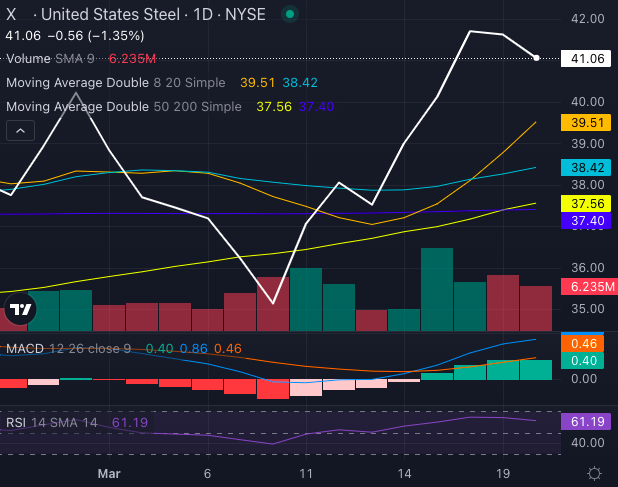

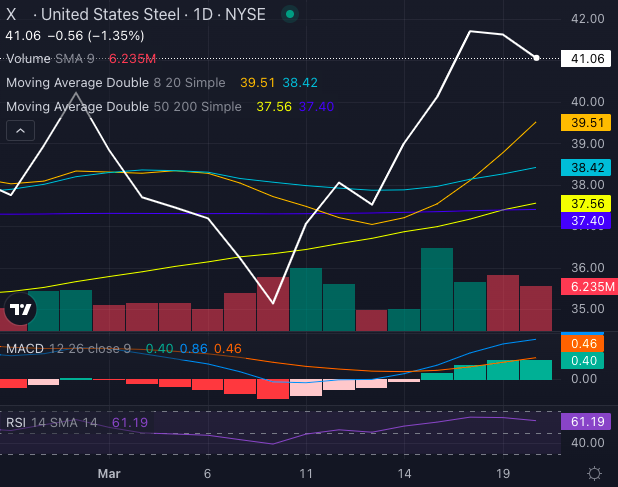

United States Steel Corp Shows Strong Momentum with Golden Cross

United States Steel Corp X is signaling bullish trends following an 8.35% rise over the past week. This upward movement is marked by the formation of a Golden Cross, a technical indicator often associated with continued price increases.

Current share prices exceed key moving averages, indicating robust momentum as investors evaluate the company’s earnings prospects and merger uncertainties.

Chart created using Benzinga Pro

X Stock Breaks Key Resistance Levels

Recent trading activity shows that X Stock has clearly surpassed both its short- and long-term moving averages, solidifying its bullish trend:

- The Stock is currently priced at $41.06, significantly higher than its eight-day simple moving average (SMA) of $39.51, a 20-day SMA of $38.42, and a 50-day SMA of $37.56, indicating strong bullish signals.

- Its 200-day SMA stands at $37.40, reflecting a considerable technical advantage.

Amid this momentum, traders are closely monitoring whether X can overcome resistance levels and sustain its upward trajectory.

Read also: US Steel Faces Q1 Pressures, But Eyes Long-Term Gains From BR2 & Nippon Partnership

Analysts Weigh in: JPMorgan’s View on Merger Concerns

JPMorgan analyst Bill Peterson holds an Overweight rating on X Stock, setting a price target of $43 per share. The firm’s Q1 EBITDA guidance of $125 million aligns with expectations and surpasses competitors like Steel Dynamics Inc STLD and Nucor Corp NUE.

Despite these positive indicators, several challenges loom, including delayed pricing effects, fading demand in Europe, and expenses tied to the BRS2 expansion.

The proposed merger with Nippon Steel Corp NISTF hangs in uncertainty, but Peterson believes that US Steel’s valuation will stay buoyed above the $40 mark, suggesting that any regulatory challenge may present a dip-buying opportunity.

Stanley Druckenmiller Increases Stake in US Steel

In a noteworthy turn, billionaire hedge fund manager Stanley Druckenmiller has elevated his investment in US Steel by 143% last quarter. This move coincides with indications from President Donald Trump suggesting support for the stalled Nippon merger, possibly expediting its revival.

With the backdrop of a Golden Cross, strong buying momentum, and a significant investor backing, US Steel’s forthcoming actions may result in substantial movement. The market now awaits whether the Stock will advance or face limitations from regulatory concerns.

Read Next:

Photo: Shutterstock

Momentum75.50

Growth14.38

Quality–

Value73.39

Market News and Data brought to you by Benzinga APIs