# D-Wave’s Breakthrough Sparks Quantum Stock Surge

It’s not every day that a single announcement sends an entire group of stocks surging by double digits.

Editor’s Note: The market may be turbulent, but innovation never stops — and that’s exactly why InvestorPlace Senior Analyst Louis Navellier remains confident.

Recently, a relatively unknown company, D-Wave Quantum, made a significant breakthrough in quantum computing. This has led to substantial gains in quantum stocks, with some experiencing double-digit increases in just one day.

Currently, quantum computing resembles the state of AI back in 2016, presenting an enticing investment opportunity.

However, grasping the complexities of quantum computing and its market implications can be overwhelming. To address this, Louis Navellier held an urgent briefing last Thursday, just one week ahead of Nvidia’s pivotal “Quantum Day” announcements, which could reshape the industry.

Click here now to watch a replay of that event.

Louis will elaborate on D-Wave’s breakthrough here. Over to you, Louis.

Firstly, I want to express my gratitude to everyone who participated in my Next 50X NVIDIA Call special summit on Thursday.

We explored various topics, including:

- NVIDIA Corporation’s (NVDA) upcoming Quantum Day (Q Day) event.

- The revolutionary changes quantum computing will bring to AI.

- The single Stock I believe could deliver a 50X return — akin to NVIDIA’s rise during the AI Revolution.

You can watch the replay of the Next 50X NVIDIA Call here.

Timing was fortuitous, as while NVIDIA’s Q Day is a week away, quantum computing stocks jumped on Wednesday following recent news.

Why Everyone Is Talking About Quantum Supremacy

A single announcement led to multiple stocks rising by impressive percentages, particularly on Wednesday after D-Wave Quantum Inc. (QBTS) revealed a groundbreaking achievement.

The company reported that one of its quantum computers completed a complex materials-science simulation in just 20 minutes. This task would have taken today’s most powerful classical supercomputers nearly one million years to finish.

D-Wave claims this is the first problem of significant scientific value to be solved through quantum computing, and the results were documented in the peer-reviewed journal Science.

This event, termed “quantum supremacy,” indicates that D-Wave has successfully applied quantum technology to accomplish tasks beyond classic supercomputers’ capabilities.

This development is significant. Until recently, advancements in quantum computing were mostly confined to government labs and academic institutions.

Quantum computing functions at the subatomic level, utilizing advanced technologies such as ultracold superconducting chips. These computers process calculations with quantum bits, or “qubits,” allowing them to tackle problems far too complex for classical computing.

For this milestone, D-Wave utilized an “annealing” quantum computer, which specializes in optimization challenges by rapidly exploring vast possibilities simultaneously.

In collaboration with an international team, D-Wave simulated “spin glasses,” a type of complex magnetic material crucial to various scientific and business applications. The simulations were performed on both their Advantage2 prototype and the classical Frontier supercomputer at Oak Ridge National Laboratory.

The results were remarkable, with D-Wave’s quantum computer completing simulations in minutes, delivering precise data. The same job would have required nearly one million years on the Frontier supercomputer and consumed more electricity than the entire world uses in a year.

This achievement serves as practical, tangible proof that quantum computing is nearing readiness for real-world applications.

This news propelled D-Wave’s shares up by 11% and another quantum stock increased by 16%. Additionally, my top quantum pick experienced a 10% rise.

D-Wave’s shares further climbed on Thursday after it reported its fourth-quarter and year-end results for 2024, gaining another 18%. The company reported an adjusted net loss of $75.6 million, or $0.39 per share, down from $82.9 million or $0.60 per share the previous year. Revenue remained stable, but bookings surged by 128%, from $10.5 million to $23.9 million year over year.

The leading players in quantum computing are generally smaller companies striving to enhance revenue, decrease losses, and accomplish crucial breakthroughs simultaneously.

Although this is challenging, the potential rewards are significant, as quantum computing could:

- Accelerate biopharmaceutical companies’ drug discovery processes.

- Enable automakers to develop more effective driverless technologies.

