Investors Eye New Options for Primo Brands Class A Shares

Investors in Primo Brands Corporation Class A (Symbol: PRMB) can explore new options available today, specifically set to expire on June 20th. The time until expiration significantly impacts how much option buyers are willing to pay. With 98 days remaining, these new contracts provide sellers of puts or calls a chance to secure a higher premium compared to contracts expiring sooner. Our YieldBoost formula at Stock Options Channel has assessed the PRMB options chain and found a noteworthy put contract.

Put Contract Insights

The $30.00 strike price put contract currently offers a bid of 60 cents. If an investor chooses to sell-to-open this put contract, they commit to buy the stock at $30.00, while also collecting the premium. This results in an effective cost basis of $29.40 per share (before broker commissions). For those already interested in acquiring shares of PRMB, this may represent a compelling option compared to the current market price of $31.38 per share.

Notably, the $30.00 strike price is approximately 4% below the current trading price, positioning it out-of-the-money by that margin. However, there is a possibility that this put contract could expire worthless. Current analytical data, including various greeks and implied greeks, indicate a 65% likelihood of that outcome. Stock Options Channel will continue to monitor these odds over time, publishing a detailed chart on our website under this contract’s detail page. If the contract does expire worthless, the premium would yield a 2.00% return on the cash commitment, translating to an annualized return of approximately 7.45%. Our platform refers to this potential as the YieldBoost.

Trading History

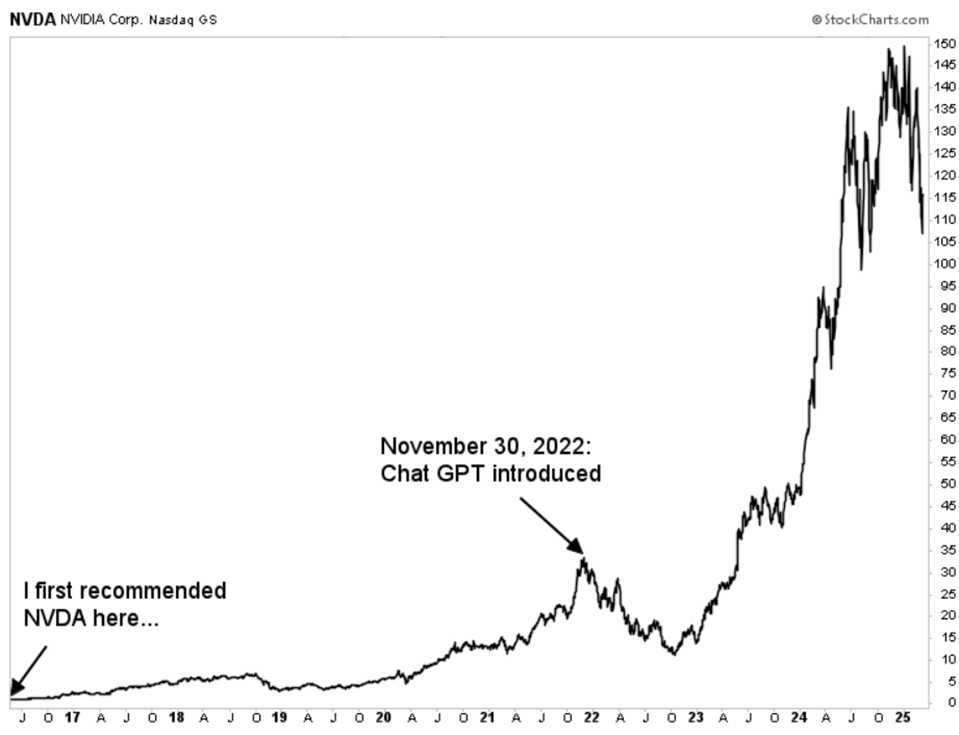

Below is a chart depicting the trailing twelve-month trading history for Primo Brands Corporation Class A, highlighting the $30.00 strike price relative to that historical context:

The implied volatility for the put contract discussed is 34%. In contrast, we estimate the actual trailing twelve-month volatility, based on the last 249 trading days and today’s price of $31.38, to be 27%. For further opportunities in put and call options contracts, consider visiting Stock Options Channel.

![]() Top YieldBoost Puts of Stocks with Recent Secondaries »

Top YieldBoost Puts of Stocks with Recent Secondaries »

Also see:

- Dividend Bargains You Can Buy Cheaper Than Insiders Did

- VKTX Shares Outstanding History

- Sherwin-Williams DMA

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.