Etsy Faces Challenges Amid Declining Sales and Investor Concerns

Shares of Etsy (NASDAQ: ETSY) have dropped significantly after the company announced its full-year 2024 earnings, with the stock declining by approximately 10% as of this report. However, this recent decline is minor in the context of a more than 80% decrease from its peak in late 2021. Here’s an analysis of potential challenges ahead for the company.

Etsy’s Core Operations

Etsy operates online marketplaces that facilitate transactions between buyers and sellers. Its flagship platform, which generated about 86% of the company’s revenue in 2024, allows creators and artists to sell their products directly to customers.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Learn More »

Image source: Getty Images.

Additionally, Etsy owns the Reverb marketplace for musical instruments and Depop, which focuses on secondhand clothing. Together, these smaller platforms contribute roughly 24% to its revenue, with a balanced split between them. The Etsy platform remains the company’s core business.

Following the pandemic, investor interest in Etsy soared, causing the stock to rise more than 500% from early 2020 to its peak in 2021. This surge stemmed from the need for online retail solutions during lockdowns. As the world adapted to COVID, however, Etsy’s marketplace transformed from essential to optional. Consequently, investors sold off the stock, which now appears to have returned to its 2020 price levels.

ETSY data by YCharts

Financial Performance Shows Weakness in 2024

Etsy’s 2024 financial results revealed troubling trends for investors. Notably, the value of merchandise sold across Etsy’s platforms decreased by 4.4% this year, following a 1.2% drop in 2023 and a 1.3% decline in 2022, indicating a clear downward trajectory for the business.

Interestingly, merchandise sales experienced substantial growth during 2020 and 2021—more than doubling in 2020 and increasing by 31% in 2021—primarily driven by pandemic-related demand. However, the current data suggests that Etsy may have saturated the crafts market.

One concerning statistic is that the number of “active buyers” fell by 2.6% year over year in Q4 2024, with those buyers purchasing 3.5% less on average. Even more alarming, “habitual buyers” declined by 9.5%, indicating that customer engagement may be waning. Note that Q4 is crucial for holiday shopping.

What’s intriguing is that Etsy reported earnings growth despite these worrying signs. This increase is largely due to the company buying back 12.2 million shares in 2024, or about 10% of its outstanding stock. Although share buybacks can enhance earnings per share, in this context, such practices could be disguising underlying issues within the company’s operations.

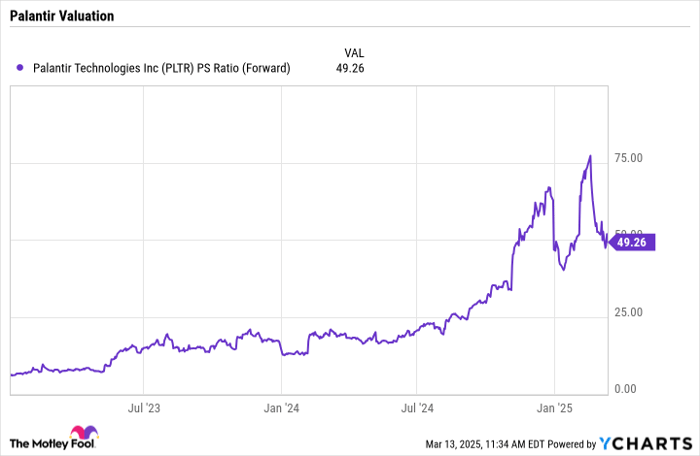

Evaluating Etsy’s Valuation

With Etsy’s stock experiencing a decline from its pandemic highs, investors should assess the company’s valuation. By comparing it to eBay, which also operates as a marketplace, we can gain insights into Etsy’s future potential. Etsy currently has a price-to-earnings ratio of approximately 19.5, compared to eBay’s 16.5. It remains plausible that Etsy’s P/E ratio could continue to decline as stock prices drop, indicating further downward pressure on its valuation.

Is Etsy a Good Investment Right Now?

Before investing in Etsy, consider the following:

The Motley Fool Stock Advisor analyst team has identified 10 stocks they believe are better investment options currently, with Etsy not making the list. The companies that did make the cut are anticipated to deliver strong returns in the years ahead.

For example, back when Nvidia was recommended on April 15, 2005, a $1,000 investment would now be worth about $709,381!

Stock Advisor provides an easy-to-follow guide for investors, including portfolio-building tips, regular updates, and two new Stock picks each month. The Stock Advisor service has outperformed the S&P 500 since 2002.

See the 10 stocks »

*Stock Advisor returns as of March 10, 2025.

Reuben Gregg Brewer has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Etsy and eBay. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.