Analysts See Strong Upside for iShares Core Dividend ETF and Holdings

At ETF Channel, we analyzed the holdings of various ETFs in our coverage universe. By comparing the trading price of each holding against the average analyst 12-month forward target price, we computed a weighted average implied analyst target price for the iShares Core Dividend ETF (Symbol: DIVB). Based on its underlying holdings, we determined the ETF’s implied analyst target price to be $55.12 per unit.

Current ETF Trading Price and Analyst Outlook

Currently, DIVB is trading at approximately $48.06 per unit. This suggests that analysts anticipate a potential upside of 14.69% as they project targets for the underlying holdings. Notably, three holdings within DIVB show significant upside potential against their respective analyst target prices. These are Red Rock Resorts Inc (Symbol: RRR), Victory Capital Holdings Inc (Symbol: VCTR), and SL Green Realty Corp (Symbol: SLG).

Notable Holdings with Upside Potential

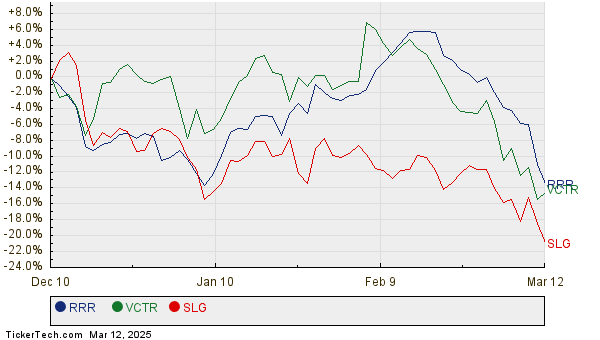

For example, Red Rock Resorts (RRR) is priced at $43.13 per share, while analysts set the average target at $56.42, signaling a 30.82% upside. Victory Capital Holdings (VCTR), trading at $56.52, has an average target of $73.22, equating to a 29.55% increase. SL Green Realty Corp (SLG), priced at $57.60, has a target price of $69.56, offering a potential upside of 20.77%. Below is a price history chart for RRR, VCTR, and SLG:

Summary of Analyst Target Prices

The following table summarizes the current analyst target prices mentioned above:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| iShares Core Dividend ETF | DIVB | $48.06 | $55.12 | 14.69% |

| Red Rock Resorts Inc | RRR | $43.13 | $56.42 | 30.82% |

| Victory Capital Holdings Inc | VCTR | $56.52 | $73.22 | 29.55% |

| SL Green Realty Corp | SLG | $57.60 | $69.56 | 20.77% |

Investor Considerations

Investors may wonder if these analyst targets are justified or overly optimistic regarding the future trading positions of these stocks. It’s important to assess whether analysts have valid reasons for their targets or if they are lagging due to recent company and industry changes. A high price target in relation to a stock’s current trading price can indicate optimism. However, it may also lead to potential downgrades if the targets no longer reflect market realities. Consequently, further research into these projections by investors is advisable.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

also see:

● DWM Average Annual Return

● ETFs Holding GCAP

● ALO Historical Stock Prices

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.