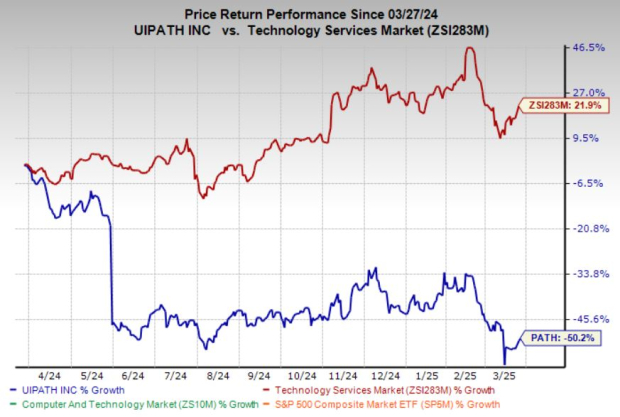

UiPath Stock Declines but Shows Promise for Investors

UiPath Inc. PATH Stock has dropped 50% over the last year, contrasting sharply with the industry’s 22% growth. This analysis will evaluate PATH’s performance to determine if its current valuation is an appealing buy for investors.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

UiPath’s Growth Amid Automation Market Expansion

UiPath leads the growing Robotic Process Automation (RPA) market, which is projected to significantly expand in the coming years. The firm’s comprehensive automation platform positions it well to meet the rising demand for AI-driven automation solutions.

Despite encountering intense competition, PATH continues to thrive through strategic partnerships with major players like Microsoft MSFT, Amazon AMZN, AWS, and Salesforce CRM. In the fourth quarter of fiscal 2025, UiPath reported a 5% year-over-year revenue increase, reaching $424 million. Its annual recurring revenues climbed to $1.67 billion during the quarter, reflecting a 14% growth compared to the previous year. This achievement underscores the company’s success in expanding its subscription services and retaining customers.

Strong Financial Standing

PATH maintains a solid financial foundation, marked by a robust balance sheet. By the close of the fiscal fourth quarter, the company had $1.6 billion in cash and equivalents and no outstanding debt. This debt-free position ensures that cash reserves can support growth initiatives and strategic investments, giving PATH the flexibility to innovate and expand its market presence without financial constraints.

Furthermore, PATH enjoys strong liquidity. With a current ratio of 2.93 at the end of the fiscal fourth quarter, the company far exceeds the industry average of 1.65. A current ratio above 1 means the company has enough assets to cover its short-term obligations, enabling it to handle economic fluctuations and seize new opportunities in the competitive RPA landscape.

Valuations Below Industry Peers Present Opportunities

The significant decline in PATH’s stock price has led to noticeably lower valuations. Currently, the Stock trades at a forward 12-month price-to-earnings (P/E) ratio of 21.54X, well below the industry average of 32.74X. This gap suggests that PATH may be undervalued compared to its peers, potentially presenting a worthwhile entry point for investors. The lower P/E ratio reflects market uncertainties but also indicates a chance for growth-focused investors to purchase shares at a discount.

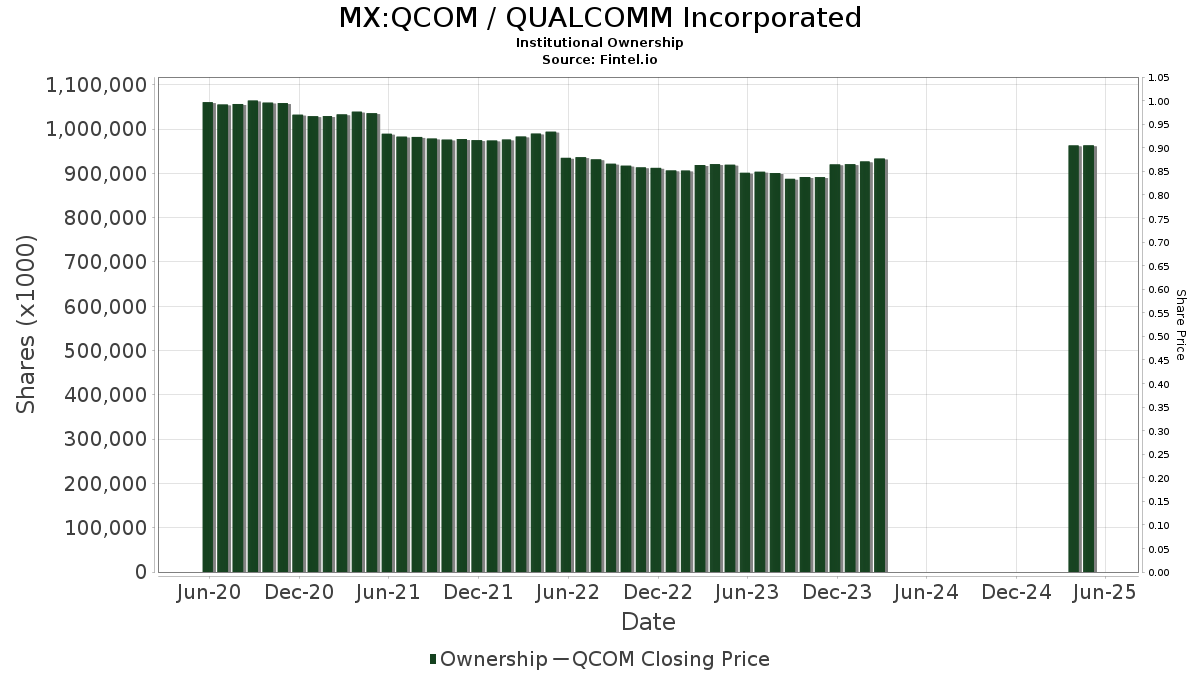

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Analysts Optimistic About PATH’s Future

Over the last 60 days, analysts have increased six estimates for fiscal 2026 and two for fiscal 2027 while reducing one estimate for each year. These upward revisions reflect increasing confidence in PATH’s ability to deliver improved financial results in the future. The adjustments indicate positive sentiment regarding the company’s strategic focus, operational efficiency, and potential to leverage growth opportunities, enhancing its appeal to long-term investors in the automation market.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Strong Buy Opportunity for Investors

Given UiPath’s leading position in the market, solid financial standing, and strategic relationships with industry giants, PATH represents a compelling “Strong Buy” opportunity. The Stock is currently undervalued, offering a promising entry point. Analysts have revised their earnings estimates for fiscal 2026 and 2027 upwards, signaling confidence in PATH’s long-term growth within the RPA sector.

Currently, PATH holds a Zacks Rank #1 (Strong Buy). Interested investors can view the complete list of today’s Zacks #1 Rank stocks here.

Zacks Highlights Top Semiconductor Stock

Our top semiconductor stock is just 1/9,000th the size of NVIDIA, which has surged more than +800% since our recommendation. While NVIDIA continues to perform, our new top chip Stock has considerable growth potential.

With strong earnings growth and a growing customer base, this stock is well-positioned to meet the increasing demand for Artificial Intelligence, Machine Learning, and the Internet of Things. The global semiconductor market is expected to grow from $452 billion in 2021 to $803 billion by 2028.

See This Stock Now for Free >>

Get the latest recommendations from Zacks Investment Research. Download our report on the 7 Best Stocks for the Next 30 Days for free. Click here to access.

Includes analysis on Amazon.com, Inc. (AMZN) : Free Stock Analysis report

Analysis on Microsoft Corporation (MSFT) : Free Stock Analysis report

Assessment of Salesforce Inc. (CRM) : Free Stock Analysis report

UiPath, Inc. (PATH) : Free Stock Analysis report

This article originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.