Consumer Sentiment Plummets: Potential Buying Opportunity for Stocks

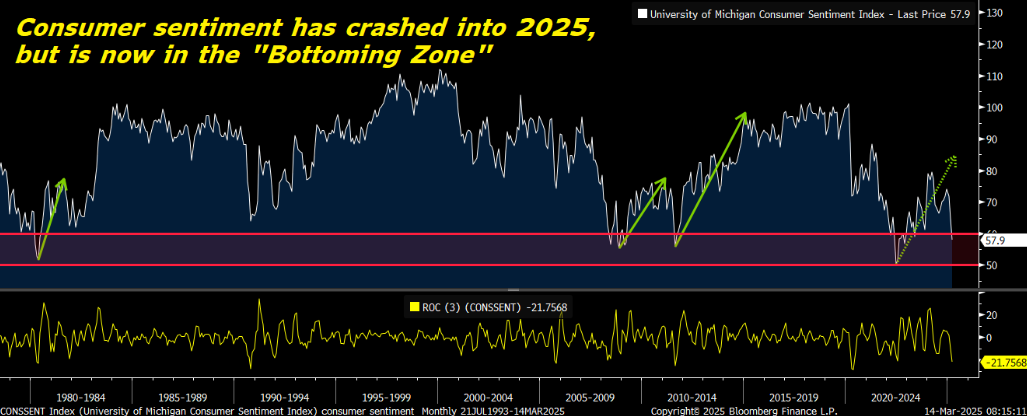

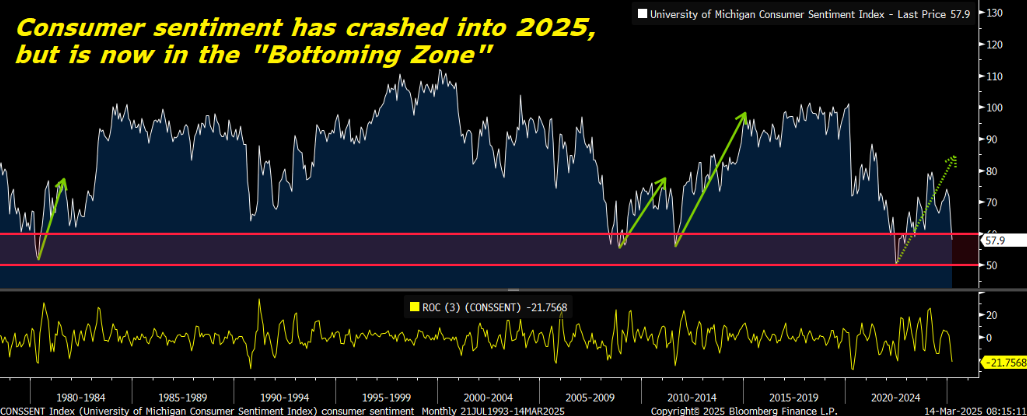

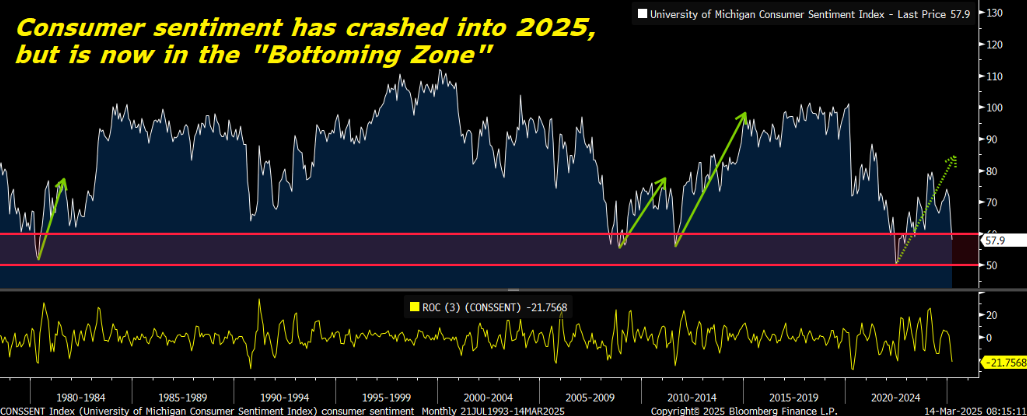

Editor’s Note: Over the past three months, consumer sentiment has dropped by 21%, marking its largest three-month decline since the COVID-19 pandemic’s peak in the summer of 2020.

