returns of +143.0%, +175.9%, +498.3%, and +673.0%.

Several stocks featured in this report may currently be under Wall Street’s radar, presenting an excellent opportunity for investors. You can discover these five potential winners today.

For timely stock recommendations from Zacks Investment Research, download the report on the 7 Best Stocks for the Next 30 Days. Click here for this free report.

Cheniere Energy, Inc. (LNG): Free Stock Analysis report.

Antero Resources Corporation (AR): Free Stock Analysis report.

Archrock, Inc. (AROC): Free Stock Analysis report.

Coterra Energy Inc. (CTRA): Free Stock Analysis report.

This article was originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.