Maximize Profits by Trading Rallies in Market Declines

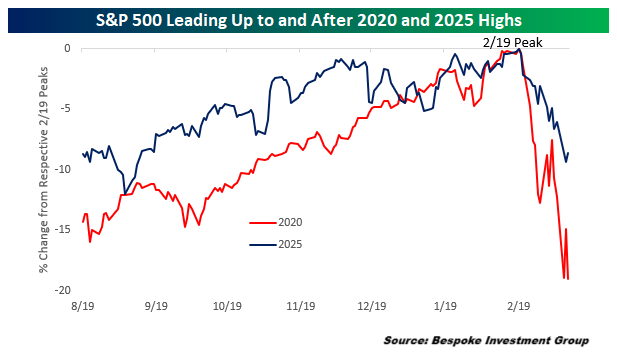

Market volatility can deter traders from entering new positions. However, even amidst downturns, tradeable rallies can create opportunities to profit. A successful strategy involves identifying short-term rebounds and leveraging them, all while adhering to a disciplined exit plan.

Recognizing and Trading Short-Term Rallies

During sharp sell-offs, some stocks become oversold, leading to potential short-term rebounds. Traders can seize these moments using a structured approach:

1. Find Oversold Stocks with Strong Fundamentals and Technicals

- Seek stocks with an RSI (Relative Strength Index) below 30, signaling oversold conditions.

- Assess technical indicators, like moving averages and MACD, along with fundamental ratings from sources such as Chartmill or the top ten names from Portfolio Armor.

- Focus on stocks that exhibit solid business fundamentals likely to recover once selling pressure diminishes.

2. Time Your Entry with Market Sentiment

- Keep an eye on fear indicators, including the VIX and put/call ratios, to assess market sentiment.

- Consider entering trades when indicators show extreme fear, provided technical signals suggest stabilization.

3. Use Options to Mitigate Risk and Enhance Upside

- Purchasing near-the-money call options can provide favorable reward-to-risk ratios.

- Opt for short-term expirations (one to three weeks) to target rapid rebounds.

- Gradually scale out of trades to secure profits while retaining some exposure for possible further upside.

Recent Case Study: Spotify’s Tradeable Bounce

To illustrate this method, let’s examine a recent trade involving Spotify Technologies S.A. SPOT. The stock had experienced significant selling pressure, resulting in an RSI near 28, yet it retained robust technical and fundamental ratings. Recognizing a possible bounce, we executed the following trade:

Trade Setup and Execution

- Entry: Purchased $530 strike SPOT calls expiring March 14th for $2.40 when SPOT was trading at $487.

- Exit (First Half): The following day, SPOT bounced, leading to the sale of half at $6, resulting in a 150% gain.

- Exit (Second Half): Later that same day, we sold the remaining position at $6, fully securing our profit.

This disciplined strategy—identifying an oversold stock, entering at a high-probability point, and selling during strength—shows how to effectively navigate short-term trading opportunities.

Applying This Strategy to Future Trades

Traders can implement this framework in future setups by:

✅ Screening for oversold stocks with fundamental strength.

✅ Entering positions during peak fear while utilizing technical indicators for stabilization.

✅ Using options as a risk management tool to maximize potential profits.

✅ Selling into rallies rather than holding onto uncertainty.

For those interested in monitoring similar trading setups, consider subscribing to our trading Substack/occasional email list below.

Additionally, if you seek downside protection during future market rallies, download the Portfolio Armor optimal hedging app by scanning the QR code below, or by tapping here if you’re on your phone. Our app can help you identify cost-effective hedges suited to your risk tolerance and time frame.

If you’d like updates and insights

Use our platform to find optimal hedges for specific securities, discover our current top ten stock picks, and develop hedged portfolios on our website. You can also keep up with Portfolio Armor on X here, or become a free subscriber to our trading Substack using the link below (this is now our go-to for occasional emails).

Momentum97.12

Growth33.96

Quality–

Value9.93

Market News and Data brought to you by Benzinga APIs