Netflix’s Strong Market Position Draws Investor Attention Amid Tariff Concerns

February’s cooler Consumer Price Index (CPI) report has helped stabilize markets as tariff concerns linger. Among the stocks that investors might be considering for a rebound is Netflix NFLX.

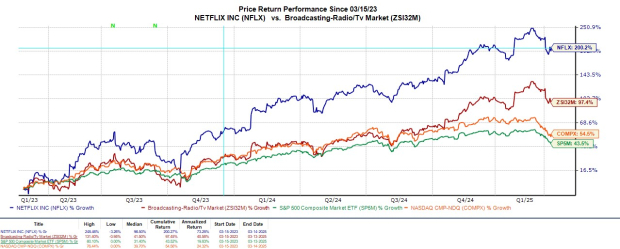

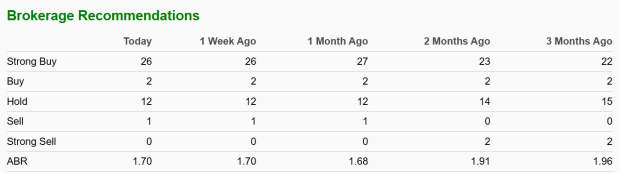

While NFLX has dropped 14% from its 52-week peak of $1,064 a share in mid-February, it has gained 2% year-to-date, outperforming the S&P 500’s -6% and the Nasdaq’s -8%. Over the past two years, NFLX has exhibited impressive performance, climbing 200% and significantly surpassing broader market indexes and its peers in the Zacks Broadcast Radio & Television Market, which is up 97%.

Image Source: Zacks Investment Research

Netflix’s Market Sentiment

Amid economic uncertainty, investor confidence in Netflix remains strong, with numerous analysts increasing their price targets for NFLX. This optimism aligns with Netflix’s position as the leading streaming service, outpacing competitors like Disney (DIS), Paramount Global PARA, and Amazon’s (AMZN) Prime Video. Key factors contributing to Netflix’s success include its original content and ongoing international expansion, along with the introduction of an ad-supported subscription model at a lower price.

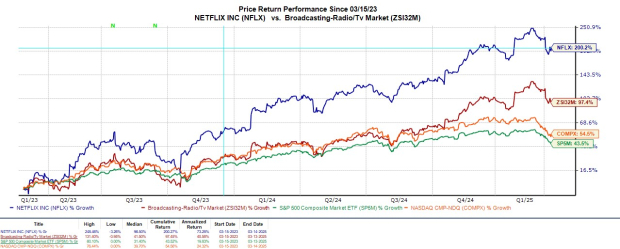

In its latest Q4 report from January, Netflix revealed that its ad plan contributed to 55% of new sign-ups in regions where it is available, resulting in total subscribers surpassing 300 million. Notably, Netflix added an unprecedented 19 million subscribers during Q4, surpassing Wall Street’s expectations by 13 million. Additionally, the company achieved over $10 billion in operating income in fiscal 2024, while its GAAP net income surged 61% to $8.71 billion.

The report for Q1 will be released on Thursday, April 17. Netflix has outperformed the Zacks EPS Consensus in the last four quarterly reports, averaging an earnings surprise of 7.17%.

Image Source: Zacks Investment Research

Analyst Ratings and Price Target for NFLX

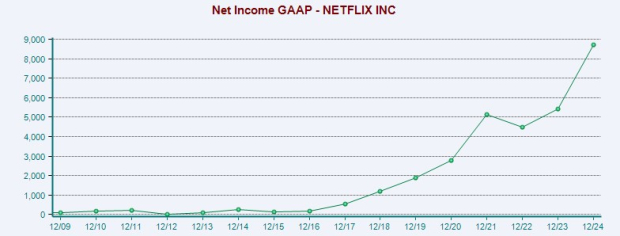

Currently, Netflix stock is covered by 41 different brokerage firms that provide data to Zacks, leading to an average brokerage recommendation (ABR) of 1.70 on a scale from 1 (Strong Buy) to 5 (Strong Sell).

Image Source: Zacks Investment Research

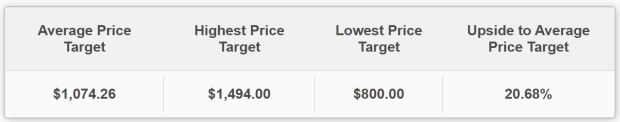

The average Zacks price target based on short-term forecasts from 38 analysts is $1,074.26, suggesting a potential upside of 20% from current levels.

Image Source: Zacks Investment Research

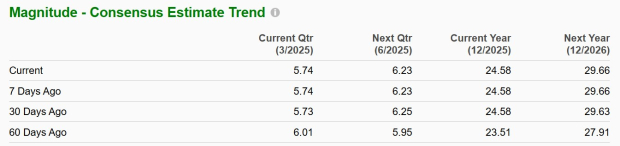

EPS Forecast Revisions

Earnings estimates for Netflix have shown positive momentum, with projections for EPS growth of 24% in fiscal 2025, reaching $24.58 compared to $19.83 in the previous year. For FY26, EPS is anticipated to further increase by 20% to $29.66.

Interestingly, estimates for FY25 and FY26 have risen by 4% and 6%, respectively, over the last 60 days.

Image Source: Zacks Investment Research

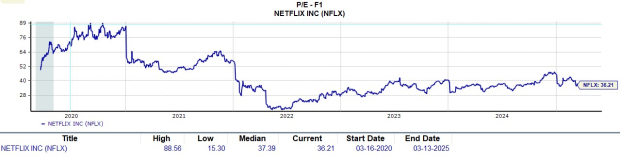

Evaluating Netflix’s P/E Valuation

In addition to the positive EPS revisions, NFLX is currently trading at a forward earnings multiple of 36.2X. This is significantly lower than its five-year high of 88.5X and represents a slight discount compared to the median multiple of 37.3X during this timeframe.

Image Source: Zacks Investment Research

Conclusion and Considerations

Reflecting the positive trend in earnings estimates, Netflix Stock holds a Zacks Rank #1 (Strong Buy). While concerns regarding tariffs have raised recession fears, its ad-supported service could provide a boost in a potential economic downturn. This positioning may help Netflix maintain its dominance in the streaming market against competitors like Disney, Paramount, and Amazon.

Zacks’ Research Chief Names “Stock Most Likely to Double”

Our team of experts has just released the 5 stocks with the greatest probability of gaining +100% or more in the coming months. Of those 5, Director of Research Sheraz Mian highlights the one Stock set to climb highest.

This top pick is among the most innovative financial firms. With a fast-growing customer base (already over 50 million) and a diverse set of cutting-edge solutions, this Stock is poised for significant gains. While not all our elite picks succeed, this one could far surpass previous Zacks’ Stocks Set to Double, like Nano-X Imaging, which skyrocketed +129.6% in just over nine months.

Free: see Our Top Stock And 4 Runners Up

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Netflix, Inc. (NFLX): Free Stock Analysis report

Amazon.com, Inc. (AMZN): Free Stock Analysis report

The Walt Disney Company (DIS): Free Stock Analysis report

Paramount Global (PARA): Free Stock Analysis report

This article originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.