# Wall Street Gains Momentum Amid Fed Signals, But Risks Remain

Wall Street propelled the Stock market upward on Wednesday as Jay Powell and the Fed indicated that two interest rate cuts could be on the horizon in the latter part of 2025. However, enthusiasm faded on Thursday, as investors hesitated to re-enter the market due to ongoing tariff disputes and geopolitical uncertainties.

To maintain their recent momentum, bulls will need to push back above the 200-day and 50-week moving averages soon.

Fortunately, the fundamental elements supporting the Stock market, notably interest rates and earnings growth forecasts, remain positive. Additionally, Nvidia’s recent conference underscored that the surge in artificial intelligence spending is expected to continue.

For investors willing to navigate short-term volatility, purchasing undervalued stocks could yield considerable profits in the future. Distressed stocks today might look like bargains in five years or even five months.

Identifying a market bottom in real time is challenging. Nevertheless, the Stock market tends to favor patient investors who buy during downturns. Since the beginning of 2020, the S&P 500 has soared more than 75%, and the Nasdaq has risen by 96%. These gains include periods during the COVID bear market and the extended bear market of 2022.

In today’s Full Court Finance, Zacks evaluates two promising technology stocks—Celestica Inc. and Taiwan Semiconductor Manufacturing Co.—as key investment opportunities for exceptional value and long-term growth in artificial intelligence.

Spotlight on an Underrated Tech Stock for Value and Growth

Celestica Inc.CLS is a global leader in electronics manufacturing services, focusing on designing, engineering, and manufacturing products critical to growing sectors such as AI data centers and semiconductor manufacturing.

Celestica has secured significant client partnerships within the AI sector, recently landing a notable contract for a “1.6 Terabyte switching program” with a prominent hyperscaler customer, bolstering its reputation among tech giants like Meta, Amazon, and Microsoft.

In addition to its AI endeavors, the firm also benefits from growth opportunities in aerospace and defense, telecommunications, healthcare technologies, and supply chain solutions.

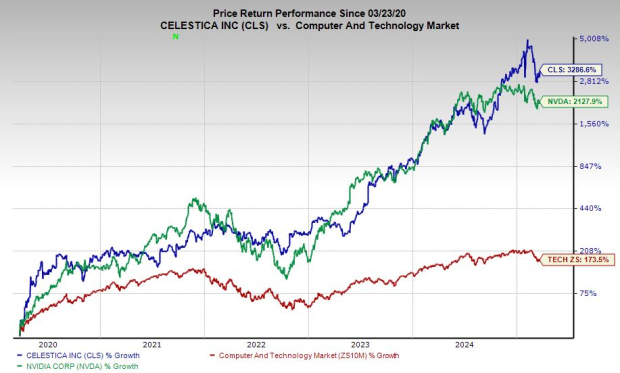

Image Source: Zacks Investment Research

Since its public debut in the late 1990s, Celestica has experienced remarkable growth, averaging 20% revenue expansion from FY22 through FY24. Over this same period, it reported an average of 65% EPS growth on a GAAP basis.

In late January, Celestica provided promising guidance for 2025, with expectations for revenue growth of 12% in 2025 and 18% in 2026, projecting total revenue of $12.72 billion compared to $5.6 billion in 2021. The firm anticipates a 23% increase in adjusted earnings for both years. These optimistic forecasts have contributed to a Zacks Rank #1 (Strong Buy), with the most accurate FY26 earnings estimate coming in 9% higher than the consensus.

Celestica’s stock surged over 3,000% in the past five years, outperforming the Zacks Tech sector’s 175% increase and Nvidia’s 2,100% growth.

Despite its accomplishments, CLS is currently trading 33% below its recent highs and 50% below its average Zacks price target. The stock appears poised for support near its 200-day moving average, as bulls aim to help it reclaim its 21-day moving average.

Image Source: Zacks Investment Research

From a valuation perspective, Celestica trades at a substantial 45% discount compared to its 10-year highs and at a valuation of 19.9X forward 12-month earnings, which is 18% lower than the tech sector average. The company’s forward 12-month sales ratio stands at 0.9X, signifying an impressive 80% discount when contrasted with the tech industry’s 6.3X ratio.

Why You Should Consider This Leading Chip Stock Today

Taiwan Semiconductor Manufacturing Co.TSM is a key player in manufacturing advanced chips that drive artificial intelligence and other technological advancements. The company is essential to the AI boom and the overall technology-based global economy.

Tech giants like Nvidia and Apple depend on Taiwan Semiconductor to produce their most sophisticated chips. By adhering to its foundational principle of ‘manufacturing only’, TSM has successfully maintained its leading position in the industry.

TSMC Maintains Dominance in Semiconductor Market Amid Global Competition

Taiwan Semiconductor Manufacturing Company (TSMC) continues to capture more of the semiconductor market, holding a significant position as other firms exit chip production. Currently, TSMC commands approximately 60% of the global foundry market and an impressive 90% of advanced chip manufacturing. The company is proactively addressing geopolitical risks by expanding its operations beyond Taiwan to locations in Japan and the United States. With a solid balance sheet, TSMC is well-positioned to support its growth initiatives and dividends.

Image Source: Zacks Investment Research

Revenue Growth Projections for TSMC

TSMC is projected to experience robust revenue growth, with expectations of a 26% increase in fiscal year 2025 and a subsequent 19% rise in fiscal year 2026. This surge will elevate revenue from $90 billion in 2024 to an anticipated $136 billion in the following year. Additionally, the company’s adjusted earnings per share (EPS) is expected to climb by 30% in FY25 and 20% in FY26.

Stock Performance and Valuation

Over the past 20 years, TSMC’s stock has tripled compared to the Zacks Technology sector, and it has risen 90% over the last two years, demonstrating robust performance akin to NVIDIA in the past year. However, like many tech stocks, TSMC has faced a wave of profit-taking, currently trading approximately 40% below its average Zacks price target and around 20% off its recent peak. The company is now attempting to establish support levels near its 50-week moving average.

Image Source: Zacks Investment Research

Currently, TSMC trades at a 45% discount compared to its highs and 23% lower than the technology sector average of 18.2X forward 12-month earnings. Despite a remarkable 620% increase over the last decade, TSMC’s valuation matches its 10-year median.

Investment Opportunities and Insights

We’re not kidding.

Several years ago, we surprised our members by providing 30-day access to all our investment picks for just $1, with no further obligations.

Thousands have seized this opportunity, while others were skeptical of a catch. We aim to familiarize you with our portfolio services, including Surprise Trader, Stocks Under $10, Technology Innovators, and others, which recorded 256 positions with double- and triple-digit gains in 2024 alone.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click for your free report.

NVIDIA Corporation (NVDA): Free Stock Analysis report.

Celestica, Inc. (CLS): Free Stock Analysis report.

Taiwan Semiconductor Manufacturing Company Ltd. (TSM): Free Stock Analysis report.

This article originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.