Rocket Lab Competes for $5.6 Billion Launch Contract Amid Market Turmoil

The stock market is facing significant challenges, with investors expressing concern over the Trump administration’s tariffs on international goods, impacting corporate profitability across various sectors. Yet, one area shows resilience: the space economy. Driven by national security priorities and leaders like SpaceX, private rocket launches and services are primarily conducted within the United States.

Interestingly, consumer demand isn’t a major factor affecting rocket flight companies. The demand for launches is expected to remain strong, especially from the U.S. government, regardless of economic fluctuations. Thus, it is not surprising to see Rocket Lab USA (NASDAQ: RKLB) approved to vie for a $5.6 billion launch contract from the United States Space Force.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Learn More »

This project spans a five-year ordering period through 2029, focusing on high-priority national security missions. Here’s what it could signify for Rocket Lab’s stocks in the future.

Investment Focus: Rocket Lab’s Neutron Rocket

The National Security Space Launch (NSSL) program is currently in its procurement phase, inviting rocket launch contractors to submit bids. On March 27, Rocket Lab announced it was cleared to compete for these launch bids. Gaining approval does not guarantee contracts, but it enables the company to present a proposal that the U.S. government might select. Other potential competitors include SpaceX and Blue Origin, making it a competitive landscape.

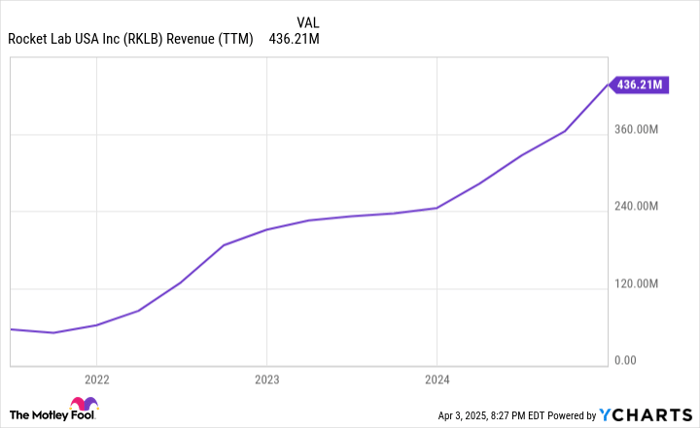

A $5.6 billion contract presents a large opportunity for a company of Rocket Lab’s size. It guarantees a minimum of 30 missions, with options for expansion until 2034. Given the nature of government contracts, this figure could increase significantly over the next few years. Having generated just $436 million in revenue last year, Rocket Lab views this contract as a substantial growth opportunity.

However, a significant challenge remains: Rocket Lab has not yet completed the Neutron rocket, which is designed for these missions. Testing is set to take place in 2025, with hopes for commercial launches shortly thereafter. The company’s success hinges on delivering a reliable Neutron rocket, as it stands to gain not just financially, but also in terms of industry reputation. Achieving this could unlock further contracts with both government and private partners.

Strategy for Investors: Focus on Rocket Lab’s Rocket

Investing in Rocket Lab can seem complicated due to its varied product lines and potential contracts. Simplifying the perspective, the primary focus for Rocket Lab is clear: successfully launching the Neutron rocket and delivering payloads for customers.

The competitive landscape includes established companies like SpaceX, which currently commands the market. If Rocket Lab successfully brings the Neutron into operation, it could capture a significant share of both government and commercial contracts, ensuring a steady revenue stream.

Rocket Lab has demonstrated its contract-winning capabilities with the smaller Electron rocket. If it continues to build its product offerings effectively, there could be substantial growth ahead for Rocket Lab, potentially reaching market values similar to SpaceX’s reported $350 billion. In comparison, Rocket Lab currently holds a market cap of around $8 billion.

Data by YCharts.

Is Rocket Lab Stock Worth Buying?

Based on current data, Rocket Lab Stock appears overvalued. With a market cap of $8 billion against $436 million in revenue, its price-to-sales ratio (P/S) stands at 18.4. This valuation raises concerns for a low-margin, currently unprofitable, and capital-intensive industry. Therefore, recommending Rocket Lab Stock based on historical financials proves challenging.

Nonetheless, long-term investing often involves predicting future performance, and Rocket Lab has the potential to increase its revenue tenfold in the coming decade, with expectations of generating profits for its shareholders. While this represents a high-risk investment, it also offers significant potential upside if successful.

If Rocket Lab intrigues you and you’re considering an investment, a prudent approach would be to start with a modest position. This strategy limits downside risk while allowing the possibility of growth, especially if Rocket Lab evolves into a major player like SpaceX.

Should You Invest $1,000 in Rocket Lab USA Now?

Before purchasing Stock in Rocket Lab USA, weigh the following:

The Motley Fool Stock Advisor team has identified the 10 best stocks for investors today, and Rocket Lab USA is not among them. The top selections are poised to deliver impressive returns in the near future.

Consider that when Nvidia was listed on April 15, 2005, investing $1,000 would now amount to $578,035!*

Stock Advisor provides straightforward guidance for constructing a successful portfolio, including timely updates and two new Stock recommendations monthly. The Stock Advisor service has outperformedthe S&P 500 since 2002*. Don’t miss the latest top 10 list with your subscription to Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of April 5, 2025

Brett Schafer has no position in any of the stocks mentioned. The Motley Fool recommends Rocket Lab USA. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.