Investment analyst Luke Lango states that we’ve reached a bottoming zone for sentiment.

This sentiment dip could signal a significant rebound in the market, suggesting it might be an excellent time to consider buying stocks.

Luke will explain why, despite the current data, we might see consumer sentiment bounce back in the coming months—along with a potential recovery in stock prices.

Take it away, Luke…

Currently, consumers are feeling pessimistic about the economy. The University of Michigan’s recent Consumer Sentiment report indicates a deteriorating outlook.

To put it plainly, consumer sentiment is in a significant decline. The university’s headline index fell from 64.7 in February to 57.9 in March, the lowest point since November 2022.

The Current Conditions Index declined to 63.5, its lowest since September 2024, while the Expectations Index dipped to 54.2, the lowest since July 2022.

Consumer sentiment has been on a steady downward path throughout the year.

Notably, consumer sentiment has dropped by 21% over the past three months—the steepest decline since the early days of the COVID-19 pandemic.

This is striking data.

However, it’s essential to distinguish between perception and reality.

So, is the situation as dire as it appears?

In reality, the economy shows signs of strength. The gross domestic product (GDP) growth stands at a positive 2.3%. Consumer spending remains healthy, unemployment is low at 4.1%, and inflation has decreased to about 2.8%. Wage growth is robust at approximately 4.3%, outpacing inflation, according to the Federal Reserve Bank of Atlanta. Additionally, corporate profits continue to rise, with over 75% of the S&P 500 companies surpassing consensus earnings estimates.

While ongoing trade tensions, policy uncertainties, and spending cuts are challenges, the overall economic framework remains stable.

Although sentiment appears bleak now, the underlying economy seems to be performing adequately.

Conditions may shift, but as it stands, economic fundamentals remain normal.

This perspective supports the belief that consumer sentiment could rebound in the upcoming months—along with stock performance.

Analyzing the Bottoming Zone

Current consumer sentiment is impacted by factors like tariff issues and policy uncertainty. However, these elements are expected to ease in the near future.

It appears the Trump administration is implementing these strategies to set the stage for future initiatives, such as potential tax cuts and deregulation, which could uplift consumer sentiment.

We believe short-term policy developments will weigh on sentiment, but a shift in focus could lead to a recovery in consumer outlook.

The data aligns with this optimism.

The University of Michigan’s Consumer Sentiment Index has descended to levels typically classified as the “bottoming zone.”

Historically, since 1980, consumer sentiment has fluctuated between low and high extremes. It has consistently hit bottom within the 50 to 60 range.

In 1980, amid aggressive rate hikes, it bottomed at 52; in 2008 during the financial crisis, it reached 55; in 2011, it hit 56 during the European sovereign debt crisis; and in the middle of 2022’s inflation surge, it plummeted to 50.

Currently, the sentiment index has dropped below 58, indicating that we have entered a bottoming phase.

If this indeed represents the bottom, it could present a prime opportunity to consider stock purchases.

Significant rebounds in consumer sentiment from the bottoming zone have historically aligned with substantial market recoveries—as seen in the early 1980s, post-GFC, during 2012/2013, and between 2023/2024.

Final Thoughts on Consumer Sentiment

Currently, Wall Street is experiencing turbulence.

This week, the S&P 500 entered correction territory, falling 10% from recent highs at one of its quickest rates ever. Likewise, the Nasdaq has slid 15% and the Russell 2000 has dropped nearly 20%.

If our analysis of consumer sentiment reaching a bottom is accurate, then we can expect a similar trend in stock prices, suggesting that the recent market fluctuations may present a favorable buying opportunity.

Therefore, we are advising our subscribers to seize this moment and invest in stocks now.

Identifying the right sectors for investment is crucial.

We’re optimistic about AI, recognizing it as one of the most significant technological advancements in three decades. This trend has already yielded impressive profits, allowing investors to achieve ~990% gains in Palantir (PLTR) and 400% increases in Nvidia (NVDA) over the past two years. More opportunities are likely to emerge.

However, navigating this crowded AI trade requires diligence, prompting us to explore the next big leap forward in this industry.

Our pursuit has led us to what I term AI 2.0—a venture potentially more promising than the current AI Boom.

Discover the new generation of AI that might offer even greater profit potential than today’s leading tech companies.

Sincerely,

Luke Lango

Editor, Hypergrowth Investing