AI and Stock Splits Shape Wall Street’s Investment Strategies in 2024

Over the past two years, artificial intelligence (AI) has emerged as a critical trend on Wall Street, propelling the Dow Jones Industrial Average, S&P 500, and Nasdaq Composite to record highs. Yet, an additional factor is capturing investors’ attention: Stock splits.

Where to invest $1,000 right now? Our analyst team just revealed the 10 best stocks to consider today. Learn More »

A Stock split allows a publicly traded company to adjust its share price and outstanding shares without affecting its market capitalization or operational performance. These changes are termed “cosmetic” because they do not measurably alter a company’s value.

Image source: Getty Images.

Types of Stock Splits: Forward vs. Reverse

There are two types of Stock splits, and the investment community clearly favors one over the other. Reverse splits aim to increase a company’s share price, often indicating operational struggles or efforts to avoid delisting from major stock exchanges.

Conversely, forward Stock splits lower the nominal share price, making shares more accessible to retail investors. Companies that conduct forward splits tend to be performing well within their industries and appealing to everyday investors.

As 2024 saw over a dozen notable Stock splits, investors are now wondering which Stock will be the first breakout split of 2025?

Assessing Candidates for Stock Splits

Entering 2025, there have been numerous reverse splits and a few forward-split announcements, yet none have come from leading market players. When evaluating which companies are positioned for a split, factors beyond just share price must be considered.

For instance, some firms, like Warren Buffett’s Berkshire Hathaway, show no inclination to perform splits. A single Class A share (BRK.A) is priced at nearly double the median U.S. home price, and Berkshire’s management appears to favor retaining share structure as it is.

BRK.A data by YCharts.

