Trump’s Tariff Plan Raises Concerns for Nvidia Investors

After months of speculation, President Donald Trump revealed his full tariff strategy on April 2, which includes updated tariffs affecting more than 180 countries. While some tariffs are relatively low at 10%, others have reached staggering highs of over 90%.

The implications of these tariffs are significant for U.S. companies that depend heavily on imports, particularly large tech firms that utilize a global supply chain.

Nvidia at the Center of Tariff Discussions

One company drawing considerable attention is Nvidia (NASDAQ: NVDA), a leader in graphics processing units (GPUs) and a key player in the burgeoning artificial intelligence (AI) sector. With the new tariffs in place, questions arise about how they may affect Nvidia’s business operations.

Nvidia’s Import Dependencies and Tariff Impact

Located in California, Nvidia designs its chips but does not manufacture them. It relies primarily on Taiwan Semiconductor Manufacturing Company (NYSE: TSM) and Samsung for production.

The company now confronts a 32% tariff on imports from Taiwan and a 34% tariff on imports from China, both of which are critical to Nvidia’s supply chain. However, the good news is that semiconductors, crucial for its GPUs and AI chips, have mostly avoided the new tariffs.

Still, Nvidia’s reliance on aluminum and steel for its data center hardware could pose challenges. With tariffs on these materials set at 25%, costs could increase significantly; for example, a product costing Nvidia $1,000 might now set the company back $1,250.

Financial Ramifications of the Tariffs on Nvidia

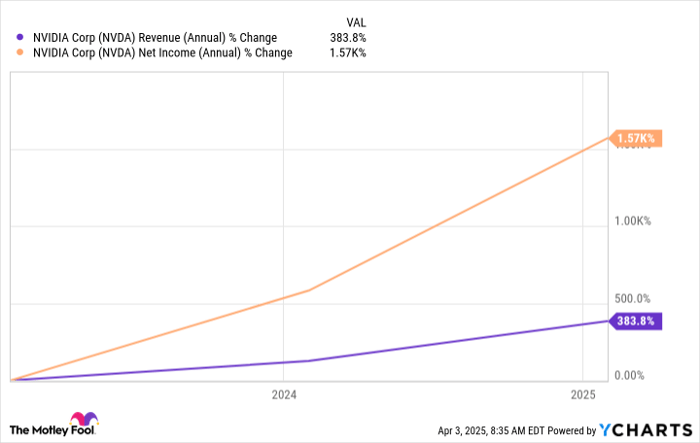

Nvidia has seen remarkable growth in both revenue and net income over the last three years, fueled by heightened demand for its GPUs and AI technologies. Nevertheless, higher production costs due to tariffs will likely impact the company’s profits in the short term. Analysts expect a decline in earnings and tighter margins as these new expenses take hold.

Nvidia could respond by passing these costs on to consumers, but this approach risks alienating price-sensitive customers, especially amid growing recession fears. Such a move could harm Nvidia’s long-term business health.

Investor Outlook: Should You Worry?

While these tariffs create challenges for Nvidia, the company has a robust financial position, with over $43 billion in cash and short-term investments. This financial cushion provides Nvidia with the flexibility to navigate the current economic landscape and adapt its strategies accordingly.

If you are an Nvidia investor approaching retirement and feel the need to secure profits or limit losses, it’s reasonable to consider your options. However, if you have time to wait, don’t abruptly exit your investment based on these tariffs.

Moreover, Taiwan Semiconductor Manufacturing’s plans to bolster its U.S. operations might alleviate some tariff-related issues in the future, while anticipated growth in the AI sector could mitigate immediate financial impacts.

If concerns about Nvidia’s stock weigh on you yet you still believe in its long-term potential, consider using dollar-cost averaging. This strategy can help smooth out the effects of market volatility as no one can accurately predict short-term stock movements.

To Invest or Not: Nvidia Stock Considerations

Prior to purchasing Nvidia stock, reflect on the following:

The Motley Fool Stock Advisor team has identified what they consider to be the 10 best stocks to buy currently, with Nvidia not making the list. The selected stocks are believed to provide substantial returns over the upcoming years.

If you had invested $1,000 in Nvidia on April 15, 2005, based on prior recommendations, you’d have approximately $676,774 today!

Stock Advisor offers an accessible framework for investors, including portfolio building advice, ongoing analyst updates, and new stock picks every month. Since its inception, Stock Advisor has more than quadrupled the returns of the S&P 500.

*Stock Advisor returns as of April 1, 2025.

Stefon Walters has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia and Taiwan Semiconductor Manufacturing. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.