- Facilitate chemical companies’ creation of groundbreaking new materials.

- And lead to countless other innovations.

Quantum Computing Continues to Advance

D-Wave’s achievement is just one of many rapid advancements in quantum technology.

This year, Google introduced its quantum chip, Willow, capable of executing calculations millions of times faster than traditional supercomputers. Additionally, Amazon recently launched its Ocelot quantum processor, and Microsoft released Majorana 1, reinforcing the trend of quantum advances. (I previously reviewed these developments here.)

These innovations confirm a critical reality: Quantum computing is shifting from theoretical concepts to practical application.

Major tech companies recognize this, including NVIDIA, the leader in generative AI chips, which is actively engaging in quantum computing initiatives even before its Q-Day event:

- NVIDIA launched CUDA-Q, a hybrid platform merging quantum and classical computing, facilitating the transition between traditional and quantum technologies.

NVIDIA’s Quantum Computing Initiatives and Market Implications

- NVIDIA is developing a platform that integrates quantum processing units (QPUs) with its graphics processing units (GPUs), signaling a strategic move for the future.

- The company is actively creating quantum simulation tools, enabling developers to work in quantum-like environments before actual hardware becomes mainstream.

- Significant industry players are already interested in incorporating NVIDIA’s technology into their quantum initiatives.

NVIDIA recognizes that quantum computing will become crucial when traditional computing approaches its limits later this decade. This belief prompted me to host the Next 50X NVIDIA Call summit last Thursday.

Importantly, as recent news from D-Wave shows, quantum computing is not just a future prospect but is currently in progress.

While I appreciate D-Wave’s contributions, it is not my top recommendation in the quantum sector.

I anticipate a significant announcement from NVIDIA on March 20, aligned with my top choice in this area. I shared comprehensive information during my Next 50X NVIDIA Call summit.

The Future Is Happening NOW

It’s crucial to realize that as more groundbreaking advancements are made, the media coverage will increase as well.

Today’s quantum computing landscape resembles that of artificial intelligence (AI) in 2016, just before NVIDIA experienced a remarkable 7,000% surge.

