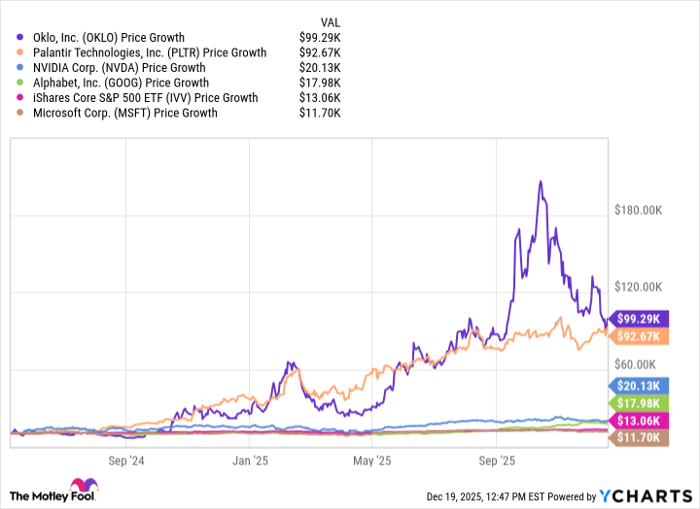

PayPal’s Declining Stock amidst Competitive Pressure and Economic Challenges

PayPal (PYPL) shares have decreased by 17% year to date, primarily due to escalating competition from fintech companies like Apple Pay. Additionally, the uncertain macroeconomic landscape, influenced by U.S. President Donald Trump’s trade tariff proposals affecting China, Canada, and Mexico, poses risks to the Stock market.

Since reaching a 52-week high of $93.66 on December 9, 2024, PayPal shares have significantly fallen, with a drop of 24.3%. However, the Stock appears undervalued, as indicated by its Value Score of B. Currently, PYPL Stock trades at a forward 12-month P/E ratio of 13.7X, which stands in stark contrast to the Zacks Financial Transaction Services industry’s average of 23.56X.

PYPL’s P/E Ratio (F12M)

Image Source: Zacks Investment Research

Over the trailing 12-month period, PayPal shares have increased by only 6.5%, trailing behind the industry’s growth of 17.7%.

PYPL Stock’s Performance

Image Source: Zacks Investment Research

Currently, PayPal shares are trading below their 50-day and 200-day moving averages, further indicating a bearish trend.

PYPL Shares Trade Below 50-Day & 200-Day SMAs

Image Source: Zacks Investment Research

This raises the question: Is PayPal Stock a buy, sell, or hold at its current price? Let’s take a closer look.

PYPL’s Strong Portfolio Supports Future Prospects

PayPal’s robust portfolio has helped the company foster strong relationships with both merchants and consumers. Its two-sided platform facilitates direct interactions, bolstering financial connections. Investments in enhancing branded checkout, person-to-person (P2P) services, and Venmo led to a 2% year-over-year increase in total active accounts, reaching 434 million in 2024. Furthermore, payment transactions rose by 5% year over year, totaling 26.33 million.

This expanding customer base has contributed to a 10% growth in total payment volume (TPV), which reached $1.68 trillion in 2024. Transaction margins also saw a dollar increase of 7% year over year, while Buy-Now-Pay-Later TPV expanded by 21% to $33 billion. The adoption of Fastlane is expected to drive future growth, particularly as PayPal secures partnerships with entities like NBCUniversal, Roku, and StockX. The company anticipates that transaction margins (excluding interest on customer balances) will rise by at least 5% in 2025, with high-single-digit growth expected by 2027. Over the long term, this growth could exceed 10%.

Fastlane improves the checkout experience by allowing seamless one-click purchases. Collaborations with Adyen, Global Payments, and Pfizer are expected to attract more merchants to this platform. Notably, around 75% of Fastlane users are either new or previously inactive PayPal users, highlighting its role in broadening PayPal’s reach.

