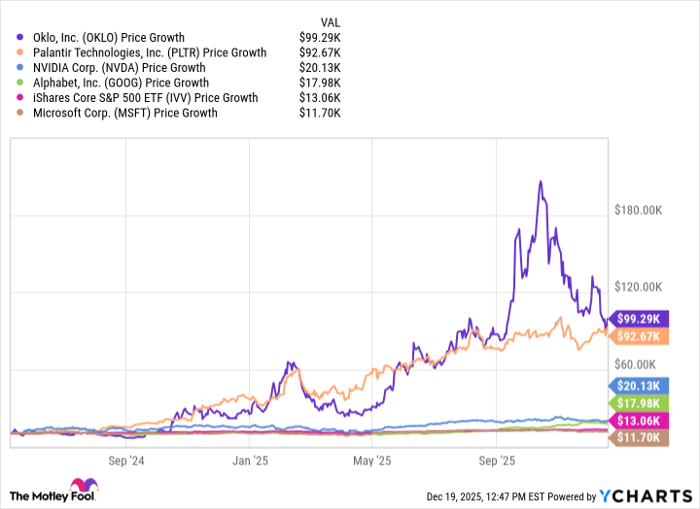

Invesco Senior Loan ETF Sees Notable $149.6 Million Outflow

In the latest week of trading, the Invesco Senior Loan ETF (Symbol: BKLN) has attracted attention due to a significant outflow of approximately $149.6 million. This figure represents a 1.8% decline in shares outstanding, dropping from 403,500,000 to 396,300,000.

The chart below illustrates BKLN’s price performance over the past year in relation to its 200-day moving average:

BKLN’s recent trading indicates a price of $20.77, situated between its 52-week low of $20.61 and its high of $21.24. Evaluating the current share price against the long-term 200-day moving average can serve as a valuable technical analysis tool. Learn more about the 200 day moving average »

Exchange-traded funds (ETFs) function similarly to stocks but utilize “units” instead of “shares.” Investors buy and sell these units, which can also be created or destroyed based on market demand. Each week, we track the changes in shares outstanding to identify ETFs experiencing significant inflows, indicating new unit creation, or outflows, which suggest unit destruction. New unit creation necessitates the purchase of underlying assets, while unit destruction entails selling these assets, potentially impacting the individual components held within the ETFs.

![]() Click here to find out which 9 other ETFs experienced notable outflows »

Click here to find out which 9 other ETFs experienced notable outflows »

See also:

- OZEM Options Chain

- DDLS Videos

- NBCM Videos

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.