Fifth Third Bancorp Faces Challenges Despite Solid Q4 Results

Cincinnati, Ohio-based Fifth Third Bancorp (FITB) operates as a bank holding company, delivering a diverse array of financial products and services. The firm, valued at $26.4 billion by market capitalization, operates through various segments: Commercial Banking, Consumer and Small Business Banking, and Wealth and Asset Management.

Fifth Third Bancorp qualifies as a “large-cap stock,” since its market cap exceeds the $10 billion threshold. This classification underscores the company’s substantial size, market presence, and influence within the regional banking sector.

Active Investor: FREE newsletter going behind the headlines on the hottest stocks to uncover new trade ideas.

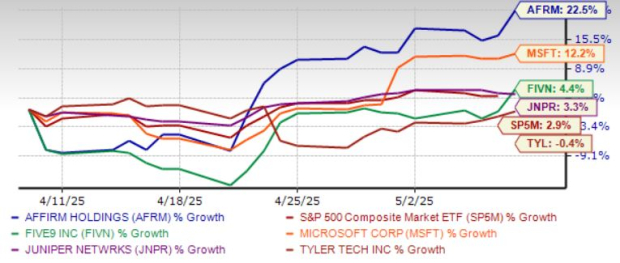

In recent months, however, FITB’s performance has been lackluster. The stock has declined by 19.6% from its three-year high of $49.07, reached on November 25, 2024. Over the past three months, FITB fell 8.2%, significantly underperforming the S&P 500 Index ($SPX), which dipped 4.5% during the same period.

When looking at a longer-term perspective, FITB has also lagged behind the S&P 500. Over the last six months, FITB has seen an 8.8% decline, while its performance over the last 52 weeks includes a modest 7.7% gain. By contrast, the S&P 500 experienced a slight dip of 0.7% over the past six months and delivered returns of 8.4% over the past year.

To illustrate the current trend, it’s important to note that FITB consistently traded above its 200-day moving average until it fell below this benchmark in early March. Additionally, since mid-December of the previous year, FITB has mostly traded below its 50-day moving average.

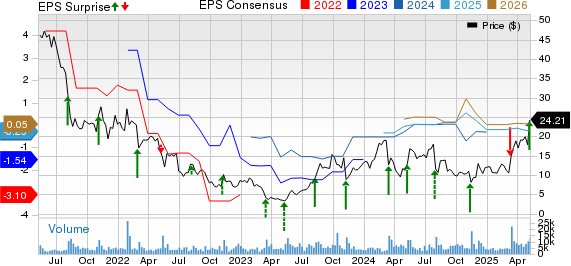

Fifth Third Bancorp’s stock rose by 1.2% following the release of its mixed Q4 results on January 21. While the company experienced a 4.6% year-over-year decline in interest income to $2.5 billion, it reported a 1.4% increase in net interest income (NII), exceeding $1.4 billion, attributed to improved NII margins. Non-interest income stood at $732 million. The firm also reported a significant 15.7% year-over-year drop in non-interest expenses, totaling $1.2 billion, which led to an impressive 18.3% year-over-year growth in net income to shareholders, reaching $582 million.

Despite these gains, the company encountered an 84 basis point year-over-year decline in average portfolio loans and leases, which fell to approximately $117.9 billion. The non-performing asset (NPA) ratio increased to 0.71 from 0.59 in the comparable quarter last year. After the initial post-earnings surge, FITB stock dropped by 2.1% in the following trading session.

Additionally, Fifth Third Bancorp has underperformed compared to its peer, M&T Bank Corporation (MTB), which only dipped 1.5% over the past six months and surged by 23.6% over the past year.

Among the 22 analysts monitoring FITB stock, the consensus rating is classified as a “Moderate Buy.” The average price target of $49.98 implies a potential upside of 26.8% from current price levels.

On the date of publication, Aditya Sarawgi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article are solely for informational purposes. For more information, please view the Barchart Disclosure Policy here.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.