Tesla’s Struggles Open Doors for Rivian Automotive in EV Market

The electric vehicle (EV) investment landscape faces turbulence, largely due to challenges confronting the current U.S. sales leader, Tesla (NASDAQ: TSLA). CEO Elon Musk’s recent controversial actions have negatively impacted sales for the automaker, both domestically and abroad. This situation has led some investors to speculate whether Rivian Automotive (NASDAQ: RIVN) might seize the opportunity to boost its sales, reduce its losses, and revitalize its Stock.

Currently, Rivian’s Stock is down more than 90% from its all-time high shortly after its IPO in late 2021. If Rivian capitalizes on Tesla’s misfortunes, its stock could rebound. However, potential investors should exercise caution; the company’s management has set a lackluster target for 2025, while economic and political uncertainties pose additional risks.

Challenging Business Environment for Rivian

Regardless of political perspectives, Musk’s political involvement has undoubtedly polarized public perception of Tesla’s brand. Recent registration figures for new Teslas in Europe, along with extensive protests, suggest a potential decline in first-quarter sales. If Tesla’s sales continue to fall, it could inadvertently benefit other EV manufacturers, including Rivian.

Sales momentum is crucial for Rivian. The company delivered 50,122 vehicles in 2023, a modest increase to 51,579 deliveries in 2024. The management’s guidance of delivering only 46,000 to 51,000 EVs in 2025 is disappointing amid these figures. Just a month ago, Rivian released its Q4 report, where management seemed to miss potential closing opportunities related to Tesla’s possible downturn. There may be room for adjustments in future guidance.

Moreover, investors must consider the broader economic and political challenges facing smaller EV manufacturers. For instance, consumer sentiment in the U.S. has plummeted to levels seen only a few times in the last 70 years, potentially discouraging big-ticket purchases. Automobile loan delinquencies are approaching highs last seen during the 2008 financial crisis and the COVID-19 pandemic, which could exacerbate Rivian’s situation.

Political conditions are also shifting against Rivian. Recent signals from President Trump indicate a possible withdrawal of congressionally approved funding for EV initiatives, including federal tax credits for EV buyers. Additionally, newly imposed tariffs on imported vehicles and components could increase supply chain costs for Rivian, affecting its competitive position. Though Rivian’s vehicles are made in the U.S., these tariffs target not just domestic production but imported auto parts as well. Management acknowledged that tariff impacts and potential incentive reductions would influence its 2025 guidance.

Understanding Rivian’s Financial Situation

When assessing Rivian’s financial health, it’s important to note that the company reports profitability using adjusted EBITDA (earnings before interest, taxes, depreciation, and amortization), a non-GAAP standard that excludes certain expenses. In 2024, Rivian posted an adjusted EBITDA loss of $2.68 billion, which management anticipates will reduce to between $1.7 billion and $1.9 billion this year.

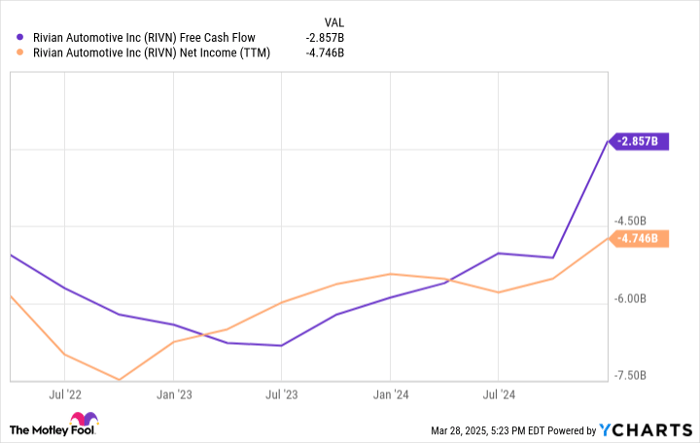

Rivian’s free cash flow and net income highlight its actual cash situation and losses:

Data by YCharts.

On the upside, Rivian is making strides financially. While it recorded a gross loss of $1.2 billion in 2024, its gross margins turned positive in Q4, with aspirations for a modest gross profit in 2025. The company also secured approximately $10 billion in new capital through a joint venture with Volkswagen and a loan from the U.S. Department of Energy.

Buy, Sell, or Hold: Evaluating Rivian

Investing in Rivian Stock remains a risky endeavor, as the company’s viability does not guarantee a favorable outcome for shareholders.

Two major concerns emerge. Firstly, Rivian’s valuation, measured by enterprise value relative to revenue, surpasses nearly every automaker except Tesla. Justifying this premium is difficult, especially given its substantial losses and minimal revenue growth in recent years.

Secondly, Rivian’s stock-based compensation in the previous year accounted for almost 14% of its revenue. Management excludes this expense from adjusted EBITDA, revealing far worse losses when considered. Such compensation contributes to share dilution, which diminishes the potential upside for investors as profits are distributed among an expanding shareholder base.

The outlook presents more red flags than positive indicators. Rivian’s strategy appears to be slowly diluting investor value while waiting for a turnaround—potentially a long wait—for a company that is currently unprofitable and stagnant. These conditions raise doubts about buying or holding Rivian Stock, particularly given its inflated valuation relative to industry peers. Currently, a sell recommendation seems prudent.

Should You Invest $1,000 in Rivian Automotive Now?

Before making an investment in Rivian Automotive, consider this:

The Motley Fool Stock Advisor analyst team has identified what they deem the 10 best stocks to buy now, and Rivian Automotive is notably absent from this list. The selected stocks are positioned to generate significant returns in the coming years.

Reflect on when Nvidia made this list on April 15, 2005—had you invested $1,000 then, it would be worth $664,271 today!*

Stock Advisor offers an easy guide to success, including tips for building a portfolio, regular analytical updates, and two new Stock selections each month. Since 2002, the Stock Advisor service has returned more than quadruple that of the S&P 500.*

*Stock Advisor returns as of April 1, 2025

Justin Pope has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Tesla, as well as Volkswagen AG. The Motley Fool has a disclosure policy in place.

The views and opinions expressed herein are solely those of the author and do not necessarily reflect those of Nasdaq, Inc.