Evaluating Sirius XM: Buy, Sell, or Hold in 2025?

Here’s a great discussion starter for your next cocktail party: Ask fellow investors about Sirius XM Holdings (NASDAQ: SIRI). The satellite radio company generates a wide variety of opinions, reflecting the diversity of its programming offerings.

Supporters of Sirius XM stock may consider it one of the most attractive value investments in today’s market, especially given its substantial dividend. On the other hand, critics point to a declining subscriber base and a grim outlook for the premium audio service. Which perspective holds more weight for 2025? Perhaps the truth lies somewhere in between. Let’s analyze the factors that contribute to whether Sirius XM is a buy, sell, or hold this year.

Start Your Mornings Smarter! Receive Breakfast news each market day directly in your inbox. Sign Up For Free »

Reasons to Buy Sirius XM

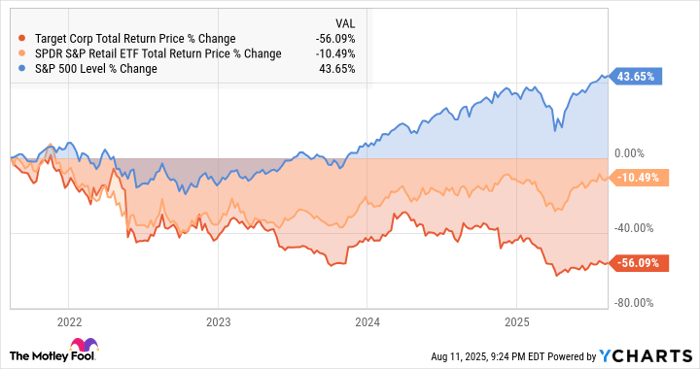

Sirius XM stock has plummeted nearly 60% since the beginning of last year. This significant decline might seem alarming, but it also presents a compelling value opportunity. Currently, Sirius XM is trading at a mere 7.3 times its projected earnings for this year, a low figure in a generally inflated market.

On a positive note, Sirius XM continues to generate substantial free cash flow. The company is forecasting $1.15 billion in free cash flow for this year, up from $1.02 billion in 2024, despite stalled growth over the past few years.

Moreover, Sirius XM has been efficient in returning value to shareholders. The company has actively repurchased stock, reducing its fully diluted share count by half over the last dozen years. Since entering into a dividend payout policy in late 2016, Sirius XM has consistently increased its dividends, resulting in an impressive yield of 4.7% given the current share price environment.

Looking ahead, there are several potential catalysts favoring Sirius XM. As commuting returns to the workplace, the demand for in-car services may rise. Additionally, the average age of passenger vehicles in the U.S. reached a record 14 years last year, indicating that an upgrade cycle could emerge if economic conditions stabilize and auto loan rates decline from their previous highs. While optimistic, this outlook must be balanced with the concerns raised by critics.

Image source: Getty Images.

Reasons to Sell Sirius XM

However, there are pressing concerns for potential investors. Sirius XM’s revenue has fallen for two consecutive years, with guidance indicating a further 2% decline in 2025. The company has lost total subscribers for its core service in four of the last five years. Data shows that average revenue per user, which had previously been on the rise, fell in both 2023 and 2024.

The situation is complicated further by increasing long-term debt, which reached $10.3 billion at the end of last year. This is concerning considering the company’s market capitalization is $7.7 billion while its enterprise value stands at $18.3 billion. The previously mentioned earnings multiple of 7.3 becomes a much higher figure exceeding 17 when viewed in the context of enterprise value.

Sirius XM has attempted to diversify by expanding its business model, notably acquiring automotive telematics and streaming platforms like Pandora. Unfortunately, Pandora’s decline has been sharper than Sirius XM’s core service, which continues to generate 75% of its revenue and most of its profitability.

Reasons to Hold Sirius XM

Many investors find reasons to maintain their positions in Sirius XM. Notably, Berkshire Hathaway owns over one-third of the company’s shares outstanding and has increased this stake three times in the past six months. If Warren Buffett is betting on the dip, it raises the question: why wouldn’t other investors consider doing the same?

The debate between bullish and bearish sentiments reveals key uncertainties surrounding Sirius XM’s future. Although the stock has underperformed relative to its fundamentals, significant challenges remain, particularly in an era dominated by connected cars that provide alternatives like Bluetooth and affordable mobile streaming apps. Monthly churn rates remain consistent historically; however, the real issue lies in attracting new subscribers. What happens if auto sales increase but new signup rates do not?

Additionally, the potential retirement of Howard Stern after two decades could impact listener retention and cost management. Yet, Sirius XM is also investing in popular podcasting talent, a strategic move aimed at engaging younger audiences necessary for future growth.

Sirius XM presents a riskier investment, even with its appealing valuation. However, it’s too intriguing to overlook. The market sentiment reflects this; despite the challenging year for many stocks, Sirius XM’s price remains close to where it started in 2025. While I maintain a cautious optimism about Sirius XM this year, the potential risks cannot be ignored.

Should You Invest $1,000 in Sirius XM Now?

Before making a decision on Sirius XM stock, consider the following:

The Motley Fool Stock Advisor analysts have recently identified their choices for the 10 best stocks to invest in now—Sirius XM is notably not included. These recommended stocks could yield substantial returns in the coming years.

For context, if you had invested $1,000 in Nvidia when it made the list on April 15, 2005, your investment would be worth $672,177 today!*

Stock Advisor offers a straightforward blueprint for investment success, including portfolio building advice, regular analyst updates, and two new stock picks each month. The Stock Advisor service has considerably outperformed the S&P 500 since 2002.* Join now to access the latest top 10 stocks list.

*Stock Advisor returns as of March 24, 2025

Rick Munarriz holds positions in Sirius XM. The Motley Fool has positions in and recommends Berkshire Hathaway. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the author’s and do not necessarily reflect those of Nasdaq, Inc.