Understanding the Value of Wall Street Analyst Ratings for NFLX

Investors frequently rely on Wall Street analysts’ recommendations when determining whether to Buy, Sell, or Hold a Stock. While rating changes from these brokerage-employed (or sell-side) analysts often influence a Stock‘s price, it’s essential to evaluate their true significance.

Let’s analyze the current outlook on Netflix (NFLX) and assess the reliability of brokerage recommendations in guiding investment decisions.

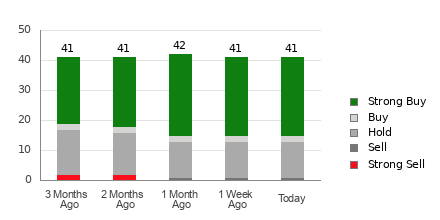

As it stands, Netflix boasts an average brokerage recommendation (ABR) of 1.70 on a scale of 1 to 5, ranging from Strong Buy to Strong Sell. This ABR is the result of analyses from 41 brokerage firms, suggesting a general consensus between Strong Buy and Buy.

Breaking down those figures: out of the total recommendations, 26 are classified as Strong Buy, while two earn a Buy rating. Collectively, Strong Buy and Buy hold a significant majority of 63.4% and 4.9%, respectively.

Trends in Brokerage Recommendations for NFLX

For those interested in price targets and forecasts, you can find further details for Netflix here>>>

While an ABR that favors buying Netflix is promising, relying solely on this information might not be prudent. Research reveals that brokerage recommendations often fail to effectively guide investors toward stocks poised for significant price increases.

What accounts for this discrepancy? The interests of brokerage firms can create a bias in their rating processes. Our findings indicate that brokerage analysts typically provide five “Strong Buy” ratings for every “Strong Sell” they issue.

This pattern suggests that analysts’ incentives may not align with those of retail investors, as they frequently do not predict actual stock price movement accurately. Consequently, leveraging this information as a means to confirm your own research may prove most beneficial.

Zacks Rank, our proprietary Stock rating system, effectively categorizes stocks from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell). This model is based on solid performance metrics and can serve as a reliable indicator of a stock’s price movements in the near term. Using ABR to complement Zacks Rank can be wise in making well-informed investment choices.

Distinguishing Between ABR and Zacks Rank

Despite both Zacks Rank and ABR being represented on a scale of 1-5, they measure different criteria entirely.

The ABR relies solely on brokerage recommendations, typically represented in decimal form (e.g., 1.28). In contrast, the Zacks Rank outputs a numerical classification from 1 to 5, driven by changes in earnings estimates.

It is not uncommon for brokerage analysts to display excessive optimism in their ratings because of their ties to brokerage firms. This can lead to more favorable assessments than may be warranted.

Meanwhile, the Zacks Rank is influenced directly by earnings revisions, which empirical studies suggest have a strong correlation with stock price trends.

Moreover, Zacks Rank grades remain proportional across all stocks with current-year earnings estimates, ensuring a balanced assessment across different ranks.

A key distinction lies in the timeliness of the data. The ABR might not always reflect the latest market conditions. In contrast, the Zacks Rank is updated frequently to account for shifts in earnings projections, leading to timely insights regarding future price movements.

Is NFLX a Sound Investment?

Regarding earnings estimates for Netflix, the Zacks Consensus Estimate for this year has seen a 0% increase over the past month, now positioned at $24.58.

Growing optimism among analysts about the company’s earnings trajectory, as shown by a consensus for higher EPS estimates, could signal potential upward movement for the Stock soon.

The notable change in the consensus estimate, along with related factors concerning earnings estimates, culminates in a Zacks Rank #1 (Strong Buy) for Netflix. Investors can find the complete list of today’s Zacks Rank #1 (Strong Buy) stocks here>>>>

Thus, the Buy-equivalent ABR for Netflix can be a useful guiding factor for investors.

Zacks’ Research Chief Identifies “Stock Poised for 100% Growth”

Our expert team has identified five stocks with the highest potential for 100% appreciation in the coming months. Among these, Director of Research Sheraz Mian underscores one particular Stock expected to achieve remarkable gains.

This leading pick comes from a notably innovative financial firm, already serving over 50 million customers, and is equipped with a diverse range of advanced solutions. Although not all of our selections may be successful, this particular Stock holds promise that could eclipse previous Zacks noted gains, similar to Nano-X Imaging’s substantial +129.6% rise within nine months.

Free: see Our Top Stock And 4 Runners Up

If you want to access the latest recommendations from Zacks Investment Research, download “7 Best Stocks for the Next 30 Days” today. Click for your free report.

Netflix, Inc. (NFLX): Free Stock Analysis report.

This article was originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.