Further initiatives, like the launch of FX-as-a-service in Q4 2024, which provides automated currency conversions, are already operational with Meta Platforms (META). Additionally, network tokens for automated billing have been implemented with merchants such as Instacart and Poshmark. The expansion of value-added services is anticipated to significantly enhance transaction margins.

Moreover, “PayPal Everywhere,” introduced in September 2024, drives considerable growth in debit card adoption and opens new spending categories. Q4 2024 saw over 1.5 million first-time PayPal debit card users, with debit card TPV rising nearly 100%. Notable spending categories included gas, groceries, and restaurants. Additionally, Venmo’s user base grew by 4% year over year, surpassing 64 million monthly active accounts in the same quarter.

Strategic Partnerships Fuel PayPal’s Outlook

PayPal’s strategic partnerships with firms such as Fiserv, Adyen, Amazon (AMZN), Global Payments, and Shopify (SHOP) are positively impacting its future prospects.

PayPal has been added as a processor for Shopify Payments in the U.S., integrating its branded payment solutions into Shopify. This creates an efficient operational environment for business owners. Additionally, the partnership with Amazon brings PayPal Checkout to small and medium-sized businesses (SMBs) participating in the Buy with Prime program. Collaborations with Apple and Google to integrate Venmo debit cards into their respective payment systems represent another significant advancement.

Furthermore, PayPal remains a preferred payment option for advertisers and users across Meta Platforms’ suite of apps, helping creators and developers leverage Hyperwallet. META is also utilizing Braintree for credit card processing.

Positive Earnings Guidance from PayPal

Looking ahead, PayPal has reaffirmed its 2025 non-GAAP earnings per share guidance, projecting growth between 6-10% and anticipating higher low-teens growth for 2027. Long-term growth expectations remain robust, exceeding 20%.

The Zacks Consensus Estimate for 2025 earnings is currently set at $5.02 per share, with no changes over the last 30 days, indicating a 7.96% increase compared to 2024. Notably, PayPal has outperformed the Zacks Consensus Estimate in the previous four quarters, with an average surprise of 14.26%.

PayPal Holdings, Inc. Price and Consensus

PayPal Holdings, Inc. price-consensus-chart | PayPal Holdings, Inc. Quote

Find the latest EPS estimates and surprises on Zacks earnings Calendar.

Conclusion

PayPal’s solid portfolio and expanding partner network position the company for future growth, despite current stock performance challenges.

PayPal Faces Competition Challenges Amid Long-term Attraction for Investors

PayPal’s low valuation and favorable base appeal to long-term investors, but heightened competition is expected to impact the company’s prospects in the short term. The ongoing decline in unbranded transaction volumes raises concerns for its performance.

PayPal’s Current Status and Investment Outlook

Currently, PayPal holds a Zacks Rank #3 (Hold), indicating that investors may want to wait before increasing their positions in the stock. For those interested, you can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Zacks Identifies Top Semiconductor Stock

In contrast, Zacks has identified a new semiconductor stock that stands out in the market. While this company is only 1/9,000th the size of NVIDIA, which has seen its shares rise by over 800% since being recommended, experts believe it has significant growth potential.

With robust earnings growth and an expanding customer base, this leading chip company is well-positioned to capitalize on the increasing demand for Artificial Intelligence, Machine Learning, and Internet of Things technologies. The global semiconductor manufacturing industry is projected to grow from $452 billion in 2021 to $803 billion by 2028.

See this stock now for free >>

Additionally, if you’re looking for the latest recommendations from Zacks Investment Research, you can download “7 Best Stocks for the Next 30 Days” for free. Just click here to access this report.

For more insights, consider the following free stock analysis reports:

- Amazon.com, Inc. (AMZN): Free Stock Analysis report

- PayPal Holdings, Inc. (PYPL): Free Stock Analysis report

- Shopify Inc. (SHOP): Free Stock Analysis report

- Meta Platforms, Inc. (META): Free Stock Analysis report

This article was originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.