Analysts See Significant Upside for SPDR S&P Global Natural Resources ETF

At ETF Channel, we’ve analyzed the ETFs in our coverage universe. We compared the trading prices of each holding against average analyst 12-month forward target prices. The results indicate that the implied target price for the SPDR S&P Global Natural Resources ETF (Symbol: GNR) is $60.84 per unit.

Currently, GNR is trading at around $52.23 per unit. This indicates a potential upside of 16.48% based on the average targets set by analysts for its underlying holdings. Notably, three of GNR’s holdings show promising upside potential: Suzano SA (Symbol: SUZ), Vale SA (Symbol: VALE), and Shell plc (Symbol: SHEL). For instance, SUZ trades at $9.46 per share, while the average analyst target suggests a 69.13% increase to $16.00 per share. Similarly, VALE is poised for a 37.84% rise from its current price of $9.40 to a target of $12.96 per share. Analysts predict SHEL will reach a target price of $80.95 per share, representing a 21.17% upside from its recent trading price of $66.81.

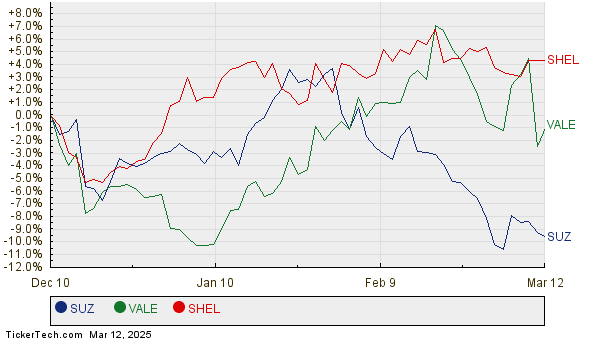

Below is a twelve-month price history chart comparing the stock performance of SUZ, VALE, and SHEL:

Together, SUZ, VALE, and SHEL account for 13.07% of the SPDR S&P Global Natural Resources ETF. The following table summarizes the current analyst target prices:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| SPDR S&P Global Natural Resources ETF | GNR | $52.23 | $60.84 | 16.48% |

| Suzano SA | SUZ | $9.46 | $16.00 | 69.13% |

| Vale SA | VALE | $9.40 | $12.96 | 37.84% |

| Shell plc | SHEL | $66.81 | $80.95 | 21.17% |

Investors must consider whether analysts’ targets are well-founded or overly optimistic about future pricing. Are these targets justified based on recent developments in the industry and the companies involved? A target significantly higher than a stock’s trading price often reflects optimism but can also lead to subsequent downgrades if expectations are out of step with market realities. These are critical questions for investors seeking further insights.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

also see:

• MXL Insider Buying

• XPDI shares outstanding history

• PLAT market cap history

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.