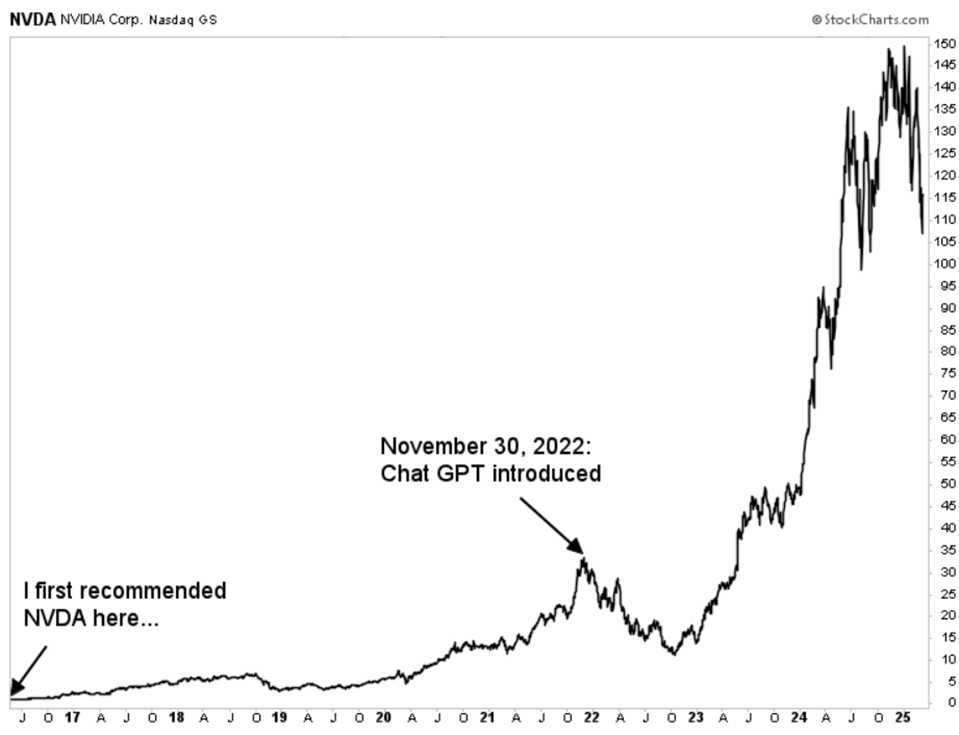

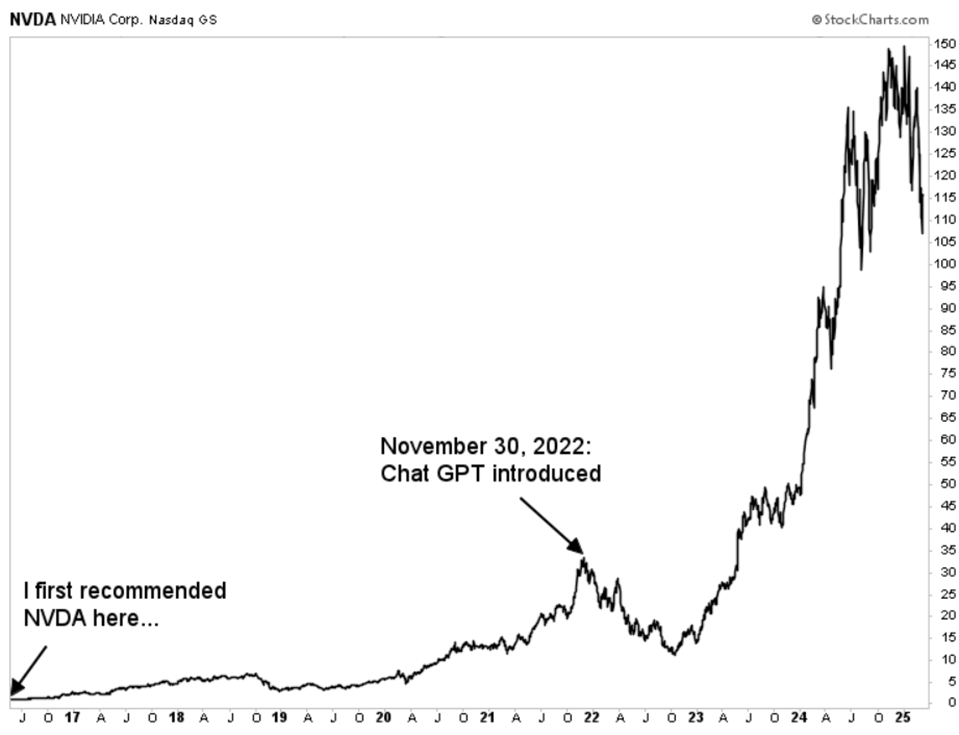

When I first identified NVIDIA in May 2016, it was long before the debut of ChatGPT in November 2022. Since then, NVIDIA has recorded returns exceeding 600%, while many investors missed substantial earlier gains of 6,400%.

Ultimately, quantum computing is poised to have its “ChatGPT moment.”

This could occur on NVIDIA’s Q-Day on March 20. However, regardless of timing, it is wise to invest before the broader market takes notice, as that opportunity may be fleeting.

Once the general public becomes aware of quantum computing, the most substantial gains will likely have already been realized.

This makes it imperative for investors to act now.

One option is to consider a small-cap quantum computing stock poised to capitalize on NVIDIA’s quantum initiatives. This company holds 102 patents and collaborates with NVIDIA, Microsoft, Amazon, and NASA.

Don’t delay until the market fully embraces this technology. Watch the replay of my Next 50X NVIDIA Call now for essential details before it is taken offline.

Sincerely,

Louis Navellier

Editor, Market 360

As of the date of this email, Louis Navellier discloses ownership directly or indirectly in the following securities discussed in this commentary, analysis, opinions, advice, or recommendations: NVIDIA Corporation (NVDA).