Two Growth Stocks for Long-Term Investors: CrowdStrike and Amazon

Over the past decade, growth stocks have attracted numerous investors seeking robust returns. With persistently low interest rates, investor optimism, and a thriving tech sector, growth stocks emerged as top performers in the market.

If you’re a long-term investor seeking dependable growth stocks to hold for the next decade, consider the following two options.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

Image source: Getty Images.

1. CrowdStrike

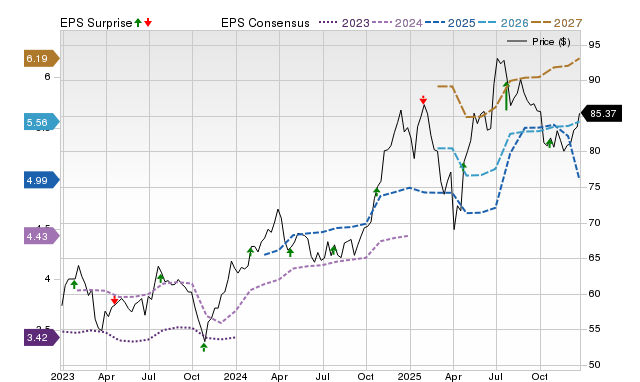

CrowdStrike Holdings (NASDAQ: CRWD) has established itself as a leading growth stock. However, a significant outage caused by the company in July 2024 has scrutinized its performance, leading to a decline in investor sentiment. As of March 6, CrowdStrike shares had fallen 4% over the past three months, including a notable 26% drop from their record high on February 14.

Investor concerns have arisen due to a weaker-than-expected outlook for fiscal year 2026. Nonetheless, abandoning the stock may prove to be shortsighted. For those searching for a long-term growth investment, CrowdStrike possesses key attributes.

CrowdStrike’s reputation as a top-tier cybersecurity platform is earned through its effective solutions. Its financial performance, customer growth, and retention rates affirm its standing in the industry.

In its fiscal fourth quarter, which ended on January 31, CrowdStrike secured over 20 deals worth more than $10 million each and more than 350 deals exceeding $1 million. Given the critical nature of cybersecurity, this points to robust customer support.

The company’s dollar-based net retention rate was 112% in its latest quarter, indicating that existing customers spent 12% more compared to the previous year. This metric contributes significantly to its revenue growth, including surpassing $1 billion in subscription revenue for the first time in its history.

CRWD Revenue (Quarterly) data by YCharts.

When evaluating potential long-term investments, key factors include large deals, strong customer retention, and a sizeable total addressable market (TAM). Management estimates that CrowdStrike’s TAM for its AI-native platform will reach $250 billion by 2029, up from an estimated $116 billion in the current year. As cybersecurity gains importance, CrowdStrike positions itself as a major contender for years to come.

2. Amazon

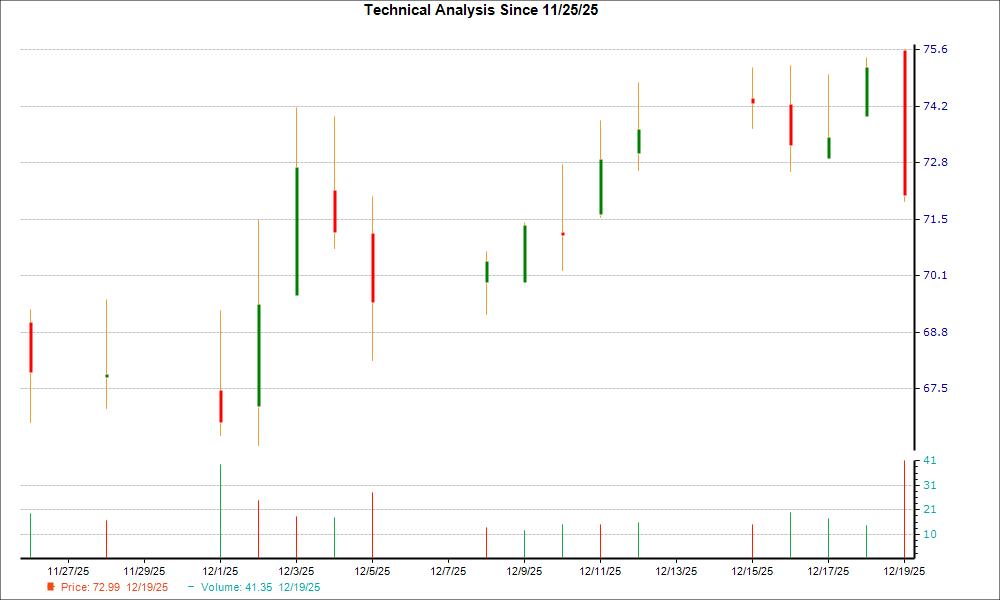

With a market cap exceeding $2 trillion, Amazon (NASDAQ: AMZN) may not fit the typical mold of a growth stock, yet it embodies all the essential characteristics.

Amazon’s success stems from its flourishing e-commerce business, but my optimism for the next decade centers on its cloud computing segment, Amazon Web Services (AWS).

AWS is the leading provider of cloud services and has emerged as a key profit driver. In 2024, its revenue increased by 19% year over year to $107 billion, surpassing Target’s total revenue over the past four quarters combined. Operating income from AWS reached $40 billion, a substantial rise from $24.6 billion.

While AWS accounted for only about 17% of Amazon’s total revenue in 2024, it represented 58% of the company’s operating income. E-commerce generates the revenue, while AWS fuels profitability.

AMZN Revenue (Annual) data by YCharts.

All major cloud platforms stand to gain from the rise of artificial intelligence (AI), but AWS’s strategy differs, positioning it for lasting success. The focus on constructing foundational AI infrastructure enables customers to develop their own tools using platforms like Bedrock and SageMaker.

In 2024, Amazon invested nearly $83 billion in capital expenditures, primarily aimed at supporting AWS growth through data centers and AI advancements. The company recognizes the necessity of e-commerce revenue to fund its ventures, but AWS plays a pivotal role in its long-term strategy. Plans for 2025 include around $100 billion in expenditures.

Amazon represents a stock I confidently recommend for long-term investment, notwithstanding the market’s inevitable fluctuations.

Explore New Investment Opportunities

Do you ever feel like you missed out on the most successful stocks? Here’s a timely chance to reconsider.

Occasionally, our expert analysts identify a“Double Down” Stock recommendation for companies poised for significant growth. If you’re concerned about missing your investment opportunity, now may be the ideal time to act. The performance metrics are compelling:

- Nvidia: If you invested $1,000 when we doubled down in 2009, you’d have $282,016!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $41,869!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $482,720!*

Currently, we are issuing “Double Down” alerts for three exceptional companies, and this opportunity may not present itself again soon.

Continue »

*Stock Advisor returns as of March 10, 2025

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Stefon Walters holds positions in CrowdStrike. The Motley Fool has positions in and recommends Amazon, CrowdStrike, and Target. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.