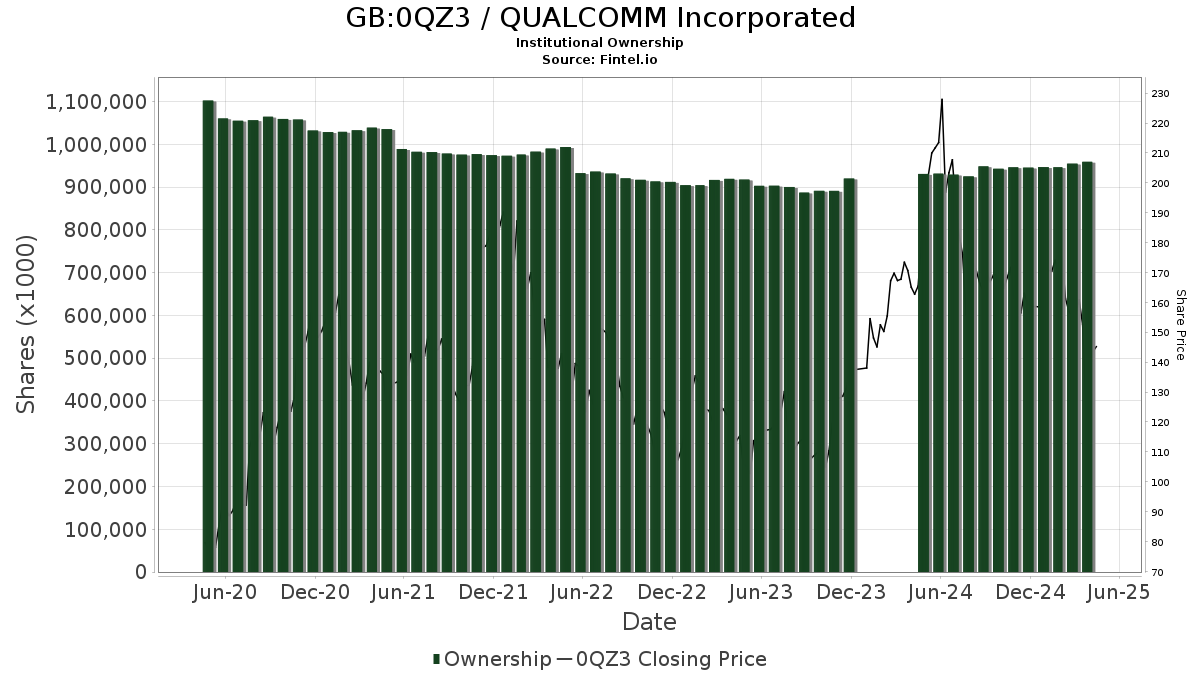

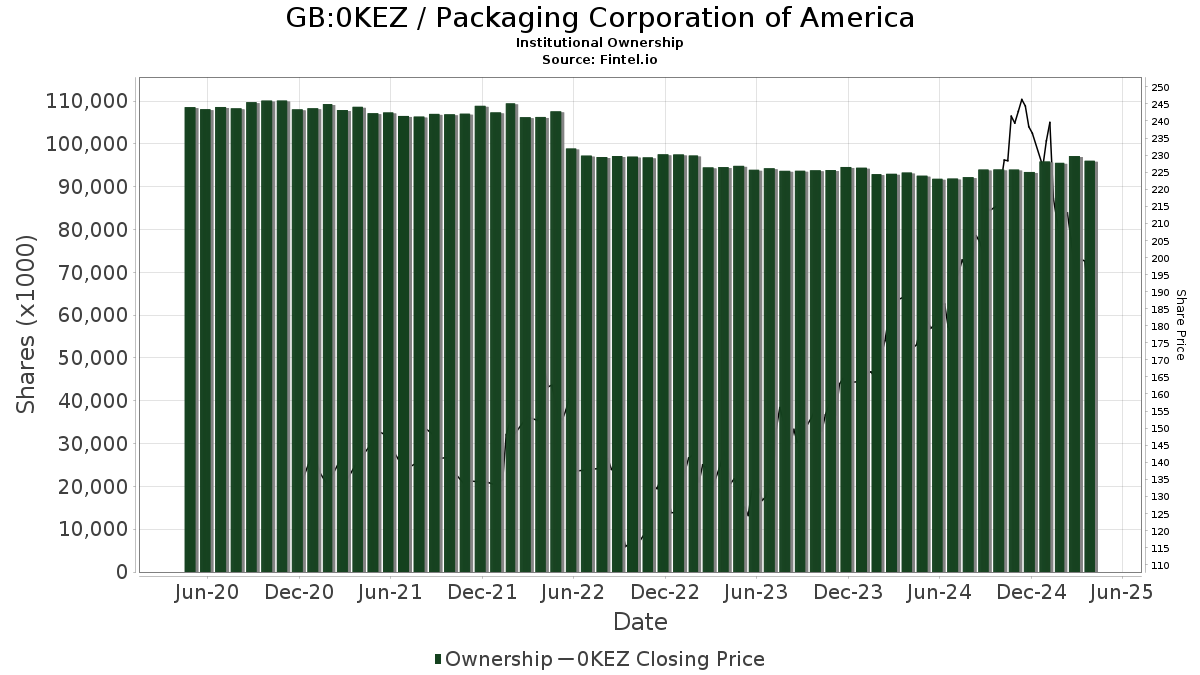

Another significant factor is the level of institutional ownership. Companies with a high percentage of shares held by institutional investors often lack motivation to lower share prices. Firms like AutoZone, Netflix, and FICO closed last week with share prices at $3,606.34, $960.29, and $1,853.29, respectively. Their retail investor ownership rates stand at only 10.1%, 19.4%, and 12.8%.

A Rising Star: Meta Platforms’ First Potential Stock Split

A standout candidate for a first-time Stock split in 2025 is Meta Platforms (NASDAQ: META). With a retail investor ownership of nearly 29% and shares priced around $600, the conditions are well-suited for a forward split.

Meta is not only a leader in social media but also benefits from its substantial competitive advantages. The company attracted an average of 3.35 billion daily active users to its suite of apps in December, which includes Facebook, Instagram, WhatsApp, and Threads. This vast user base enables Meta to command high advertising prices; last year, the average price per ad increased by 10%.

Additionally, Meta capitalizes on the cycles of economic expansion. Even during recessions, which are expected but often brief, the firm continues to perform well due to its reliance on advertising, generating around 98% of its net sales from that sector.

Moreover, as a pivotal player in the AI landscape, Meta is integrating generative AI, which allows businesses to tailor their advertising messages to specific audiences. This strategy has already begun yielding positive returns, distinguishing Meta from many tech competitors still striving for profitability in AI investments.

As 2025 unfolds, all eyes will be on Meta and its potential as Wall Street’s first significant stock split.

Meta Platforms Poised for Growth Amid Future Metaverse Development

Meta Platforms is set to significantly enhance its advertising capabilities through advanced artificial intelligence. This transformative technology is expected to play a crucial role in the development of the metaverse—an interactive, 3D virtual world. Meta aims to be a primary gateway for users engaging in these virtual interactions.

Additionally, Meta Platforms boasts substantial financial resources, allowing it to invest in high-growth projects while maintaining its lead in the social media landscape. As of the end of 2024, Meta reported $77.8 billion in cash, cash equivalents, and marketable securities. Last year, the company generated over $91.3 billion in net cash from operating activities. This robust financial position enables Meta to take risks that many other companies cannot afford.

Exceptional Operating Model Fuels Potential Stock Split

With a strong operational framework and significant retail ownership, Meta Platforms is favorably positioned to be a standout performer in 2025 with a potential stock split.

Seize This Opportunity for Future Investment Gains

Ever felt like you missed the opportunity to invest in successful stocks? If so, now is a chance to act.

Our team of analysts occasionally issues a “Double Down” stock recommendation for companies poised for significant growth. If you’re concerned about missing your investment opportunity, now is an optimal time to consider acquiring shares before prices rise. The following statistics illustrate the value of timely investments:

- Nvidia: An investment of $1,000 when we doubled down in 2009 would now be worth $314,847!*

- Apple: An investment of $1,000 from 2008 would be valued at $41,848!*

- Netflix: A $1,000 investment made when we doubled down in 2004 has grown to $524,186!*

Currently, we are issuing “Double Down” alerts for three promising companies, and this may be one of the last opportunities to invest at favorable levels.

Continue »

*Stock Advisor returns as of March 24, 2025

Randi Zuckerberg, a former market development director and spokeswoman for Facebook, is a member of The Motley Fool’s board. Sean Williams holds positions in Meta Platforms. The Motley Fool has investments in and recommends Berkshire Hathaway, Meta Platforms, NVR, and Netflix. The Motley Fool also recommends Fair Isaac. The Motley Fool adheres to a disclosure policy.

The views expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.