Market Trends: Assessing Stock Splits Amid Recent Corrections

Stock splits present a compelling narrative in the financial markets. In bullish phases, investors often flock to shares of companies announcing splits, driving up prices in anticipation. However, this enthusiasm doesn’t always align with the underlying financial reality.

In fact, Stock splits do not fundamentally change a company’s financial health. Whether through a forward Stock split, where the number of outstanding shares increases, or a reverse Stock split, which decreases the share count, the business remains unchanged post-split.

This disconnection doesn’t deter investors who remain captivated by Stock splits, particularly in a rising market. However, with the current market trending downward, the attraction to split stocks has waned. This shift raises the question: could it be useful to consider these stocks for your portfolio? Below, we discuss one Stock-split company to consider buying and one to avoid as we look at March.

Chipotle: Trading at Its Lowest Valuation in Years

Chipotle (NYSE: CMG) executed a 50-for-1 Stock split in 2024, making its shares more accessible to individual investors. Currently, Chipotle’s share price is approximately $50, reflecting a 27% decline from recent highs. Market apprehensions about a potential slowdown in restaurant spending have impacted the sector at the beginning of 2025.

Despite these concerns, Chipotle’s actual business performance remains solid. In 2024, the company’s revenue grew by 14.6%, reaching $11.6 billion, supported by new restaurant openings and a 7.3% rise in same-store sales compared to 2023. The operating margin increased to 16.9%, up from 15.8% in the previous year.

Overall, Chipotle’s earnings per share (EPS) saw a year-over-year growth of 24.7% in 2024. With significant potential to expand its store presence in North America and potentially abroad, it seems likely that the company can sustain robust EPS growth in the years ahead.

Following the recent drawdown, Chipotle’s price-to-earnings ratio (P/E) stands at 45. While not exceptionally low, it is poised to decrease as Chipotle’s rapid EPS growth continues. This level is the lowest seen in five years, excluding the panic during March 2020. Long-term investors in Chipotle may find it a favorable opportunity.

Sirius XM: Struggling Business Model

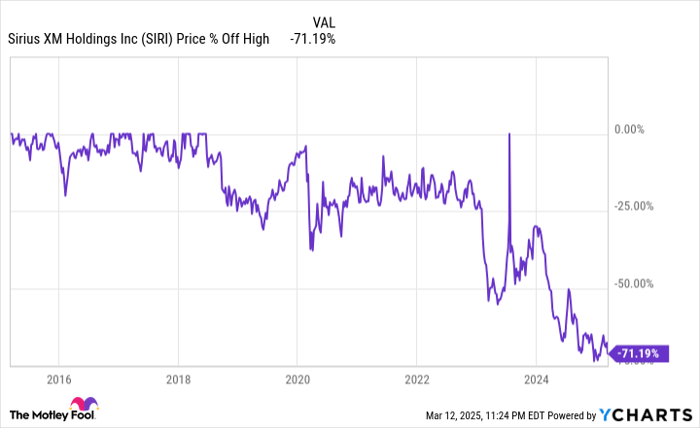

SIRI data by YCharts

In contrast, forward Stock splits typically indicate business success, while reverse splits suggest underlying struggles. Sirius XM Holdings (NASDAQ: SIRI) recently executed a reverse split, highlighting challenges as a satellite radio provider. The company is finding it difficult to transition to the modern landscape of digital audio streaming.

In 2024, Sirius XM’s revenue decreased by 4% to $6.6 billion. Its free cash flow has diminished to approximately $1 billion, marking the lowest level seen in a decade. Despite acquiring Pandora Music, growth has stalled, and the company is engaging in costly podcast licensing agreements.

While Sirius XM experienced growth in previous years, it is now facing stiff competition from platforms like Spotify and YouTube, which continue to attract millions of new users annually. Alarmingly, Sirius XM’s user base is declining.

The company also bears over $10 billion in long-term debt. If free cash flow continues to trend downward, Sirius XM could encounter dire challenges in the near future, even with its stock currently down 71% from all-time high values. It is advisable to avoid purchasing Sirius XM shares for your portfolio in March.

Don’t Miss This Second Chance at a Potentially Lucrative Opportunity

Have you ever felt you missed lucrative investment opportunities in successful stocks? If so, you’ll want to pay attention now.

Our analysts rarely issue a “Double Down” Stock recommendation, targeting companies poised for significant growth. If you’re concerned you’ve missed a prior investment opportunity, now is the optimal time to buy before it’s too late. The historical returns support this claim:

- Nvidia: an investment of $1,000 back when we doubled down in 2009 would now be worth $299,728!*

- Apple: a $1,000 investment when we doubled down in 2008 would amount to $39,754!*

- Netflix: if you invested $1,000 during our 2004 recommendation, you’d have $480,061!*

Currently, we are issuing “Double Down” alerts for three exceptional companies, and this opportunity may not present itself again soon.

Continue »

*Stock Advisor returns as of March 14, 2025

Brett Schafer has positions in Spotify Technology. The Motley Fool has positions in and recommends Chipotle Mexican Grill and Spotify Technology. The Motley Fool recommends the following options: short March 2025 $58 calls on Chipotle Mexican Grill. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.