Q1 Earnings Season Begins with Mixed Results and Concerns

As the Q1 reporting cycle heats up, major banks are set to release their March-quarter results on April 11th. However, the earnings season has already commenced, with four S&P 500 companies reporting results for their fiscal quarters that ended in February.

This week, an additional ten S&P 500 members are expected to unveil their February-quarter results, including prominent firms like Nike (NKE), FedEx (FDX), and Accenture (ACN). Research organizations, including ours, incorporate these February results into the March-quarter analysis.

By the time the major banks report a month from now, nearly two dozen S&P 500 companies will have disclosed their Q1 results.

Unfortunately, the market has reacted unfavorably to the results released so far, with three out of four stocks experiencing declines following their earnings announcements. It’s worth noting that these results from Costco (COST), Oracle (ORCL), and Adobe (ADBE) coincided with a broader market sell-off, suggesting that market forces could be behind the declines.

Although Costco, Oracle, and Adobe released stronger-than-anticipated results for their February quarters, the guidance they provided for the current period lacked optimism. This cautious outlook mirrors similar sentiments from other companies, like Walmart, Target, and Delta Air Lines.

An environment of increased anxiety is developing around the macroeconomic landscape. Concerns about the Trump administration’s tariff policies are surfacing in business and consumer confidence metrics, leading to worries about potential impacts on private sector jobs due to ongoing public sector cuts.

For a deeper dive into how tariffs impact earnings, see our analysis >>>The Earnings Impact of the New Tariff Regime

Despite these near-term risks, we maintain a balanced outlook. The current market weakness can be viewed as a potential buying opportunity. The resilience of the U.S. economy has been evident even amidst the Federal Reserve’s aggressive tightening cycle.

Critically, the U.S. economy is backed by the Fed, which currently has significant resources to stimulate growth if necessary. Regardless of how tariffs affect estimates, we should not lose sight of the fact that the corporate earnings landscape has shown steady improvement in recent quarters.

Indeed, the earnings growth rate has steadily accelerated, with the previous quarter’s growth reaching +13.7% (+16.4% excluding Energy), the highest in three years. We anticipate that these favorable growth trends will continue, expanding beyond the tech sector that dominated in recent years.

Early Q1 Earnings Scorecard

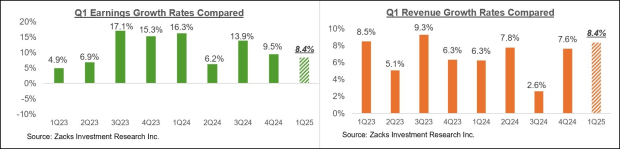

Thus far, four S&P 500 members have reported February-quarter results, showing an earnings increase of +8.4% compared to last year, driven by equivalent revenue growth. Out of these four companies, only one exceeded EPS estimates, while two beat revenue projections.

The accompanying comparison charts place the Q1 earnings and revenue growth rates of these companies in a historical context.

Image Source: Zacks Investment Research

Among the ten companies reporting this week, we will closely monitor Nike, FedEx, and Accenture for trends and insights on their outlooks. Nike is projected to earn 28 cents per share on revenues of $11.12 billion, reflecting substantial year-over-year declines of -71.4% in earnings and -10.6% in revenues. Estimates have remained stable recently but have fallen more than 50% over the past three months.

The company’s stock has lagged behind the broader market and the Zacks Consumer Discretionary sector, as shown in the chart below.

Image Source: Zacks Investment Research

Since hitting an all-time high in November 2021, Nike shares have lost over 60% of their value. This decline is attributed to various factors, such as management’s focus on direct-to-consumer initiatives during COVID, which neglected the larger wholesale market, coupled with assumptions regarding new product launches and revenue challenges in China.

Q1 Earnings Estimates Under Pressure

Expectations for Q1 earnings suggest a growth rate of +6.0% over last year’s figures, paired with a 3.8% increase in revenues, following the previous quarter’s +13.7% earnings growth and +5.4% revenue gains.

The chart below illustrates current earnings and revenue growth expectations for Q1 in context with prior quarters, as well as upcoming forecasts.

Image Source: Zacks Investment Research

We’ve observed heightened negative revisions to Q1 estimates, even before the recent signs of weakness prompted cautious guidance from several companies. The chart below demonstrates how Q1 earnings growth expectations have shifted since the onset of the quarter.

Image Source: Zacks Investment Research

As previously mentioned, January has witnessed a higher number of negative revisions to Q1 expectations compared to similar periods in recent quarters. Not only is there a greater magnitude of negative revisions, but the breadth of these downward adjustments is also more pronounced.

Since the beginning of January, estimates have decreased for 14 of the 16 Zacks sectors, with the most significant drops seen in Conglomerates, Autos, Basic Materials, Aerospace, Consumer Discretionary, and others.

Tech Sector Faces Revisions Despite Strong Earnings from Key Players

As the first quarter progresses, the Medical and Construction sectors have seen an increase in their earnings estimates. However, the Tech sector, which has maintained a positive outlook for over a year, is now experiencing negative revisions to its Q1 estimates. The recent announcement from DeepSeek in China has dampened optimism surrounding the AI investment cycle, creating a shift in market sentiment that negatively impacts AI-focused stocks this year.

This trend is evident in the performance of major companies like Oracle and Adobe. Both firms reported robust quarterly results; however, their guidance remains relatively weak. The chart below illustrates the year-to-date performance of these stocks in comparison to the broader market, represented by the S&P 500 index, and the Zacks Tech sector.

Image Source: Zacks Investment Research

A lot depends on evolving earnings expectations for the Tech sector, a key driver of growth the last two years. Analysts anticipate Q1 earnings for this sector to rise by +12.6% compared to the same period last year, with revenues up by +10%. This follows the sector’s impressive +26.3% earnings growth in the previous quarter.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

The overall earnings outlook for the Tech sector suggests more double-digit growth in the coming years, with projections indicating significant increases for 2025 and 2026.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Zacks’ Research Forecasts Potential for Big Gains

Our expert team has identified five stocks with the highest potential for gains of +100% or more in the coming months. Among these, Director of Research Sheraz Mian specifically highlights one stock that is positioned to see the greatest increase.

This standout stock belongs to a highly innovative financial firm boasting a rapidly growing customer base of over 50 million and a diverse array of cutting-edge solutions. Consequently, this stock could experience significant growth. While no selection is guaranteed, this pick could exceed past Zacks Stocks Set to Double, such as Nano-X Imaging, which surged +129.6% in just over 9 months.

Free: See Our Top Stock And 4 Runners Up

Accenture PLC (ACN) : Free Stock Analysis Report

NIKE, Inc. (NKE) : Free Stock Analysis Report

Oracle Corporation (ORCL) : Free Stock Analysis Report

Costco Wholesale Corporation (COST) : Free Stock Analysis Report

Adobe Inc. (ADBE) : Free Stock Analysis Report

FedEx Corporation (FDX) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.