Three Dividend Stocks to Buy Now: April 4 Insights

Investors looking for strong income characteristics should consider these three stocks that currently hold a buy rating as of April 4:

Hang Seng Bank Limited (HSNGY)

This provider of banking and financial services has seen its Zacks Consensus Estimate for current year earnings rise by 5.8% over the past 60 days. The company is a Zacks Rank #1 and boasts a notable dividend yield of 11.4%, well above the industry average of 3.7%.

Hang Seng Bank Ltd. Price and Consensus

Hang Seng Bank Ltd. price-consensus-chart | Hang Seng Bank Ltd. Quote

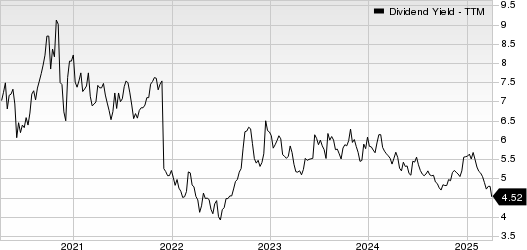

Hang Seng Bank Ltd. Dividend Yield (TTM)

Hang Seng Bank Ltd. dividend-yield-ttm | Hang Seng Bank Ltd. Quote

Frontline plc (FRO)

This shipping company has recorded an increase in its Zacks Consensus Estimate for current year earnings, up by 10.4% over the last 60 days. Frontline, which holds a Zacks Rank #1, offers a solid dividend yield of 5.4%, surpassing the industry average of 2.9%.

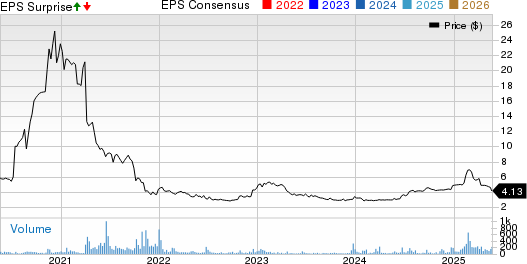

Frontline PLC Price and Consensus

Frontline PLC price-consensus-chart | Frontline PLC Quote

Frontline PLC Dividend Yield (TTM)

Frontline PLC dividend-yield-ttm | Frontline PLC Quote

Telefónica, S.A. (TEF)

This telecommunications provider recently reported a 6.5% increase in the Zacks Consensus Estimate for earnings for the next year over the past 60 days. Like the others, Telefónica is also rated as a Zacks Rank #1 company, with a dividend yield of 4.8%, compared to the industry average of 0.8%.

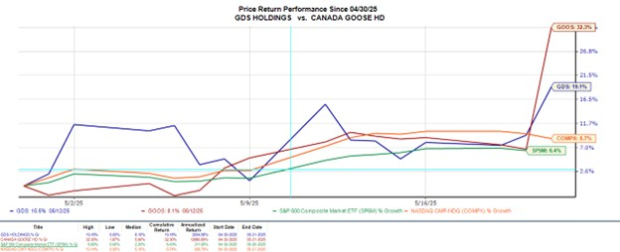

Telefonica SA Price and Consensus

Telefonica SA price-consensus-chart | Telefonica SA Quote

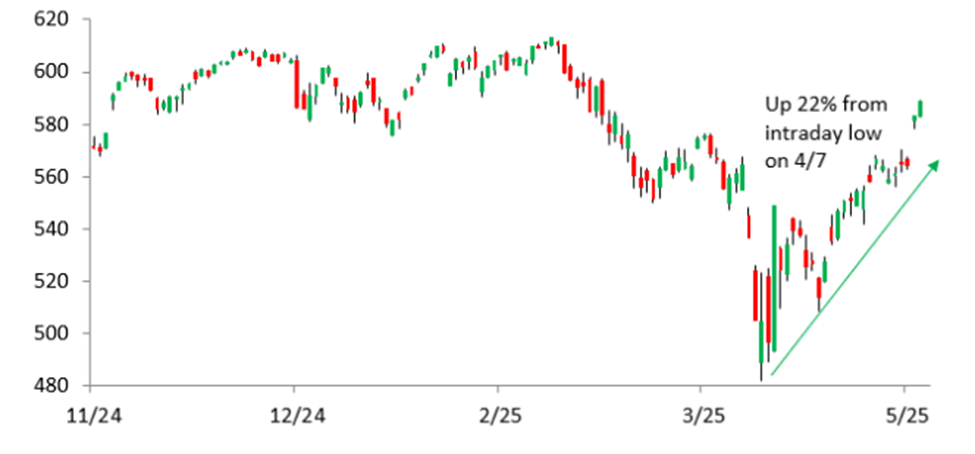

Telefonica SA Dividend Yield (TTM)

Telefonica SA dividend-yield-ttm | Telefonica SA Quote

For more recommendations, check out the full list of top-ranked stocks here.

Explore additional top income stocks with some of our premium screens.

7 Best Stocks for the Next 30 Days

Experts have identified seven elite stocks from the current list of 220 Zacks Rank #1 Strong Buys, which they predict could be “Most Likely for Early Price Pops.”

Since 1988, this selected group has outpaced the market by more than double, averaging a gain of +23.9% per year. Investors should take immediate note of these hand-picked stocks.

Telefónica SA (TEF): Free Stock Analysis Report

Frontline PLC (FRO): Free Stock Analysis Report

Hang Seng Bank Ltd. (HSNGY): Free Stock Analysis Report

This article was originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.