Tech Stocks to Watch: Netflix and Meta Platforms Amid Market Uncertainty

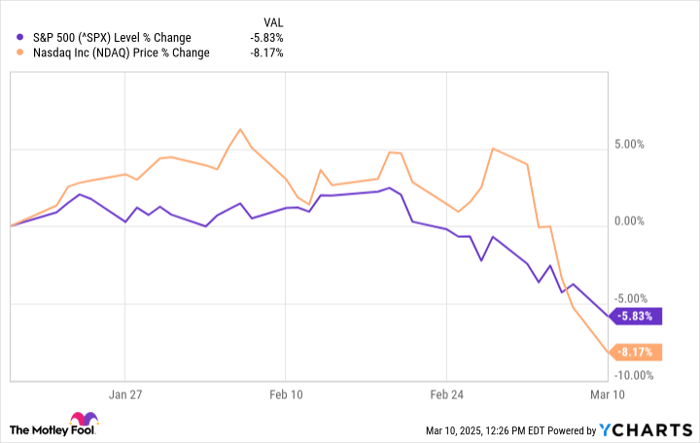

Since Donald Trump took office as the 47th U.S. president, equities have faced significant challenges. As of March 10, the S&P 500 declined by 8.6% from its peak on February 19, while the tech-heavy Nasdaq Composite dropped by 13.4% since its highs on December 16. Concerns about trade wars, tariffs, and potential macroeconomic issues have left investors, particularly in the tech sector, wary of an impending sell-off.

Market downturns, although uncomfortable, often present opportunities to acquire shares of high-quality companies at lower prices. In this context, let’s examine two tech stocks that could become particularly appealing if a significant market sell-off occurs: Netflix (NASDAQ: NFLX) and Meta Platforms (NASDAQ: META).

Wondering where to invest $1,000 today? Our analysts just revealed their top 10 best stocks to consider buying now. Learn More »

^SPX data by YCharts

1. Netflix

Netflix has demonstrated remarkable performance. The streaming service has significantly outperformed the market over recent years due to strategic business changes yielding substantial results.

The company’s fourth-quarter results further underscore its business strength. Netflix reported a 16% year-over-year revenue increase, reaching $10.2 billion, while earnings per share more than doubled to $4.27. However, like many companies in a downturn, Netflix’s stock may experience pressure.

Despite its impressive performance, Netflix’s stock is seen as relatively expensive, with a forward price-to-earnings (P/E) ratio of 34.8, compared to the average of 19.4 for the communication services industry.

This premium is arguably justified given Netflix’s current success. However, in the event of a market crash, this high forward P/E could hinder its attractiveness. Still, acquiring shares during such a downturn may be an advantageous move considering Netflix’s long-term potential.

Netflix continues to expand its ecosystem, finishing 2024 with 301.63 million paid subscribers—a 16% increase year-over-year. This growth strengthens its network effect, allowing Netflix to better understand consumer preferences and improve content strategies. Consequently, this enhances engagement, subscription rates, and advertising revenue, especially with its new low-cost subscription option.

The potential of streaming remains vast, accounting for only 42.6% of television viewing time in the U.S. as of January. Netflix estimates an overall revenue opportunity of $650 billion, highlighting significant untapped potential in the market.

While competition is intensifying, Netflix remains the market leader, well-positioned to capitalize on this opportunity. Therefore, Netflix is a solid long-term investment, particularly attractive during market downturns.

2. Meta Platforms

Meta Platforms has also shown robust performance. The company’s advertising revenue is thriving, in part due to its integration of artificial intelligence (AI) across its services. For example, Meta’s Reels feature—short-form videos on Facebook and Instagram—is driving growth through improved recommendations powered by AI.

In the fourth quarter, Meta Platforms reported a 21% year-over-year revenue growth to $48.4 billion, with earnings per share rising 50% from the previous year to $8.02. The platform now boasts 3.35 billion daily active users, an increase of 5% year-over-year.

Having such a large user base is advantageous, and Meta continues to deepen user engagement. The recent launch of Meta AI, a generative AI platform, along with Threads—a competitor to X (formerly Twitter)—further enhances its ecosystem. Currently, Meta AI has 500 monthly active users while Threads has attracted 275 million users.

The expansive ecosystem provides Meta with substantial long-term monetization opportunities, particularly through paid services like WhatsApp messaging. Moreover, it is likely Meta will find ways to leverage its AI innovations into profitable revenue streams in the future.

With a solid foundation in advertising, Meta’s core business is expected to remain strong. Companies will continue to seize the opportunity to showcase their products to billions of potential customers. Given its forward P/E ratio of 23.5, Meta Platforms appears fairly priced considering its strong performance within the communication services sector.

If market conditions cause tech stocks to decline further, Meta’s shares could become a bargain. Investors should monitor this stock closely and consider acquiring shares if the price drops.

Don’t miss this potential opportunity

Have you ever felt you missed the chance to invest in successful stocks? You may want to pay attention now.

Occasionally, our team of analysts issues a “Double Down” Stock recommendation for companies expected to perform well. If you think you’ve missed your chance, now may be the time to act while the opportunity is still available. The historical numbers can be compelling:

- Nvidia: If you invested $1,000 when we doubled down in 2009, you’d have $282,016!*

- Apple: If you invested $1,000 when we doubled down in 2008, you’d have $41,869!*

- Netflix: If you invested $1,000 when we doubled down in 2004, you’d have $482,720!*

Currently, we’re issuing “Double Down” alerts for three exceptional companies, and opportunities like this are rare.

Continue »

*Stock Advisor returns as of March 10, 2025

Randi Zuckerberg, former director of market development and spokeswoman for Facebook and sister of Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Prosper Junior Bakiny has positions in Meta Platforms. The Motley Fool has positions in and recommends Meta Platforms and Netflix. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.