Analysts Target 26.47% Upside for SPDR S&P Kensho New Economies ETF

At ETF Channel, we analyzed the underlying holdings of the ETFs in our coverage universe. We compared the trading price of each holding against the average analyst 12-month forward target price, calculating the weighted average implied target price for the SPDR S&P Kensho New Economies Composite ETF (Symbol: KOMP). Our findings indicate that the implied analyst target price for KOMP is $62.38 per unit.

Currently, KOMP is trading near $49.32 per unit, suggesting analysts anticipate a significant upside of 26.47% based on the average targets for its underlying holdings. Among KOMP’s notable holdings, three stocks stand out for their considerable upside potential: Kaspi KZ JSC (Symbol: KSPI), Grifols SA, Barcelona (Symbol: GRFS), and Hesai Group (Symbol: HSAI).

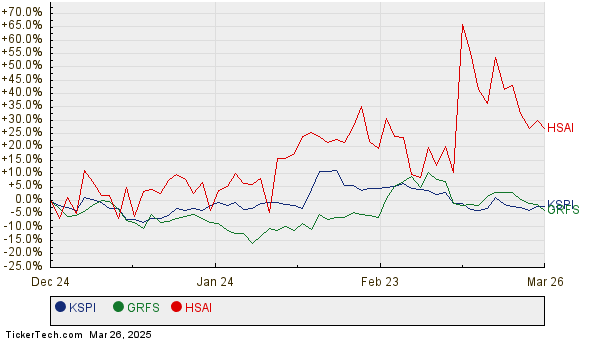

For instance, Kaspi KZ JSC, which trades at $96.26 per share, has an analyst target of $141.60 per share, representing a 47.10% upside. Similarly, Grifols SA has room to grow 43.05% from its recent price of $7.55, with an average analyst target of $10.80. Hesai Group also shows promise, as analysts project a target price of $25.28 per share, a 37.50% increase from its recent price of $18.39. Below is a twelve-month price history chart comparing the stock performance of KSPI, GRFS, and HSAI:

Here’s a summary table reflecting the current analyst target prices for these stocks:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| SPDR S&P Kensho New Economies Composite ETF | KOMP | $49.32 | $62.38 | 26.47% |

| Kaspi KZ JSC | KSPI | $96.26 | $141.60 | 47.10% |

| Grifols SA, Barcelona | GRFS | $7.55 | $10.80 | 43.05% |

| Hesai Group | HSAI | $18.39 | $25.28 | 37.50% |

These analysts’ targets prompt a crucial question: Are they optimistic or justified? Investors should consider whether the projections reflect current company and industry developments or if they risk downgrades due to outdated evaluations. Research is essential for investors seeking to understand how these factors might influence future price movements.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

also see:

• Top Ten Hedge Funds Holding RAIL

• BVX Insider Buying

• Funds Holding JEM

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.